Condor Spread Option Strategy

Post on: 9 Июнь, 2015 No Comment

What is the Condor Option Spread?

The condor spread. is very similar to the butterfly option strategy in that it is a low risk, low reward options strategy that profits when the underlying asset has very small percentage changes from entry till its What is the Condor Option Spread?

The condor spread. is very similar to the butterfly option strategy in that it is a low risk, low reward options strategy that profits when the underlying asset has very small percentage changes from entry till its expiration date. The key difference between the two strategies is in the number of options utilized in each. The condor spread employs the use of four equidistant options as opposed to the three options involved with the butterfly spread. The condor has a wider profitable zone but achieves a lower profit.

The condor spread is a net debit transaction while its’ sister strategy the iron condor is a net credit spread. The condor option spread can be purchased using puts or calls; either strategy will yield the same results if the condor remains in a profitable situation. To create a call condor spread, one would need to purchase one OTM call, sell one ATM call, sell one OTM call, and purchase one further OTM call. The combination of these four options will create a net debit spread. Again, just as with the butterfly spread, the condor spread can be split up and looked at as a bull call spread and bear call spread put together.

As you can imagine, one drawback to this stategy is the high commision costs that will be endured since you are buying four options. Additionally, the strategy requires very small percentage changes from entry to expiration. Let’s take a look at the risk characteristics associated with this strategy.

Condor Spread Risk Characteristics

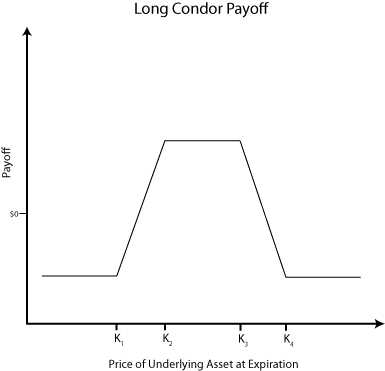

As you can see, the most profitable situation for someone who is long the condor spread is in which the underlying security trades between the two middle strikes at expiration. This is where maximum profit will be achieved. Additionally, the maximum loss that can be had on this strategy occurs where the wings form. The risk in the trade is merely the debit that was paid to initiate the position. The key difference between this strategy and the butterfly spread lies in the body. The condor spread has a wider range in which the security can trade within to be profitable at expiration. The butterfly spread is most profitable at the middle strike price only.

As we stated above, the risk can be calculated as:

Risk = — ITM Call Premium + ATM Call Premium + OTM Call Premium — DOTM(Deep Out The Money) Call Premium

Again, the breakeven calculations for the condor are exactly the same as the butterfly spread. There are two breakeven point:

b1* = ITM Call Strike + Risk

b2* = OTM Call Strike — Risk

As long as the security stays between b1* and b2* in the above graph, the trader will be in a profit able position. Let’s talk a little about how this makes sense. When your dealing with so many options contracts as a newbie, it can be a bit difficult to do the breakeven calculation as the variety of options contracts, long and short, will confuse you. Let’s break this down a bit further. We are going to discuss an example where a security is currently trading at $55. It is irrelevant at this point what the options premiums are. We are simply going to review the value of the options that would be part of this strategy. Therefore, I selected a strike of 50, 55, 60, and 65 to comprise the condor option spread.

What can you derive from this example? Can you correlate it to the graph above? You can see that this stategy is in a profit postion when the market value of the security is between the two short call option strike prices. This correlates to the body of the condor from the above graph. Secondly, you can see that all of the options are worthless when the stock closes at the strike prices correlating to the long call options (50 and 65). This is where the wings start to form in our risk characteristics graph above.

Now, let’s bring the options premiums into play. We are dealing with a condor spread, not an iron condor, so this will be a net debit transaction. Let’s suppose we paid $1.5 net for the premiums. You can basically subtract $1.5 from each of the profit calculations in the final row in this chart and you will derive the profit loss in this trade. Therefore, your maximum profit potential in this scenario is $5 — $1.5 or $3.50.

Conclusion

In conclusion, the condor is a decent strategy for a range bound stock but should only be considered in short term trading situations with a maximum of two months till expiration. This is speaking from my experience, you ultimately have to do what you are comfortable with. The longer you give an option to go against you, the odds increase for that to happen. We are looking for the underlying security to stay within a very tight range and for that reason, I tend to shy away from the condor spread.