Collars Why Not To Use LEAPS Calls As Stock Replacement

Post on: 16 Март, 2015 No Comment

Stay Connected

I’m interested in trading collars, but instead of buying stock I want to buy a long-term call, to save money and increase the ROI (return on investment).

Do you ever do your collars this way? It seems like a superior approach to collars, and I was wondering why I’m having such a hard time finding a thorough discussion of this approach?

Do you teach it?

I don’t teach this specific strategy, have never used it, and want to be certain you understand its limitations. You don’t need me to teach you how to do this. If you decide to use these almost collars you’ll have no difficulty in setting up the trades.

1. I agree that the trade you suggest seems to be superior. But appearances can be deceiving.

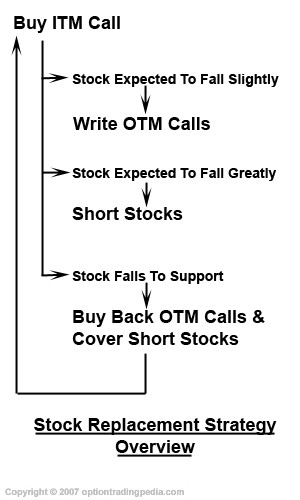

2. You can probably find much to read on the topic of using LEAPS as a stock replacement when writing covered calls. That should be sufficient for you to gain an understanding of your suggested strategy because all you have to do is buy puts to complete the collar.

But, I do issue this warning: Those who write about using LEAPS as a stock replacement never mention the disadvantages (risks) of using LEAPS this way. Are these writers unaware of the risks, or are they protecting a vested interest in getting readers to adopt this method and pay for specific trade recommendations?

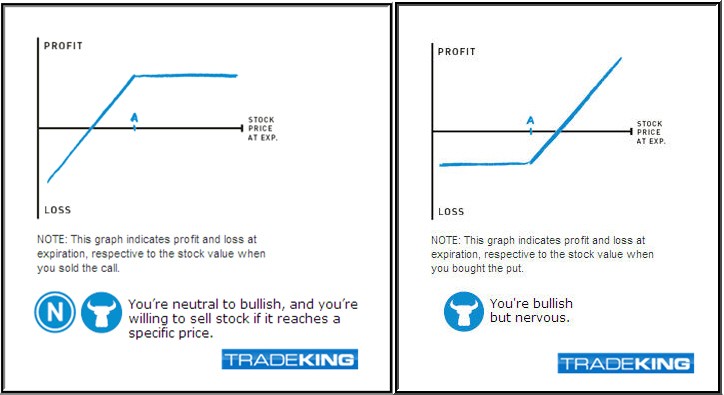

3. The delta of a LEAPS call is less than 100, and when the stock rallies, the LEAPS call — even when reasonably deep in the money — doesn’t move point for point with the stock. That may not seem to be a problem, but if the call you sold (wrote) moves into the money and the stock continues to rise, owning the LEAPS option instead of stock does turn into trouble. Especially when expiration nears.

The call you sold increases in value faster than your LEAPS call, because it has a higher delta — a delta that rapidly moves towards 100. Thus, you begin to lose money as the stock rises, and it’s possible to lose enough money to turn the trade into a loser. And don’t ignore the fact that you’re losing extra cash because the value of your put option is decreasing.

This never happens with a real covered call or collar. There’s never an upside loss with the slightly bullish collar (or even more bullish covered call).

You do gain the benefits mentioned, but in return you add upside risk. Is that a good trade-off for you?

If you’ve experience trading options, in my opinion, it’s unnecessary to trade the true collar — unless you already own stock and there are tax considerations.

It’s more convenient to sell an equivalent position. the put spread, instead. Why?

Commissions are reduced (two legs instead of three) and the position is easy to follow and/or adjust.

(If you’re not 100% certain that a collar is equivalent (same profit, loss, risk, reward) to the collar, then continue to trade collars. It’s important that you be comfortable with positions in your portfolio.)

To sell the put spread: Look at the collar. Buy the same put as the collar and sell the put with the same strike and expiration as the call.

You mention ROI: The margin on the put spread is small. But I must issue a big warning: Do not trade too many of these.

I assure you that many traders, thinking, How risky can it be to sell a bunch of these spreads when the margin is only $500? (for a five-point spread) sell too many and get burned.

If you want to trade three collars, sell only three put spreads. This is very important, and too often ignored.

If selling put spreads doesn’t appeal, then you may also buy call spreads. These positions are all equivalent to each other. Again, looking at the collar you plan to trade, sell the same call as the collar, and buy the call with the same strike and expiration as the put purchased for the collar.

I prefer to avoid using LEAPS, but if you understand the limitations, then you have a choice to make. If ROI drives you, consider selling the appropriate put spread.

Clarification:

If this is your collar:

Buy 100 shares RGTO

Buy one RGTO Jan 60 put

Sell one RGTO Jan 70 call