Credit Spread Trade how to set one up

Post on: 13 Апрель, 2015 No Comment

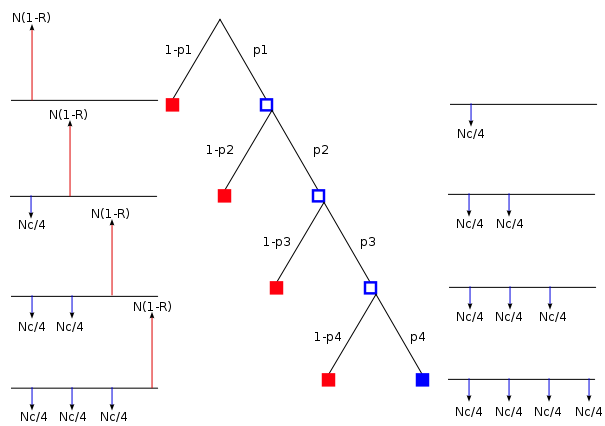

Here is an example of how to set up a Spread Trade with your broker or online trading software. This type of trade has a less than 20% chance of turning against you sufficiently to require a repair trade, but I am including the process so that you can be ready.

Step by step instructions for trading a credit spread

Step One: Pick your stock. Complete a trend analysis on the stock. Look ahead to make sure that there are no earnings dates or dividends due, as these both can have an effect on your trend. Scan the news on the stock, so you have feel for what is happening with the company. I usually go for expensive stocks, because you get better returns for each trade. DO NOT PROCEED UNTIL YOU HAVE A GOOD TREND IN PLACE! (TOP TIP : You can analyse up to 10 stocks per day for free with INO’s Trend Analysis . )

Step Two: On the Tuesday (or later) AFTER a given month’s expiration Friday, prepare to sell a credit spread for the next month’s expiration (i.e. no more than 30 days out).

Step Three: Choosing which spread to sell. To do this, you need to open Optionistic’s Probability Calculator (NOTE: If you subscribe, you get current data; if not, you must input your own price data. I do this, and it works fine. I will continue to try and find a free full service calculator!). Put in the current stock price, and the number of days to expiration. Put in the Implied Volatility of the stock (your broker software should have this information with the stock price). Put in the price of your closer option (the one that you will sell) as the first target, and the further out option (the one that you will buy) as the second target. Hit go!

For Bearish Call Spreads, you want to choose an option where the probability of ending below the lowest target is 80% or better.

For Bullish Put Spreads, you want to choose an option where the probability of ending above the highest target is 80% or better.

There it is! You have an 80% chance of winning!

Step Four: Sell your Credit Spread! Depending on your broker, you will need a certain margin per spread that you sell. The broker that I use requires a margin of $1,000 per credit spread, which makes it really easy to calculate. If I have $5,000, I can sell 5 spreads for one stock, or one credit spread for each of 5 stocks. Some have a lower requirement based on a complicated formula, but I like this rule of thumb — it gives me a little cash left over in case I need to run a spread repair.

NOTE :to find out exactly how to calculate the margin requirement, and your ROM (profit), go here .

Step Five: Calculate your profit. You do this by calculating the Return on Margin(ROM). If you margin is $1,000, and you sell your spread for $150, you have a ROM of 15%. You do that every month, and that is not a bad return!

Step Six: Monitor your stock. You can do this in about one minute a day. You do not need to worry unless the stock comes very close to or even touches your closest option (the one you sold). As long as it does not cross this line, you can pretty much ignore what happens to the price. Remember, there is only a 20% chance of the line being crossed.

Step Seven: When your option contracts expire valueless, do it again!

What If.

If your trend holds: As the stock gains or drops in price, your Credit Spread will drop in value very quickly, boosted by Time Decay. As the spread gets really cheap, you can buy it back and sell another one closer in. I usually set this so that I buy the spread back for $0.50 or less, and then sell a new spread for a good credit. In fact, for a fast dropping or growing stock, you can sometimes do this three or four times in a month, making for huge gains. I once did it five times on a stock, earning a neat 70% profit!

If the stock stagnates and goes neither up nor down: That is fine — sit it out till expiration, where your Credit Spread will expire worthless — you keep your profit. Sometimes a good trick is to buy back your spread and sell a new one 2-3 days before expiration — Time Decay will have milked any value out of your spread, and the chances of the stock making a big jump in two days is minimal, so you can squeeze it quite close.

If the stock moves against you: No sweat! Monitor it, but as long as it does not get to your closest option strike price (i.e. the one you sold), it will still expire worthless — you keep your profit .

If your stock hits your break even line (which is just inside your closest option, the one you sold): At this point you can do Credit Spread Repair. Buy the Credit Spread back, and immediately sell another Credit Spread. You can either buy the same kind of spread (call or put) or if the trend has definitely changed, buy the opposite. It is mostly possible to do this for no loss, or even a little gain.

EXAMPLE OF CREDIT SPREAD REPAIR:

Step 1. In a bearish trend, you have sold a call credit spread. XYZ is at $100.

SOLD XYZ June 120/125 Call Spread@ 0.80. Net Credit $80

Step 2. The trend reverses, and the stock hits $120. Trade a repair as follows:

BUY XYZ June 120/125 Call Spread@1.50. Net Debit $150

Sell XYZ June 135/140 Call Spread@0.80 Net Credit $80

RESULT: Total Credit (from both trades) = $160; Total Debit (from buy back)=$150. Total Net = $10

Alternate Trade:

BUY XYZ June 120/125 Call Spread @1.50. Net Debit $150

Sell XYZ June 135/140 PUT Spread @0.80 Net Credit $80

You can set this up as a stop loss trade on your broker software.

CONCLUSION: It doesn’t actually matter what happens to your stock. You have an 80% chance of keeping your profit upon expiration. If the worst case scenario occurs (20% chance), then you enact a repair and come out with nothing lost except broker fees. And then you get your profit next month.

The Cardinal Rule of Trading: Don’t lose money!

With this system, you don’t need to lose money. You have a maximum of 20% chance of one of your trades coming out a net zero. You have an 80% or greater chance of any of your trades earning 15% or more each month.

Here is a video from Free Trading Videos.com showing how a Credit Spread Trade looks like on the charts:

TOP TIP: Want to learn more? Here is an options trading video course that takes you step by step through real trades on the TOS trading platform. This course is excellent value for money.

Return from Setting up a Credit Spread Trade to the Home Page