Commodities 101 Money & Markets

Post on: 22 Апрель, 2015 No Comment

Commodities are vital component of the world economy and our everyday lives. Agricultural commodities are the foundation of the food industry; energy commodities provide electric power and transportation fuels; and metallic commodities are essential to construction and industry. The thirst for commodities has sparked wars throughout world history.

Until recently, investors seeking to profit from commodity price changes had two choices: open a futures trading account or identify stocks that are highly correlated to commodity prices – such as gold mining or oil companies. However, with the advent of exchange-traded funds, there are now a variety of commodity-based ETFs that track the underlying price of the commodity on the physical market and can be easily accessed by investors.

Commodity Fundamentals

First the basics: commodity prices are driven by supply and demand. When supply decreases and demand increases, prices rise. When there is excess supply and weak demand, prices drop. In contrast, stock prices are ultimately are driven by company earning and investor perceptions of future earnings. Needless to say, commodities do not pay dividends.

There are four major categories of commodities:

- Energy (crude oil, hearing oil, gasoline and natural gas0

- Agricultural (corn, soybean,s wheat, cocoa, coffee, cotton, and sugar)

- Livestock (hogs, pork bellies, live cattle, and feeder cattle)

- Metals (gold, silver, platinum, palladium, copper, and aluminum)

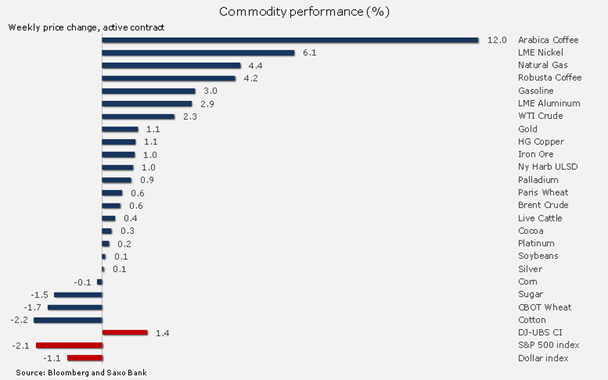

In recent years, commodity prices have been very volatile. Gold and silver skyrocketed in price starting in 2009, fell back a bit, and are now showing signs of resuming their a long-term bullish trend. Crude oil prices tripled in price several years ago, only to lose most of those gains in the financial crisis, and have gyrated up down in large swings ever since. This volatility – which is characteristic of commodities – creates tremendous profit opportunities for savvy investors.

It’s important to understand that most commodities have a natural supply and demand cycle that often impacts prices. For example, gold has a tendency to peak in late January or early February as holiday season and Valentine’s Day jewelry sales drive gold demand and push prices up. Crude oil has a tendency to bottom out in December and to peak in September in response to refiners building inventories for summer driving and heating oil season. Anyone looking to trade and invest in commodities needs to be aware of these seasonal tendencies. The Commodity Trader’s Almanac , which I write every year in collaboration with Jeffrey Hirsh, provides in-depth analysis of commodities and their seasonal patterns.

Interest in commodity-based ETFs has exploded in recent years and shows little sign of abating. There are three basic ways to gain exposure to commodities through ETFs:

- Physically backed funds

- Equity funds

- Exchange traded notes (ETNs)

Each of these varieties has advantages and drawbacks. You need to be particularly discerning about a fund’s objective and how it pursues its goal. Does the ETF hold the physical commodity or does it use futures contracts to replicate exposure? Does it hold equities of companies that are engaged in the production of a particular commodity? Your investment decision needs to be based on far more than just the name of the ETF. Just because a fund’s name includes “oil,” “natural gas,” “gold,” etc. you can’t be sure how that fund accomplishes exposure to that particular commodity

Physical Commodity ETFs

As the name implies, physical commodity ETFs actually own the underlying commodity. For example, investors who buy shares in SPDR Gold Trust (GLD) are gaining an ownership stake in the fund’s stockpile of gold bullion, without having to deal with physical delivery or with logistics such as storing and insuring physical gold. Other ETFs backed by bullion include iShares Comex Gold Trust (IAU) and ETFS Physical Swiss Gold Shares (SGOL).

Equity-Based Commodity Exposure

Another way to gain exposure to commodities is through the companies that produce, transport, and store them. An equity-based commodity ETF offers “leverage-like” exposure to commodities through the stocks of companies involved in natural resources and other raw materials. These equity funds are viable alternatives to futures-backed ETFs, which may be subject to trading limits and other regulatory restrictions. Further, equity-based commodity ETFs have better tax implications than ETFs that hold physical stockpiles of precious metals.

For example, for investors looking to gain exposure to gold, there are equity-based alternatives such as Market Vectors Gold Miners (GDX) and Market Vectors Junior Gold Miners (GDXJ). GDX provides exposure to worldwide companies that are involved primarily in mining for gold, including large-, mid-, and small-cap stocks. GDXJ tracks small- and mid-cap companies involved in gold and/or silver mining. Both funds are treated like stocks for tax purposes which makes these funds more suitable for short-term players in the gold market

Using ETNs to Gain Access to Commodities

The third way to gain access to commodities is by using ETNs, which are senior, unsubordinated, unsecured debt issued by an institution. ETNs are linked to a variety of assets, including commodities and currencies. ETNs are designed to have “no tracking error” between the product and its underlying index. Owners of an ETN such as iPath Dow Jones-AIG Commodity ETN (DJP) will get the return of the index, minus the management fees.

Commodity ETNs also offer a more favorable tax treatment over commodity ETFs. Investors who hold a commodity ETN for more than one year only pay a 15% capital gains tax when they sell a product. Futures-based commodity ETFs are taxed like futures and gains are marked to market every year. This 23% vs. 15% tax difference has helped attract investors to ETNs.

With so many advantages, especially the tax treatment of commodity ETNs, why isn’t this category booming? One of the concerns about ETN is credit risk of the issuing bank. Post-financial crisis it isn’t so hard to imagine bank failures which, not that long ago, would have seemed to be a rare, once-in-a-century occurrence.

Commodity Exposure, a Cautionary Table

In general, the further away you are from your desired market, the greater the potential that the investment instrument will not exactly track the underlying commodity. Physically-backed funds in gold, silver, platinum, and palladium reflect the forces of supply and demand in the market for the physical material and, as such, track market prices very closely. Of course, such exposure is not possible with all commodities.

Equity-based commodity funds can still give you exposure to the commodity—whether gold, natural gas, oil, or another substance—through the companies that produce, process, and transport them. Even though it’s not the same as a physically-backed fund, the equity alternative restores transparency and takes away the possibility of regulatory limits that could affect trading.

ETNs may offer certain advantages over physically-backed and equity funds; however, those advantages come at a cost: namely tracking discrepancies with the underlying commodity and credit risk. Investors need to be aware of these issues in order to make the best selection in accordance with their goals and risk tolerance.

John Person is a 32-year veteran of the futures and options trading industry and founder of nationalfutures.com, an online education site. He is author of several trading books, including the just released Mastering the Stock Market: High Probability Market Timing and Stock Selection Tools ; three trading courses, and a DVD seminar series. His Commodity Trader’s Almanac is the definitive guide to identifying seasonal patterns and cycles in the commodity and financial markets.