Covered Call Explained

Post on: 23 Апрель, 2015 No Comment

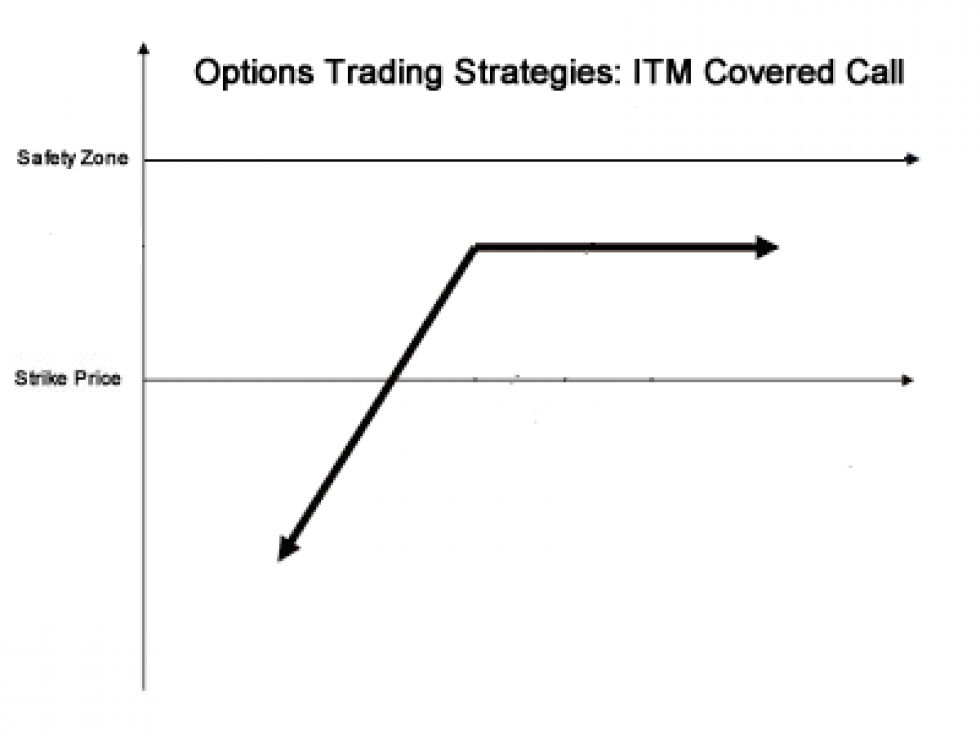

The Setup

- You own the stock

- Sell a call, strike price A

- Generally, the stock price will be below strike A

Who Should Run It

Rookies and higher

NOTE: Covered calls can be executed by investors at any level. See the Rookie’s Corner for a more in-depth explanation of this strategy.

When to Run It

You’re neutral to bullish, and you’re willing to sell stock if it reaches a specific price.

The Sweet Spot

The sweet spot for this strategy depends on your objective. If you are selling covered calls to earn income on your stock, then you want the stock to remain as close to the strike price as possible without going above it.

If you want to sell the stock while making additional profit by selling the calls, then you want the stock to rise above the strike price and stay there at expiration. That way, the calls will be assigned.

However, you probably don’t want the stock to shoot too high, or you might be a bit disappointed that you parted with it. But don’t fret if that happens. You still made out all right on the stock. Do yourself a favor and stop getting quotes on it.

About the Security

Options are contracts which control underlying assets, oftentimes stock. It is possible to buy (own or long) or sell (“write” or short) an option to initiate a position. Options are traded through a broker, like TradeKing, who charges a commission when buying or selling option contracts.

Options: The Basics is a great place to start when learning about options. Before trading options carefully consider your objectives, the risks, transaction costs and fees.

The Strategy

Selling the call obligates you to sell stock you already own at strike price A if the option is assigned.

Some investors will run this strategy after they’ve already seen nice gains on the stock. Often, they will sell out-of-the-money calls, so if the stock price goes up, they’re willing to part with the stock and take the profit.

Covered calls can also be used to achieve income on the stock above and beyond any dividends. The goal in that case is for the options to expire worthless.

If you buy the stock and sell the calls all at the same time, it’s called a ”Buy / Write.” Some investors use a Buy / Write as a way to lower the cost basis of a stock they’ve just purchased.

Maximum Potential Profit

When the call is first sold, potential profit is limited to the strike price minus the current stock price plus the premium received for selling the call.

Maximum Potential Loss

You receive a premium for selling the option, but most downside risk comes from owning the stock, which may potentially lose its value. However, selling the option does create an “opportunity risk.” That is, if the stock price skyrockets, the calls might be assigned and you’ll miss out on those gains.