Chicago PMI (Purchasing Managers Index) Economic Indicators

Post on: 16 Март, 2015 No Comment

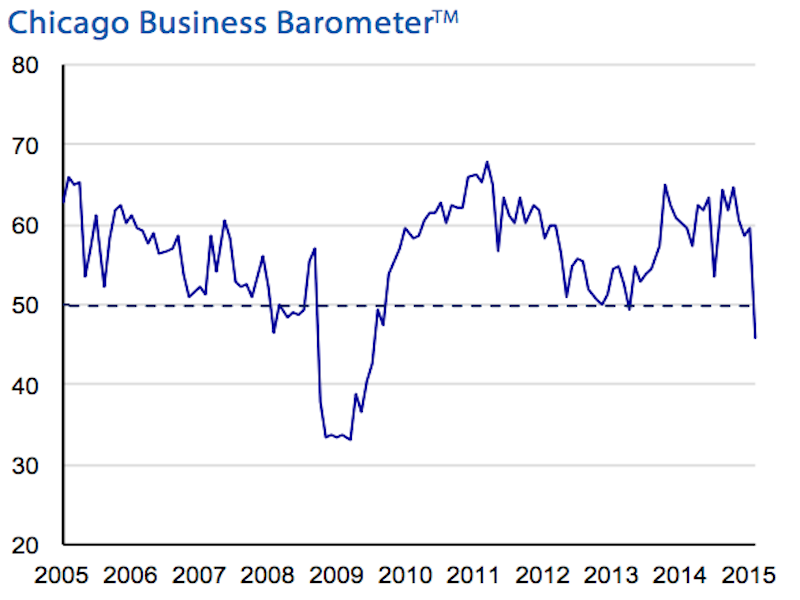

The Chicago Purchasing Managers Index (Chicago PMI) is a report issued by the MNI Deutsche Borse Group and measures business activity in the manufacturing and non-manufacturing sectors across the state of Chicago, in the United States. It is a measure of business trends across the US and is a diffusion index which is based on a survey of 200 purchasing managers in the Chicago area. The Chicago PMI is also called the Chicago Business Barometer.

The survey asks 200 purchasing managers (the respondents) to assign a grade to the relative level of certain business conditions. These business conditions are new orders, employment, production, prices, supplier deliveries, order backlogs and inventories.

A lot of manufacturing activity goes on in the Chicago area. Chicago also houses some of the biggest commodity markets and exchanges in the US, making this area of great economic importance to the US economy.

Time of Release

The Chicago PMI is released monthly, on the last trading day of the current month. The time of release is 9.45am Eastern US time. The news release is of moderate market impact. Information about the news release is obtainable from the website of the MNI Deutsche Borse Group or from various news agencies such as Bloomberg and Thomas Reuters.

Since the data is released on the last day of the month, it reviews the business activity in the Chicago area for the current month, as opposed to news releases which review activity for the previous month.

Interpreting the Data

The news data is given to MNI subscribers about 3 minutes before being released to the public, allowing them to make entries before everyone else. A baseline level of 50.0 is used as the benchmark. A reading above 50.0 indicates expansion, while a reading below 50.0 indicates contraction.

If the actual figure is better than forecast, it is good for the USD. If the actual is worse than forecast, it is bad for the USD. Trading this report is not always based on whether a report is good or bad with regards to the actual vs expected figures, but on the actual value of the news release itself. It is possible for the actual data to come out worse than expected, and still get a figure that the markets perceive as strong. This was seen in the January 2014 release where the figure fell to 59.6 from 60.8; a figure still perceived as strong.

Conclusion

Due to the importance of the Chicago region to the US economy for the reasons mentioned above, the Chicago PMI is seen as a leading indicator of economic health of the nation. Most businesses tend to react quickly to market conditions, so it is expected that their purchasing managers will be able to provide the most relevant and current insight about the state of the US economy.