Conversion Arbitrage

Post on: 5 Июль, 2015 No Comment

Conversion arbitrage does not typically find its way into books about options trading. It is not surprising, given that the term alone would cause most eyes to glaze over. With a little extra effort, however, this stock and options combination strategy should not be too difficult to fully understand.To help demystify conversion arbitrage, we begin with an uncomplicated model of conversions, making some simplifying assumptions to get at the core concept. Later, as we proceed through other sections of this tutorial, assumptions are dropped as more complex relationships are introduced into the picture.While understanding conversion arbitrage does not require an advanced degree in finance or being a veteran market maker, it will require a basic understanding of put and call options (both buying and selling), familiarity with stock buying/shorting and knowledge of the stock dividend process. Conversions incorporate these elements, and a few others, in their cost and profitability structures and in the dimension of risk assessment, so you should brush up on them before getting started. (To learn more, read Put-Call Parity And Arbitrage Opportunity. When To Short A Stock and How And Why Do Companies Pay Dividends? )Market Efficiency, or Lack Thereof

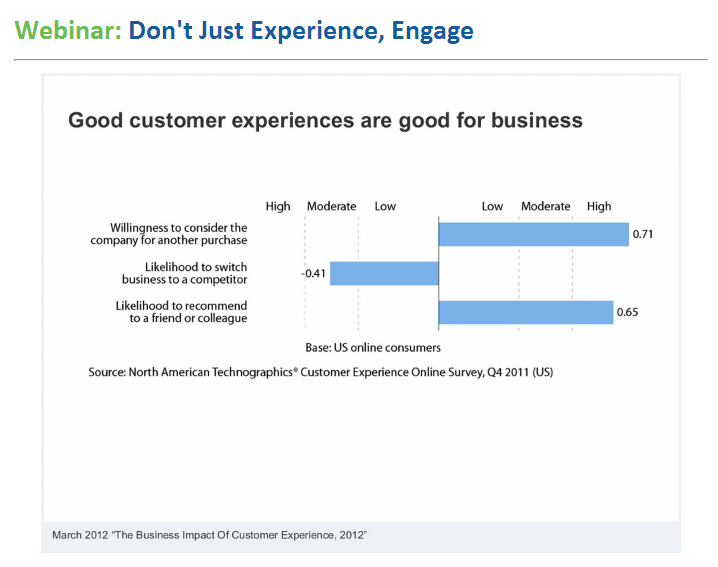

When we speak of arbitrage of any kind, it is always associated with the idea of taking advantage of some sort of marketplace mispricing pricing that is out of line with theoretical or fair value. The textbook story is one where the arbitrageur is supposed to play the role of keeping prices efficient by seizing opportunities when prices deviate from fair values, and thus driving them back to efficient levels.

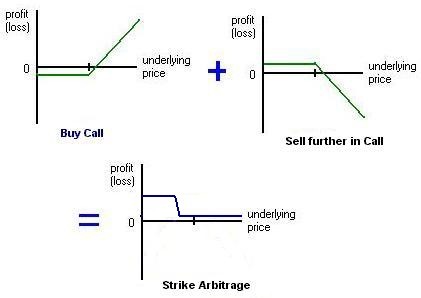

In the options markets, it is the process of conversion and reverse conversion that helps keep put and call prices efficient. If an arbitrage opportunity appears for the options strategist seeking to lock in a potential profit using a conversion strategy, the purchase and sale of conversions act ultimately to remove that opportunity for profit.

Conversions have a long history, which is usually associated with market makers or floor traders who have a trading edge as a result of being on the trading floor, operating with lower margin requirements and having much lower transaction costs.

These key advantages plus earning interest on short sales in reverse conversions helped give this approach its reputation of not being for the retail guy. In todays more level playing field for trading, however, conversion opportunities may be available for any astute trader. (Arbitrage is no longer just for market makers; find out more in Arbitrage Squeezes Profit From Market Efficiency .)

If prices are efficient, there is no way to extract a profit from conversion arbitrage above the risk free rate of interest. You would be better off buying a Treasury bill or CD and saving yourself the trouble not to mention the transaction costs.

As you will see, it is possible to find profitable conversions, especially when incorporating dividend payments and interest earned on credit balances (for reverse conversions). It is absolutely essential to fully understand exactly how to cost-price these strategies before jumping into positions. Otherwise, you may ultimately make money on the trade only to learn that you could have made just as much, or more, by plunking your money down and buying a CD. Or worse, you may actually experience a loss due to not properly understanding the hidden risks. (To learn more, read Dont Let Stock Prices Fool You .)

With this in mind, the availability of efficient online trading tools, deep discount commissions and new margin rules offer traders a better opportunity for finding conversions that provide potential profits above a CD rate or risk-free rate of interest. Hopefully this tutorial will encourage you to further explore this approach.