Changing jobs and retirement accounts

Post on: 16 Март, 2015 No Comment

Dear Dr. Don,

Dear Aiden,

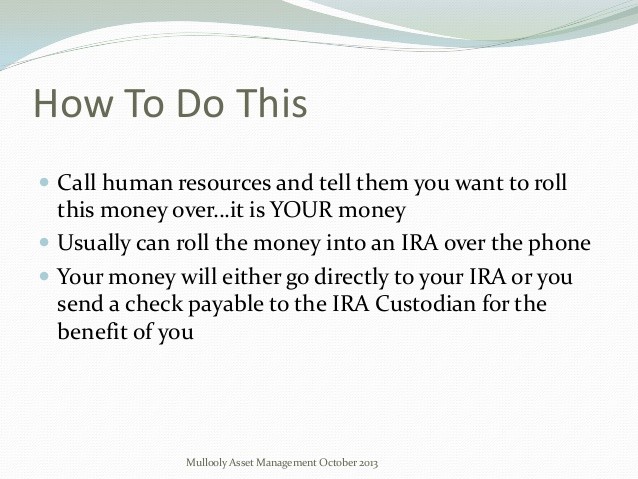

According to Mark Twain, All generalizations are false, including this one. I can’t make a blanket statement about whether your wife will face lower fees in her new employer’s 401(k) plan than she will in a traditional IRA rollover account. Regardless of her choice, she should do a trustee-to-trustee (direct) transfer so the money isn’t subject to mandatory withholding.

With some 401(k) plans the employee has access to institutional funds that have lower annual expenses than retail funds. That isn’t likely in the typical IRA rollover account. Annual account fees are usually dependent on the size of the account and are normally waived for larger accounts.

As far as the size of the account goes, it’s possible that it could stay invested in the previous employer’s 401(k) plan. Generally speaking. accounts that have less than $5,000 can’t stay invested in the previous employer’s 401(k) plan but larger sums can.

Another option that you didn’t mention is to roll the account into a traditional IRA account and then convert it to a Roth IRA account, but she shouldn’t take that step without consulting with a tax professional.

She has the right to have any distribution paid, tax free, directly to a traditional IRA or another eligible retirement plan through a direct transfer. If the previous employer’s plan won’t do a direct transfer by delivering the account investments to the new trustee, it is still obligated to provide for a direct transfer by check. She should be certain to have the check made out to the new account custodian and not directly to her. IRS Publication 590, Individual Retirement Arrangements. has more on this topic.

If the investments in the previous employer’s plan include company stock, it’s likely to be more advantageous for her to transfer the stock into a taxable account while at the same time rolling the other account investments into either an IRA account or the new employer’s 401(k) plan. If she has company stock to consider she should consult a tax professional before taking any action.

There’s a lot to consider here. Putting aside the corporate stock issue for the moment, she should look at the investment options in the new employer’s plan and see how comfortable she is with the investment choices, and the fees and expenses relating to those accounts. If she has a fair amount of money in the old plan to transfer into an account, I’d lean toward an IRA account versus putting the money into the new plan. There’s more flexibility and investment choices, and the account fees and expenses can be managed. Without recommending Fidelity as a provider, I can recommend the discussion on Fidelity’s Web site about your wife’s choices, in deciding what to do with this money.

Editor’s note: Dr. Don has a tax advantaged retirement account with Fidelity Investments.

To ask a question of Dr. Don, go to the Ask the Experts page. and select one of these topics: Financing a home, Saving & investing or Money.