Collar Option Strategy Nothing But An Hedged Covered Call!

Post on: 17 Июнь, 2015 No Comment

Collar option An hedged Covered Call

The Strategy

A Collar option is similar to Covered Call Strategy, but with an additional Long Put as a hedge or insurance against downside.

In Collar, you are trying to raise some regular income out of a stock you already own. You do this by selling a Call, that is usually an OTM and thus collecting a premium. However, you also want to protect the downside of the underlying. This you do by buying a Put (usually at-the-money) below the underlying price.

Therefore, a Collar option is a Covered Call with a limited risk.

The overall cost (of the Stock and the Put) of a Collar strategy is substantially higher than Covered Call, since there is insurance involved.

This strategy is also useful when you are ready to part with the Stock, if the price moves up from the current levels.

Suppose you are holding a Stock A at a particular current price. There are two possible intentions on your part. One is that you want to maintain the ownership of the stock, for bonus, capital appreciation, dividend etc. In this case, you wouldn’t probably worry about short term downside. While you are holding the stock, why not squeeze some income out of the same. This you do by selling an out-of-the-money (OTM) Call, preferably beyond a price range that you expect the stock to be hovering in the short term. Hopefully the Call will expire worthless and you get to keep the premium. And you can do all this fully aware that your downside (on the underlying) is protected by the Put.

Another intention on your part could be your readiness on your part to sell the stock if there is any appreciation. In this case, if the stock does move up, you may lose on the option that you sold (or run the risk of assignment), and your Put premium will be worthless, but you make some gains in the underlying stock. Even if you don’t want to part with the stock, you can simply close the option position before expiry.

The Structure

- You already own a Stock.

- Buy a Put as a hedge or insurance against downside risk

- You Sell a Call option, and this is usually an out-of-the-money option. This will partly finance the cost of buying the stock and Put.

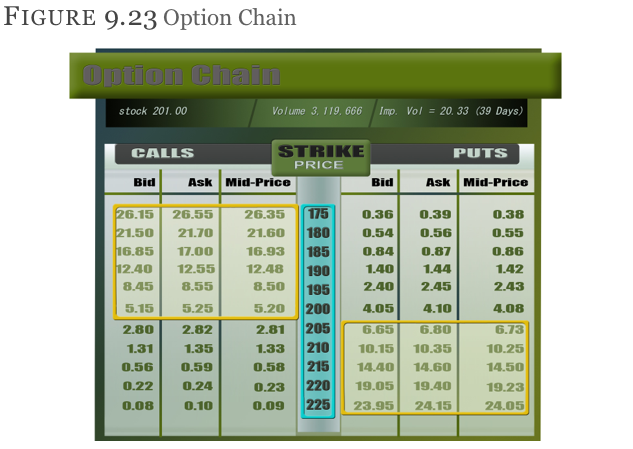

- The underlying price is usually between the two strike prices (of Call and Put)

Market Outlook

You are largely Neutral and to a lesser degree, conservatively Bullish. (since you are ready to sell the stock)

What is your likely objective ?

Earn income with limited risk. Hedge the Long Stock.

Break-even at Expiry

Purchase price of the underlying minus the premium received on selling the Call option plus the Put premium paid.

Best case scenario

Stock reaches and stays at Call strike.

Worst case scenario

Stock declines and moves below Put strike.

Inital Cash Flow

Normally Net Debit. But can be establised with Zero Cost or Net Credit as well.

Maximum Potential Profit

Limited. The premium received plus (Strike price of the Call minus the current Stock price) minus premium paid on the Put.

Maximum Potential Loss

Limited to (Current stock price minus Strike price of Put) minus net Premium received on the Call. Any loss in increase in Call premium will be offset by gains in Stock price. On the stock side, the loss is capped by the Put.

Time Decay

Time decay is good for the Collar option position since you have sold the Call option. That way, even if you wanted to buy back the option to close the position, you will have net profits. Time decay will be bad for the Long Put, but it was meant for insurance rather than speculation.

Risks

If the stock moves up, you will lose on the options side, but it should be offset by increase in stock price. Moreover, there is an opportunity loss just in case the stock moves up beyond your expectations. You cannot ride on those profits since it is capped by the Short Call.

If your intention was to hold on to the stock, the risk here is that you will have to part with the stock since it was a “covered” position. Of course, you can always buy the stock again !

The risk on the stock side is capped by the Long Put.

Implied Volatility outlook

IV should go down so that the option premium approaches zero, in which case you can afford to close the position before expiry and make some nice profits. However, this could also mean your stock is stagnating, which is not good from the perspective of your stock portfolio. Having said that, you would have probably entered Covered Call plays once because you expected some stagnation in the market, in the first place. Also remember that the decrease in IV does not necessarily mean the stock price is going down. IV can reduce even if stock price is increasing (albeit at a “normal” trend/pace).

Lower IV will affect the premium on Long Put, but remember it was meant to be an insurance.

Cost-less Collar option (or Symmetric Collar option)

You can establish Collar option strategy with Zero cost if your Short Call premium entirely covers the cost of Long Put. However, your profits on Stock appreciation is more limited now and probability of assignment is perhaps higher.

Instead of Zero-cost, you can actually get a net Credit in Collar option if you receive a higher premium on Short Call than the premium you pay on Long Put.

While these strategies will look attractive at the outset, you should have done a thorough research on what exactly are your objectives in establishing such positions. You must also know your risks in advance and plan accordingly, including Exit plan.