Cost Basis

Post on: 12 Июнь, 2015 No Comment

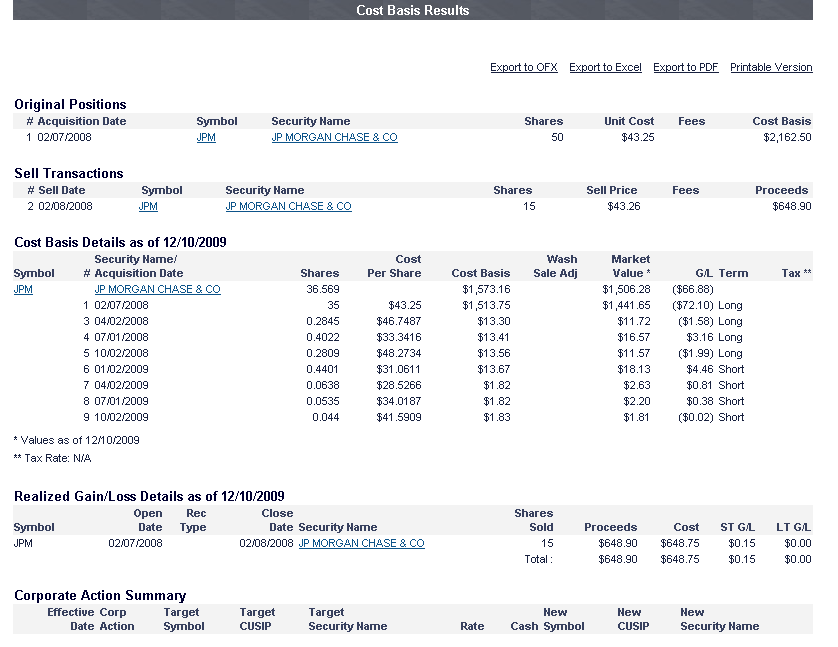

Summary of Cost Basis

In October 2010 the Internal Revenue Service (IRS) issued new mandatory regulations regarding cost basis. Under the new regulations, mutual funds are now required to report cost basis information to the IRS. When you sell or exchange shares of a mutual fund or other securities, you may have a capital gain or loss that must be reported to the IRS. To calculate the gains or losses from shares sold, you must know the cost of the different shares you own. Cost basis is the original price paid for those shares. Any transaction that increases or decreases the number of shares in an account can affect cost basis.

The effective date for shareholders of mutual funds is January 1, 2012. The new cost basis regulations treat mutual fund shares acquired before the effective date as non-covered shares. Mutual funds are not required to report cost basis to the IRS for shares purchased prior to the effective date.

Shares acquired after the effective date are considered covered shares. Mutual funds will now report the cost basis for all covered shares to both you and the IRS. When filing your tax return, you will be required to use the cost basis reported on your 1099-B for your covered shares.

The first of this regulation begins on January 1, 2011 with stocks and bonds. For mutual funds, the regulation will come into effect on January 1, 2012 and for debt instruments, options and other securities on Jan 1, 2013.

Two key provisions required by the new Cost Basis regulations are:

- Under the new regulation, the mutual fund must select a default method for cost basis reporting and notify you of its selection. You have the option to choose the same method as the fund’s default or you may choose any of the other cost basis reporting methods. This election is good for all future transactions unless you either revoke or change the election.

- The new regulation removes the exemption from Form 1099B reporting by S Corporations. A W-9 should be completed and submitted to establish proper identification of the type of corporation submitting a form. For those entities that are S-Corporations, the mutual fund’s default election is noted on the election form, but you may select a different cost basis method if you choose. Be advised, all corporations should complete the Form W-9 and return it. ANY CORPORATION FAILING TO RETURN THE W-9 WILL BE DEFAULTED TO AN S-CORPORATION AND SUBJECT TO 1099-B REPORTING. If you do not have a W-9 form one can be printed from the Documents page on this website.

If you elect Average Cost as your cost basis method, the regulations require that you make the election in writing. This can be accomplished by selecting the average cost election and signing the election form which was mailed to you. The form should be returned regardless of the method you choose. If you do not return the election form, the fund’s default method will apply.

Cost Basis

2015 Boston Financial Data Services. All Rights Reserved.