ChartAdvisor for January 30 2015 (SPY IWM DIA QQQ)

Post on: 16 Март, 2015 No Comment

The U.S. markets were mixed over the past week, as of Thursday’s close. In her testimony to Congress, U.S. Federal Reserve Chairwoman Janet Yellen indicated that the economy was expanding at a solid pace driven by strong job gains. These sentiments suggest that the central bank remains on track to raise interest rates later this year, despite some indications that the stock market is struggling to maintain its high valuation. (For more, see: Janet Yellen: Background And Philosophy .)

International markets were mixed over the past week, as of Thursday’s close. Japan’s Nikkei 225 rose 1.7%; Britain’s FTSE 100 fell 0.25%; and Germany’s DAX 30 rose 0.83%. In Europe, the ECB ’s new trillion euro bond-buying program is expected to boost inflation. but some analysts think it could be a tough sell. In Asia, China announced that it plans to realize a 7% annual growth rate over the coming year, allaying some concerns of a slowdown.

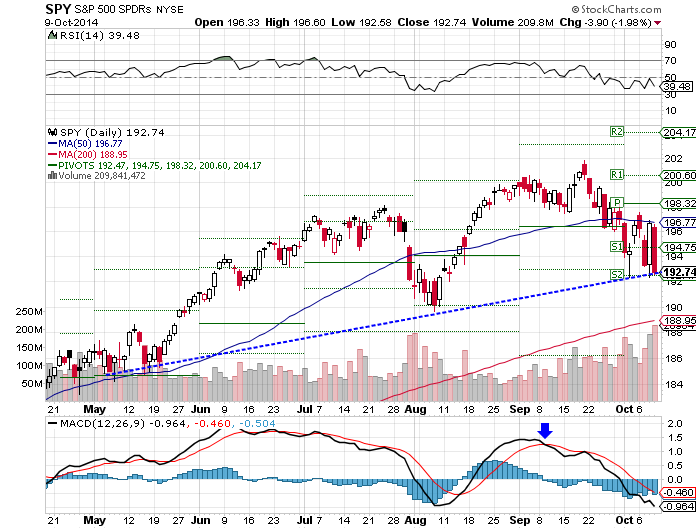

The S&P 500 SPDR (ARCA: SPY ) fell 1.43% over the past week, as of Thursday’s close. After moving lower from its pivot point at 204.71, the index moved close to its lower trend line support at around 200.00. Traders should watch for a rebound from these levels back toward the 50-day moving average at 204.13 or a breakdown below the lower support trendline to S1 pivot point support at 197.61. Looking at technical indicators, the RSI remains neutral at around 47.15 while the MACD continues to trend lower.

The Dow Jones Industrial Average SPDR (ARCA: DIA ) fell 1.41% over the past week, as of Thursday’s close. After breaking below the lower trendline support, the index reached the S1 pivot point support at 171.78. Traders should watch for a rebound back to the trendline support turned resistance or a move lower to the 200-day moving average at 168.95. Looking at technical indicators, the RSI remains neutral at 45.80 and the MACD remains in a bearish downtrend that looks poised to continue.

The PowerShares QQQ Trust (NASDAQ: QQQ ) fell 2.27% over the past week, as of Thursday’s close. After breaking below the 50-day moving average at 103.09, the index moved toward the S1 pivot point support at 100.02. Traders should watch for a rebound from these levels toward the pivot point and S1 support or a breakdown to S2 pivot point support at 96.80. Looking at technical indicators, the RSI appears neutral at 48.04 and the MACD remains in a bearish downtrend that looks as if it will continue next week.

The iShares Russell 2000 Index ETF (ARCA: IWM ) rose 0.14% over the past week, as of Thursday’s close. After moving lower from a reaction high, the index consolidated near the pivot point at around 117.88. Traders should watch for a breakout above the trendline resistance to R1 resistance at 123.15 or a breakdown below the trendline support to S1 support at around 114.35. Looking at technical indicators, the RSI appears neutral at 53.03 and MACD remains relatively neutral near the zero-line.

The Bottom Line

The major indexes were mixed over the past week, as of Thursday’s close, with many RSI readings remaining neutral. Next week, traders will be watching a number of key economic releases including personal income and manufacturing data on February 2nd, jobless claims on February 5th, and employment data on February 6th.

Charts courtesy of StockCharts.com.