Comparing ETF Options V Options

Post on: 2 Май, 2015 No Comment

Comparing ETF Options Vs. Index Options 5.00 / 5 (100.00%) 1 vote

All primers will advise all traders to become as familiar with their intended trading environments as they can be. This involves looking into trends and statistics and possessing the means to appropriately analyze indicators as they come and go. As such, traders will also have the chance to determine what market they will be most comfortable working with. While it is not something that is so heavily based in technical data, traders who are more comfortable with their trades can expect to enjoy a larger degree of personal success in the field. This is no different when comparing ETF options vs. index options. Traders will have the opportunity to flourish in both environments so long as they understand how to trade. As such, there are several primary differences between the two trading fields that traders are strongly encouraged to keep in mind in order to make the most of their trades.

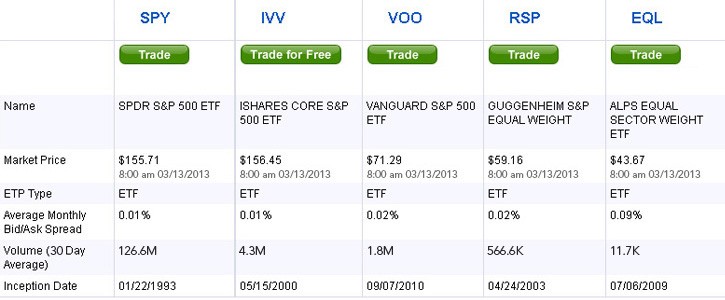

Though ETFs have become more popular in recent years, the fact is that the vast majority of them are not so heavily traded. This is due to the fact that a large number of these ETFs are specialized, or can only cover a certain specific section of the market. The result of this is the fact that they will have a relatively limited appeal with the investing public. Many of the differences that surround these two options revolve around the fact that most trading options on ETFs will result in a need to assume or deliver certain shares of the ETF. The same does not apply to index options.

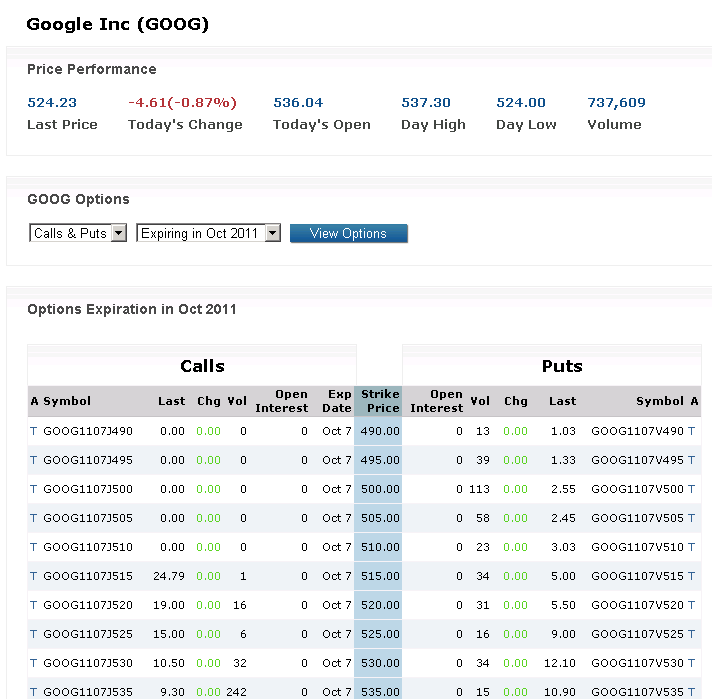

The primary reason for these differences is the fact that index options are generally European style, which means that they will often be settled in cash, while ETFs are American style options, which are settled in shares. Most American options can also be subject to early exercise, which means that they will have the chance to be traded at just about any time before their expiry, which will trigger the security. This potential, even if it is not used, can typically result in major ramifications for traders, especially those who are not so familiar with the market.

For the most part, when comparing ETF options vs. index options, it is important to remember that index options can be bought and sold prior to their expiry dates. However, even if this is done, the index options are not technically exercised because they are not associated with any underlying index. The result of this is a distinct lack of concerns on the parts of traders who are interested in early exercise options. Individuals can expect to enjoy a much larger variety of freedom when it comes to index options than with ETF options. However, much like any field, it is important to analyze existing trends and indicators and see how comfortable you may feel when working with them.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *