Currency Risk Hedging with Derivatives

Post on: 16 Май, 2015 No Comment

Derivatives are financial instruments that derive their value from other underlying assets (interest rate, commodity, currency, stock, index, etc.) They are traded Over-the-Counter or on regulated market by investors or other financial institutions. Derivative products are the most commonly used financial instruments for hedging various types of risks: exchange-rate, price, interest rate, credit, etc.

Currency risk is part of the financial and operational risks associated with the possibility of adverse movement in the exchange rate of a particular currency relative to another. As compared to investments in local assets, the fluctuating foreign exchange rates represent an additional risk factor for traders who want to variegate their portfolios globally. Hereby, the control and management of foreign exchange risk is a substantial part of business management with a view to improve the efficiency of international investments.

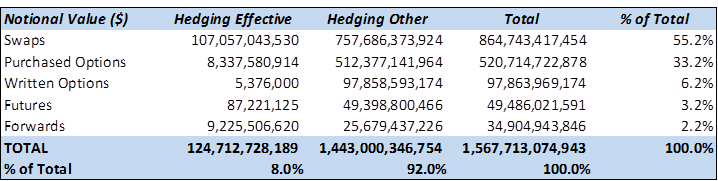

One generally accepted method for hedging currency risk is the use of derivatives as options, futures, swaps and forwards. This study is concentrated on the practices of currency risk hedging and their efficiency to control foreign exchange risk through use of derivatives. (Hedging is any action or a set of activities, aiming reduction or neutralization of identified potential risks.)

When an investor determines a particular type of risk can affect his business, he may wish to hedge this risk by becoming a party to a derivative contract. A European importer of goods from the United States, apprehending of eventual rise of the dollar and increased delivery costs, could decide to fix the U.S. Dollar to EUR buying a call option. Let us assume, the U.S. Dollar falls at the date of purchase. In such case, the importer will lose only the premium paid for buying the option. However, if the U.S. Dollar rises steadily, the value of the option will also go up thus compensating the increased value of the delivery denominated in EUR.

The basic types of financial instruments, used for hedging currency risk, are the following:

1. Forwards

The forward contract is an unstandardized instrument with economic function nearly the same as the futures contract. It is traded Over-the-Counter (OTC) and represents an agreement between two parties to buy or sell an asset at a particular moment in the future at a pre-determined delivery price (forward price). Both parties agree on the essential terms of the deal like quantity, price, time of delivery, etc. Since forward contracts are not exchange traded, they are less liquid than other financial instruments, traded on regulated market; they bear higher risk of failure of the seller to deliver at maturity date or buyer to pay the full value of the delivery to the seller.

2. Futures

Like forwards, the futures contracts require delivery of a specified asset at a predetermined future date for a price agreed when the deal was concluded. Futures are traded on a regulated market futures exchange. These transactions are concluded by investors who are on the opposite view of the market price of the base asset at maturity date. The Sellers expect the price of the asset to be lower than defined in the agreement; the buyers expect vice versa the market value of the underlying asset to be higher than an agreed-on price. Currency futures, which are contracts for delivery of any major currency, are widely used for hedging exchange rate risks. Very few futures contracts are physically settled at maturity. Instead, buyers and sellers of currency futures most often close out their open positions by offsetting the futures contracts at maturity date.

3. Options

Options are derivatives, whose price is derived from the value of a particular underlying security, currency or commodity. There are two basic types of options. The buyer of a Call option owns the right, but not the obligation to buy the base asset on or before the expiration date at an agreed-on price. Put option confers the buyer the right, but not the obligation to sell the underlying asset on or before the expiration date in accordance with the style of the options contract (depending on the style of option) for a specified price. Each option contract is a legally binding agreement between two counterparties. On the one side is the buyer of the option who, in accordance with the legal terminology, takes long position. On the other side of the agreement is the seller (issuer) who issues the option and takes the so-called short position. The seller normally receives from the buyer a specific monetary compensation, named premium for the underwriting; at the same time he takes in practice unlimited risk of adverse price movements of the underlying asset.

The pre-agreed price, at which the base asset can be purchased or sold, is called strike price (also exercise price.) The holder of an American-Style option may exercise his right to sell or buy the asset at any time before the expiration date. The European-Style option can be exercised only on the expiration date. The options are both exchange-traded and OTC traded financial instruments. They are suitable for hedging and speculative purposes in both upside and downside price movements of the underlying assets by diverse options trading strategies.

4. Swaps

The swap is a derivative financial instrument, an agreement to exchange a series of future payments of a loan, where at least one party is not aware of the future payments; the swap pricing formula is known beforehand. This derivative financial instrument is applicable when an investor has the opportunity to obtain financing under certain conditions, but he prefers others. By its legal nature, the swap can be characterized as a series of forward contracts. In practice, many types of swaps are used. The most common are: foreign exchange, interest rate and credit swaps.

An investor, who intends to hedge currency risk, may enter into derivative contract; it leads to financial result, just the opposite of the result generated by the risk. When the market price of the hedged currency falls, the value of the derivative contract increases, and vice versa. Although most participants on the derivative market use these instruments for hedging purposes, the companies frequently trade derivatives for speculation: aiming to generate profits in case of favorable price movements.