Covered Calls Bullish or Bearish Options for Rookies

Post on: 30 Ноябрь, 2016 No Comment

Mark,

You said selling a covered call is bullish, I think it is bearish. By selling you are making a “bet” that the strike price is too high. Buying a call would be a bullish bet.

Marty

Marty,

Your perspective is somewhat unusual Im not saying its incorrect just that its different.

I also see that you dont recognize that options can be used to hedge, or reduce the risk of owning an investment. To you, options are to be used only for speculation. You are free to use options that way, but you are losing out on some of the characteristics of options that makes them so special.

I consider this discussion to be important to the options rookie who is looking for a solid options education.

Without any market bias, these statements about a covered call position are all true:

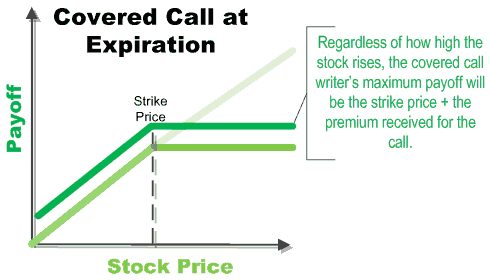

- The position is delta long

- The position earns money when the stock moves higher

- The position loses money when the stock moves lower

- Those are NOT the characteristics of a bearish position.

Profits are limited for the covered call writer

- That is not bearish

- Its a trade-off. The stockholder collected a cash premium now in exchange for potential profits above the strike price later

- Consider the trader who buys stock and sets a profit target. Thats a bullish trader

- Thats exactly what the covered call writer does. He/she sets a sell price and collects a cash premium

- A bearish trader would NOT own stock

The wager

Is the bet really that the strike price is too high?

That is overly simplistic and tells me that you use options purely to speculate. By wring a covered call, the stockholder sells someone else the right to all profits above the strike price for the lifetime of the option. In exchange he/she gets paid today.

Thats not bearish. It is a bird in the hand investing style. The trader takes the option premium now instead of possible profits later. Its not a wager to be won or lost. Its a trade. If the stock goes much higher, thats a good result. The stockholder wins. From you speculative thinking, the stockholder loses. I do not understand how you can survive as a trader if you are not happy with a profit just because you could have earned more money had you chosen a different strategy.

Im thrilled to write a covered call and be assigned an exercised notice. Thats a winning trade. More than that, its the best possible result after I decided to write the covered call.

The bullish bet

Owning stock is a bullish bet. If the stock moves higher, the trader earns a profit.

Buying a call option is a bullish bet. Yet, if the stock moves higher, there is no guarantee that the call owner will earn a profit. There may even be a significant loss.

Owning a call may give the trader a chance to make money on a rally, but far too often the trader buys the wrong option (strike price too high) or pays too much for time premium (rapid time decay that hurts the options value when the stock price does not increase quickly enough).

Leverage works both ways. An inexpensive call option can return a large profit, but it can also expire worthless, even when the stock has rallied.

Buying at the money or out of the money calls is highly speculative, and it takes the right set of conditions to deliver a profit. If the calls are deep ITM, thats a smarter play. However, Im certain thats not the idea you were suggesting.

Thanks for sharing your thoughts.