Covering the Asset Classes US News

Post on: 27 Апрель, 2015 No Comment

A guide to diversification

Scott Holsopple

You’ve heard you shouldn’t put all your eggs in one basket. But are you really well diversified? Let’s step back to investing basics.

Diversification means investing in varied assets so that if one asset drops significantly in value, other parts of your portfolio could still be in decent shape. If much of your retirement savings are invested in one stock, and that stock loses lots of value, your net worth could plummet—which infamously happened to many former Enron employees. The same goes for asset classes. You don’t want to get stuck holding the bag on just one asset class.

Asset class diversification

At a basic level, there are five primary asset classes for retirement investors; and the categories are easily segmented by risk.

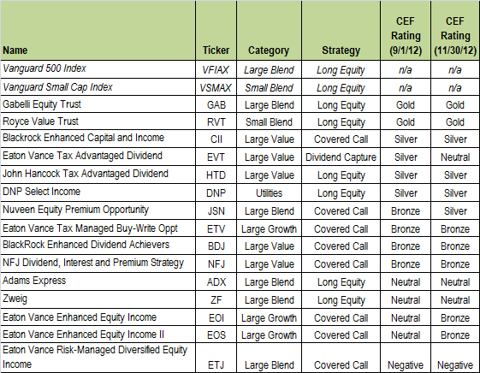

(1) International stock funds comprise the riskiest asset class available to most 401(k) investors. As an asset class, it can be volatile, but it has more potential for higher returns than some U.S. equity options. Mutual funds that fall under the international stock funds category invest in companies headquartered outside the United States.

(2) Small- and mid-cap stock funds invest in smaller U.S.-based companies. Smaller companies have potential to grow faster and offer higher returns than the asset classes below. However, they’re generally more unpredictable than larger U.S. companies.

(3) Large-cap stock funds have traditionally been thought of as the least volatile stock fund asset class. The risks and probability of potential returns for large-cap stock funds place this asset class precisely in the middle of the five asset classes. Funds that invest in U.S. companies with market capitalizations of $10 billion or more are large-cap funds.

(4) Bond funds are still riskier than cash-equivalent investments but are less risky than stocks. They have yields that provide a steady stream of income. Bond funds invest in loans made to companies or governments.

(5) Short-term fixed income funds include fairly liquid investments like treasury bills, certificates of deposit, and money market holdings. This asset class offers minimal risk and volatility in exchange for lower yield potential.

The most suitable mix of asset classes for your personal situation is called your asset class allocation.

Asset class allocation

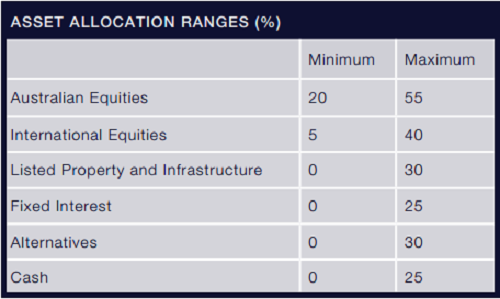

Your asset class allocation will be broken into percentages. In other words, X percent of your portfolio will go into X asset class, with 100 percent of your investments spread across some or all of the five major asset classes.

The most appropriate asset class allocation for you depends on a few important criteria: (1) your tolerance for risk, (2) your retirement timeline, (3) your personal preferences, and (4) economic conditions.

Using online calculators and doing research, you can likely figure your own risk tolerance, retirement timeline, and investing preferences. Determining how prevailing economic conditions should affect your asset class allocation is more complicated. And putting the entire puzzle together to establish the most suitable asset class allocation for you may be trickier still. If you enjoy research and analysis (and you have the time), you may want to calculate your own asset class allocation. On the other hand, a retirement adviser should have tools to help if you don’t have the time, knowledge, or desire.

Once you’ve got an appropriate asset class allocation, choose the mutual funds from each asset class that will comprise your portfolio.

The next time you hear someone say “don’t put all your eggs in one basket,” you’ll know you’re covered.

Scott Holsopple is the president and CEO of Smart401k. offering easy-to-use, cost-effective 401(k) advice and solutions for the everyday investor. His advice has been featured on various news outlets, including FOX Business, USA Today and The Wall Street Journal.