Corporate action Wikipedia the free encyclopedia

Post on: 19 Май, 2015 No Comment

Purpose [ edit ]

Purpose Of Corporate Actions

Return profits to shareholders. Cash dividends are a classic example where a public company declares a dividend to be paid on each outstanding share. Bonus is another case where the shareholder is rewarded. In a stricter sense the Bonus issue should not impact the share price but in reality, in rare cases, it does and results in an overall increase in value.

Influence the share price. If the price of a stock is too high or too low, the liquidity of the stock suffers. Stocks priced too high will not be affordable to all investors and stocks priced too low may be de-listed. Corporate actions such as stock splits or reverse stock splits increase or decrease the number of outstanding shares to decrease or increase the stock price respectively. Buybacks are another example of influencing the stock price where a corporation buys back shares from the market in an attempt to reduce the number of outstanding shares thereby increasing the price.

Corporate Restructuring. Corporations re-structure in order to increase their profitability. Mergers are an example of a corporate action where two companies that are competitive or complementary come together to increase profitability. Spinoffs are an example of a corporate action where a company breaks itself up in order to focus on its core competencies.

Impact [ edit ]

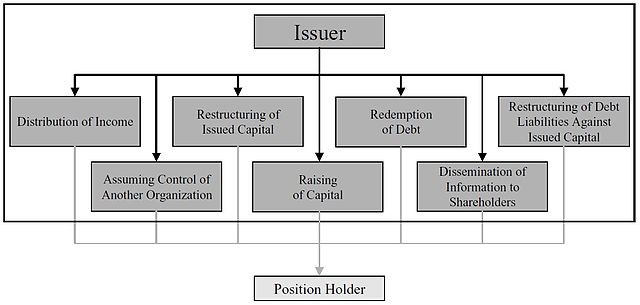

As a beneficial owner, the impact of a corporate event (action) is usually measured in terms of its impact to securities and/or cash positions; consequently corporate action events can be categorized as follows:

Benefits. The events that result in an increase to the position holder’s securities or cash position, without altering the underlying security; example can be cited of, a bonus issue, which is a Mandatory With Options Action/Event.

Re-Organisations. The events re-shape or re-structure the beneficial owners underlying securities position, at times, also allowing a combination of cash pay out. Example can be cited of Equity Restructure, Conversion, Subscription, etc.

Beneficial Impact Of Corporate Actions

Types [ edit ]

Corporate actions are classified as voluntary, mandatory and mandatory with choice corporate actions.

Mandatory Corporate Action. A mandatory corporate action is an event initiated by the corporation by the board of directors that affects all shareholders. Participation of shareholders is mandatory for these corporate actions. An example of a mandatory corporate action is cash dividend. All holders are entitled to receive the dividend payments, and a shareholder does not need to do anything to get the dividend. Other examples of mandatory corporate actions include stock splits, mergers, pre-refunding, return of capital. bonus issue, asset ID change, pari-passu and spinoffs. Strictly speaking the word mandatory is not appropriate because the share holder person doesn’t do anything. In all the cases cited above the shareholder is just a passive beneficiary of these actions. There is nothing the Share holder has to do or does in a Mandatory Corporate Action.

Voluntary Corporate Action. A voluntary corporate action is an action where the shareholders elect to participate in the action. A response is required by the corporation to process the action. An example of a voluntary corporate action is a tender offer. A corporation may request share holders to tender their shares at a pre-determined price. The shareholder may or may not participate in the tender offer. Shareholders send their responses to the corporation’s agents, and the corporation will send the proceeds of the action to the shareholders who elect to participate.

Other types of Voluntary actions include rights issue, making buyback offers to the share holders while delisting the company from the stock exchange etc.

Mandatory with Choice Corporate Action. This corporate action is a mandatory corporate action where share holders are given a chance to choose among several options. An example is cash or stock dividend option with one of the options as default. Share holders may or may not submit their elections. In case a share holder does not submit the election, the default option will be applied.

Corporate Actions Information [ edit ]

When a company announces a corporate action, registered shareholders are told of the event by the company’s registrar. Financial data vendors collect such information and disseminate it either via their own services to institutional investors, financial data processors or via online portals in the case of individual investors.