Contrarian Investing Definition Strategies Indicators

Post on: 14 Август, 2015 No Comment

Examples, Basic Strategy and Indicators

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Definition: Contrarian investing is an investment strategy that attempts to find disconnections in conventional wisdom, to go against the crowd when it appears to have pushed security (i.e. stock or bond) prices too far, up or down, in one direction.

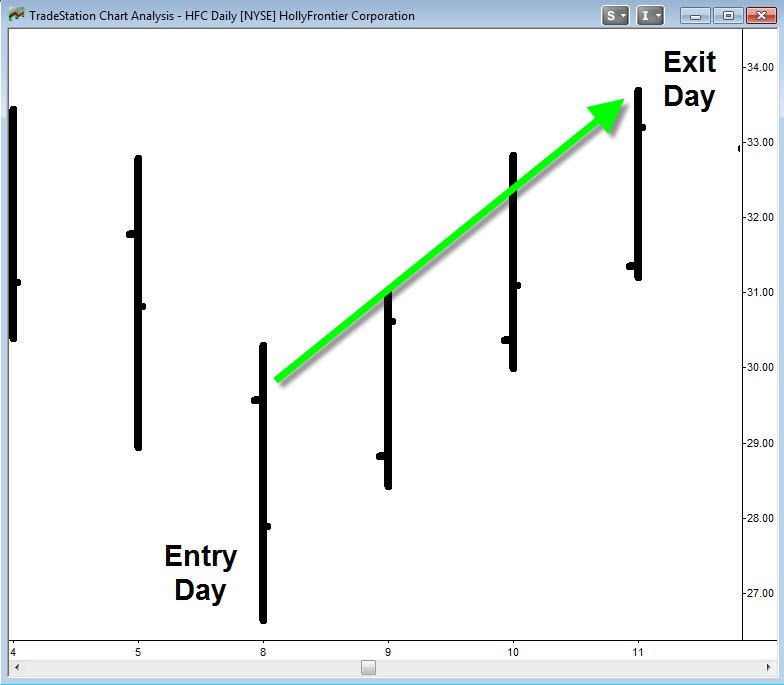

For example, investor optimism can push a stock price so high that the price no longer justifies the value of the underlying company, as revealed by fundamental analysis. Put simply, the stock is too expensive and the price is likely to fall. Many contrarian investors use tools, such as options, to bet stock prices will fall (or rise if prices have fallen below fundamental value).

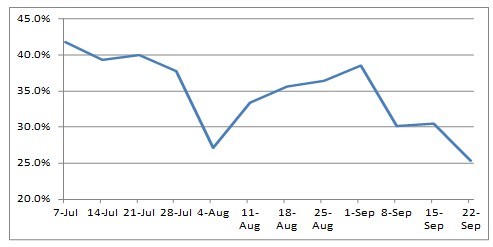

Contrarian investors may also look for signals or indicators other than valuation methods to determine broader market sentiment. For example, record-level mutual fund flows can indicate investors have pushed prices too far in one direction. Excessive inflows may indicate overbought conditions and excessive outflows may indicate oversold conditions.

Contrarian investors have even looked at media trends for indicators of market sentiment that may be overblown. For example, when there are magazine covers and television broadcasts featuring news on bull markets or bear markets the contrarian investor may receive this as an indication that the dumb money is entering or exiting stocks in mass amounts that is unsustainable for long periods and begin positioning investments for a move in the opposite direction.

Therefore contrarian investing depends largely upon the psychology and behavioral aspects of finance and market timing often involves luck as much as it does skill. Investors should be cautioned, to paraphrase John Maynard Keynes, the crowd can remain irrational longer than you can remain solvent. In translation, security prices do have their excessive points but precisely picking that point can be difficult, if not impossible. The investor crowd is right more than it is wrong and the trend is your friend most of the time, which means you should think carefully before betting against it.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.