Changing Jobs Should You Borrow to Repay a 401k Loan

Post on: 16 Март, 2015 No Comment

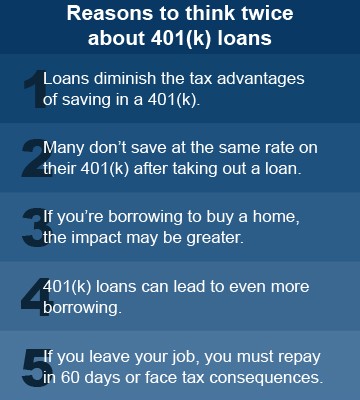

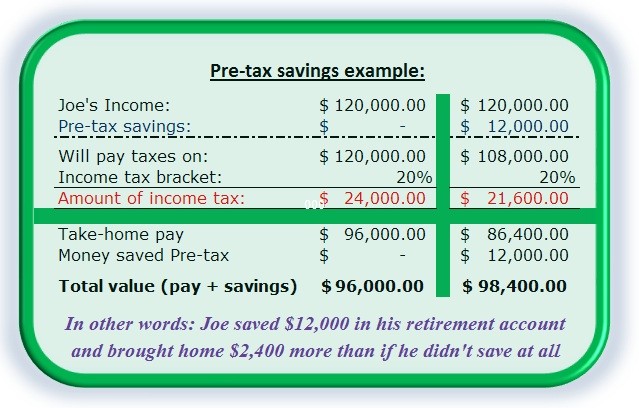

O ne of the features of many 401k retirement plans is that you can borrower money from your own account. While 401k plans are not required to permit plan participants to take out loans, many plans do. Much has been written about the pros and cons of 401k loans. One of the potential drawbacks comes into play if you leave your job (voluntarily or otherwise) while you still have an outstanding loan from your 401k plan.

When this happens, you generally have two options: (1) pay back the loan in full within 60 days, or (2) dont. If you follow option (2), however, the IRS will treat the loan as an early withdrawal from your 401k plan, and with some exceptions, smack you with a 10% penalty of the outstanding loan amount AND require you to pay taxes on the distribution. Thus, you could easily end up paying 30% or 40% of the outstanding loan amount in penalties and taxes. It goes without saying that failing to payback the loan can be a costly decision.

The problem that often arises, however, is that folks want to pay back the 401k loan, but cant afford to do so. Particularly in difficult economic times, many people are let go and lack the available funds to repay the loan. And that raises an important questionshould you borrow to repay a 401k loan?

The short answer, in my opinion, is absolutely yes. And to my surprise, its also Dave Ramseys advice, and we all know how much he preaches against non-mortgage debt. Between the taxes and penalties youll owe if you dont repay the 401k loan, the cost will almost always be greater than a short-term loan at reasonable rates to repay the 401k loan. In addition, by not repaying the 401k loan, you forever remove that money from your retirement investments, thus losing the tax-deferred return on your 401k investments forever.

But the question still remains, where should you look to borrow money to repay a 401k loan? Here are a few alternatives:

- Home Equity Line of Credit. Perhaps the first option would be to tap a home equity line of credit. Equity lines generally come with reasonable interest rates and are easy to access.

- 0% Balance Transfer cards. Another potential option is to take advantage of one or more 0% balance transfer offers. Before going this route, however, make sure you can pay off a 401k loan with the balance transfer card. Also keep in mind that the introductory rate periods are now generally just 6 months. After that, the interest rates adjust to whatever regular APR applies to the card.

- LendingClub. LendingClub offers unsecured loans up to $25,000. Depending on your credit history, credit score. and other factors, you can obtain a loan at a reasonable interest rate. All loans must be repaid over three years, although you can chose to pay off the loan sooner.

- Unsecured Line of Credit. You can obtain unsecured lines of credit from most banks and credit unions. Interest rates will vary significantly based on your credit history. I have an unsecured line at Citibank that I rarely use, but it does come in handy for short-term loan needs.

So whats your take? Should you borrow to repay a 401k loan if you dont have the funds available to repay the debt?