Covered Calls What Works What Doesn t

Post on: 23 Апрель, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

Enhance the income from your stock portfolio by writing options—such is the captivating appeal of covered-call investing. You buy Apple at $606, say, and write a September call exercisable at $640. If Apple doesn’t go up very much the option expires unexercised and you pocket the $15 premium. If it does shoot up you have a $34 capital gain plus the $15. This looks like a win either way.

Call option income lowers the volatility of a portfolio, since it offsets capital losses in a down market. In a weak market, collecting premiums from call options looks like finding money in the street.

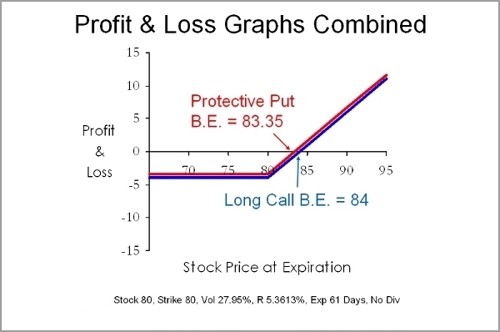

Payoff on a covered call (Source: Wikipedia)

A plethora of funds, most of them closed-end, have cropped up with covered calls in their portfolios. Among them: Invesco Powershares S&P 500 Buy-Write (PBP), Madison/Claymore Covered Call (MCN), Nuveen Equity Premium Income (JSN), Gamco Natural Resources Gold-Income (GNT), and Black Rock Enhanced Dividend Achievers (BDJ).

Does option-writing really enhance returns? Not in bull markets, that’s for sure. The Invesco Buy-Write fund, says Morningstar, has earned 9% a year over the past three years, to the S&P’s 15%. Perhaps this fund can catch up, if only we get a nice crash.

As for the long-term results from option writing, let’s look at the interesting career of William Mullen, utility pole lineman turned money manager. He did covered calls for 30 years, with mixed results.

While working during the day for the City of Memphis utility department, Mullen studied business at night. He eventually rose to the position of finance director for the utility, where he oversaw the pension fund. There, he discovered options. This was in the 1970s, when the options exchange in Chicago was new and investors were still feeling their way around these things.

In a flat market you don’t give up much when you sell out-of-the-money options, and between 1976 and 1982 the market didn’t go very far. The covered call program worked beautifully. Mullen outgrew his municipal job and became a money manager at Loomis, Sayles, selling call-writing programs to pension funds across the country.

Forbes published my somewhat skeptical review of Mullen’s call writing in 1983. The question it posed: Wouldn’t option writing lose as much ground in bull markets as it gains in sideways and down markets? I vowed to revisit Mullen’s program in a few decades. Here, a bit late, is the promised follow-up.

Mullen was a good salesman, and at his peak was overseeing options on $8.5 billion of assets. In time, though, the bull market that began in 1982 caught up with him. There were too many quarters when he was picking up nickels from option sales and giving away dollars when stocks were called away. Switching, as he did, from options on individual companies to options on stock indexes didn’t eliminate the problem.

Assets fled. Loomis, Sayles decided to close down the operation. Mullen went off to found a money-management firm of his own in Memphis, but never made it big again. He died six years ago at age 75.

There are those who, to this day, insist that writing covered calls enhances returns. They hypothesize that feverish demand from speculators makes out-of-the-money call options overpriced.