Covered Calls Explained

Post on: 7 Декабрь, 2016 No Comment

The covered call is an advanced options strategy that consists of writing 1 call option for every 100 shares you hold in the underlying stock.

Heres how it works. Long 100 Shares Sell 1 Call Option

By doing this you earn a premium writing the calls whilst at the same time appreciate all the benefits of holding the underlying stock, such as dividends and voting rights etc.

However, the profit potential of a covered call is limited since you have, in return for the premium, given up the chance to fully profit from a substantial rise in the price of the underlying stock.

Maximum Potential Profit

In addition to the premium received for writing the call options you’ll earn a paper profit if the underlying stock price rises up to the strike price of the call option sold.

The formula for calculating maximum profit is given below:

- Max Profit = Premium Received Purchase Price of Underlying + Strike Price of Short Call Commissions Paid

- Max Profit Achieved When Price of Underlying = Strike Price of Short Call

Maximum Potential Loss

The potential losses for this strategy can in theory be unlimited and occur when the price of the underlying security falls. You can mitigate this risk however by utilizing a stop loss for your stock trade.

The formula for calculating loss is given below:

- Loss Occurs When Price of Underlying, Purchase Price of Underlying Premium Received

- Loss = Purchase Price of Underlying Price of Underlying Max Profit + Commissions Paid

Breakeven

The underlying price at which breakeven occurs for the covered call position can be calculated using the following formula.

- Breakeven Point = Purchase Price of Underlying Premium Received

Covered Call Example

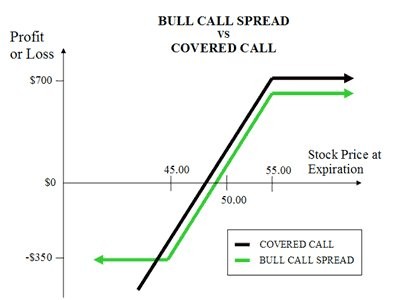

Let’s say Bank of America Stock (BAC) is trading at $50 in April and you decide to write a MAY 55 out-of-the-money call for $2. To assemble a covered call you also need to buy 100 shares of BAC which costs you $5000. You receive $200 for writing the call option giving a total investment of $4800.

Upon expiry, BAC stock has rallied to $57. Since the strike price of $55 for the call option is lower than the current trading price, the call is assigned and you can sell the shares for $500 profit. This brings your total profit to $700 after factoring in the $200 in premiums received for writing the call.

But look what happens if the stock price goes down 7 points to $43?

If the price drops to $43 youll incur a paper loss of $700 for holding the 100 shares of BAC. However, your loss is offset by the $200 in premiums received so your total loss is limited to $500.

Commission

To make the above example easier to understand we’ve left out the commissions that would have to be paid for both the options trade and the covering stock trade. In the real world you’ll have to pay these commissions which vary from broker to broker but are usually between $10 and $20.

Once you get a little more experience and start building more complex options chains you’ll want to look for a more cost effective solution. Fortunately there is just a solution available in the form of brokers that specialize in active traders. A good example of this type of broker is OptionsHouse who charge as little as $0.15 per contract (+$8.95 per trade).

Conclusion

The covered call is a popular options strategy but that doesnt mean its suitable for beginners. This strategy can result in significant losses if its not constructed with care. So make sure your covering stock trade has stop losses implemented and youre aware of the potential downside before you commit to the trade.

Having said that it can prove very profitable during periods of low volatility. So learn how to construct it properly and test it out in a virtual environment before you risk any real capital.