Compounding Your Interest Investment U

Post on: 2 Апрель, 2015 No Comment

by Dr. Scott Brown Tuesday, March 17, 2009 Wisdom of Wealth

by Dr. Scott Brown, Advisory Panelist

Tuesday, March 17, 2009: Issue #957

One of the most pervasive answers I hear about why people aren’t saving more, is that savings just sit there. They don’t do anything. With the many classes and the lectures I do, it never ceases to amaze me when I hear that.

And while other excuses run the gamut from the high cost of living to sheer apathy — the fact is, most Americans don’t really understand saving. Many believe that it’s just too risky to put your money in the market right now. On the other hand, if it’s in a CD, money market or savings account their money isn’t doing anything.

They aren’t too far from the truth.

Even the best interest rates on cash are yielding less than 2.5%. And while inflation has been down in January, it’s averaging over 3% for the last 12 months.

But right beneath our common savings misconceptions is the very way we can do it better. There is a way to double the return on your safest accounts — without increasing your risk. By reinvesting and compounding your interest, you can double your returns. Here’s why more investors need to understand compounding.

Compounding Your Interest — How To Grow Your Savings

Many know that they can grow their savings with simple reinvesting and compounding your interest.

But how much more. you might be surprised.

The amount of interest earned on a $1,000 savings deposit over five years that compounds annually at a 5% rate is $276. But if we compound it for another five years that same account grows at more than twice the amount earned after the first period. It’s earned interest of $629 instead of $276.

Why the big difference? It’s because of compounding.

Compound interest is literally interest on interest. So, after one year you earn $50 in interest (5% X $1,000); after two years you earn another $50 in simple interest plus $2.50 in compound interest (5 % X $50); after three years, you earn another $50 in simple interest plus $5 in compound interest (5 % X $100), on and on.

Simple interest is the amount of interest earned on the original principal, while compound interest is earned off the reinvested interest.

The Raw Power of Compounding Your Interest

Over many years the raw power and impact of compounding your interest is huge.

It doesn’t sound like much but a husband and wife contributing $5,000 each to a retirement or savings account would have $50,000 in five years and $100,000 in 10 years.

But with a return of just 5% it would grow to $68,019.13 in five years, and $142,067.87 in 10. That’s $42,067.87 of interest in just 10 years — and more than double their $18,019.13 five-year interest earnings.

The more frequently interest is compounded the higher the effective rate. You end up making more interest!

Now, imagine that a husband and wife saved up for 10 years starting at age 30 at 5% in two Roth IRAs and stopped contributing at age 40. They just let the $142,067.87 sit and compound for another 25 years until they retire at age 65.

That pile of cash would grow to nearly half a million.

Compounding Your Interest — Watch The Rising Interest Rate

But the interest rate would also be higher the more you compound. See in the table below, where FV represents future value.

You should be interested not only in the nominal or stated rate of interest, but also the effective rate.

The effective rate of interest is the interest actually earned for a period of time, based on both the nominal rate of interest and the number of times it is compounded annually.

Compounding your interest is an easy way to increase your savings’ return and should give you fewer excuses why you aren’t saving.

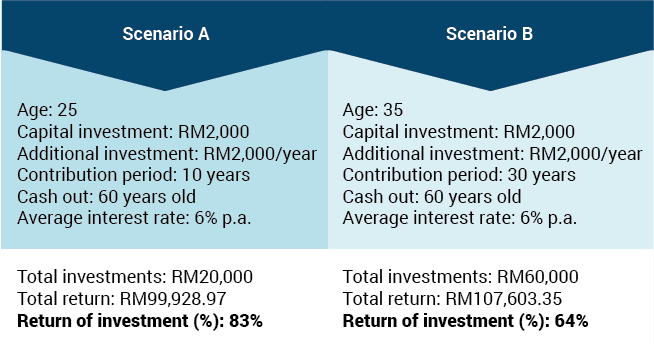

And the sooner you start, the larger your returns will be.

While we’re going through more than a rough patch in our economy, it doesn’t mean we should stop good habits that will eventually make us millionaires. Let compounding do the work for you.

It all starts with education,

Scott Brown

Today’s Investment U Crib Sheet

Last month, Scott Brown gave us Financial Stability. 4 Steps to get Your Finances in Order because as many know, it’s not as easy as it sounds to be fiscally disciplined. But it’s worth the difficulties. It’s why we do what we do here at Investment U. In addition to helping our readers become better investors, we aim to provide a range of investment options and ideas.

Just last week, Scott showed us why ETFs are becoming a growing part of many investors’ portfolios — helping to reduce costs and provide diversification. You can read more on Exchange Traded Funds. How to Put Your Mutual Fund on Steroids and why you need to see if ETFs are right for your portfolio.

Lou Basenese showed us the ins and outs of the mark-to-market rule. and how it is affecting the investments around the world. But its affects can also mean undervalued assets begging to be bought.

Compounding doesn’t just work in savings and cash accounts. Stocks show some of the most powerful effects of compounding, especially those that give out healthy dividends.