Costco Anatomy Of A Winning Options Trade

Post on: 25 Июль, 2015 No Comment

STEVE SMITH ON STRUCTURING TRADES

A recent trade in Costco (NASDAQ:COST ) for the OptionSmith portfolio provides us with the opportunity to look into the thought process that goes into initiating and closing out an options position.

This trade was somewhat unusual in that I executed it at the opening. I typically dont initiate a trade in the first 15-30 minutes of the trading session, and in this case, I ended up closing it out without hours. My typical holding period is anywhere from a week to two months.

But given the compressed time frame, this trade is a useful example of the things I look for in choosing an entry point, a strike price, the expiration period, and the capital allocated.

Before the opening on Wednesday, October 9, Costco reported earnings that were disappointing on the surface, and the stock was indicated to gap some $2 lower near $110 a share.

Buying a gap down on earnings news, especially with the overall market on such shaky ground can be foolhardy. the S&P 500 (INDEXSP:.INX) was down 20 handles the prior day and was indicated down another 10, indicating high risk.

However, Costco is a name I follow closely, and I had been looking for a buying opportunity. So I read through the earnings report and looked at the chart. My trades have both a fundamental and technical component. Sometimes one takes more weight than the other, and that will help determine the strategy. In Costcos case, both seemed to align. The earnings report was not perfect — but not that bad.

As I noted in the alert:

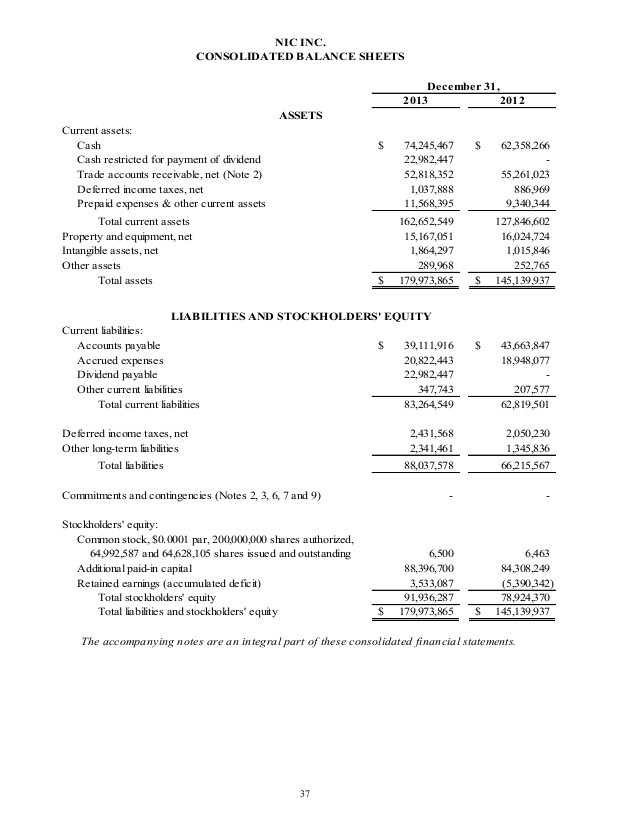

The company reported increases in both its top and bottom lines — 0.8% and 1.3% respectively. While the revenue gain is slim, top-line growth is hard to come by these days. More impressive is that same store sales increased 5% in the U.S. and 7% internationally. Membership revenue increased 4%, suggesting that the companys price increase is being accepted.

The indication for the stock to open at the aforementioned $110 level was right at a solid support level, and the stock had already come down some 7% in the prior two weeks. This seemed like a pretty good entry point, and for risk-management purposes, I could use a tight stop at the $108 level.

The next step was choosing the strike and expiration. Given the alleged disappointment and the shaky market, I wanted to give this trade some time to play out. With October options having only 8 trading days remaining at that point, I looked towards November.

Choosing the strike is mostly a function of the target price and time. In this case, I was set on a target of $116 a share, in-line with the May 28 interim high — a potential fulcrum point. So I decided on the at-the-money $110 call, which would give me a decent delta. And if it took time for the stock to rally, it would retain time premium and intrinsic value better than an out-of the-money call.

My next step was to decide the size of the position. Given that I had a pretty strong conviction, I was willing to allocate the upper end of my 5% limit on individual trades; in this case, based upon the size of the OptionSmith portfolio, that meant buying 15 calls at $3 a contract. My typical positions run from $1,000-$6,000. Note that towards the upper end of this scale, stops are always used to reduce risk.

It turned at that Costco bounced very quickly — within hours — to about $115 share. At this point, this point the call had doubled in price to $6, and as I wrote in the alert closing out the position, there was no need to be married to the $116 target that offers only incremental more profit versus the risk.

The first chart below shows the support level (blue line) and target price(yellow line), while the second illustrates the intraday action.

Of course, not every trade is a winner — so next time well take a look at an options trade that went south.

But for now, lets focus on what we learned from this trade:

1) Set a target price and stop-loss level before you make a trade.

2) Size individual positions in accordance with your confidence in the trade, as well as with your overall risk tolerance.

3) If a trade swings in your favor quickly, dont be afraid to book profits, even if your exact target hasnt been hit yet.

Editors Note: Steve Smiths OptionSmith portfolio is up a whopping 30% in 2013. Take a FREE trial today . and get his exclusive eBook Beyond Puts and Calls: 9 Step to Profitable Options Trading. Click here to access this offer.