CFDs Trade Online Huge Range Of CFD Markets

Post on: 12 Май, 2015 No Comment

CFDs the main benefits:

- CFD trades are not currently subject to stamp duty*

- No position expiry hold for as long as you choose

- You can go long (i.e. make money if an asset price rises) or go short (i.e. make money if the price falls)

- Lower outlay commit less funds by trading on leverage

- Trade equities on underlying market prices with no additional bid-ask spread

- Utilise Direct Market Access ( DMA ) functionaility

- Level 2 trading data

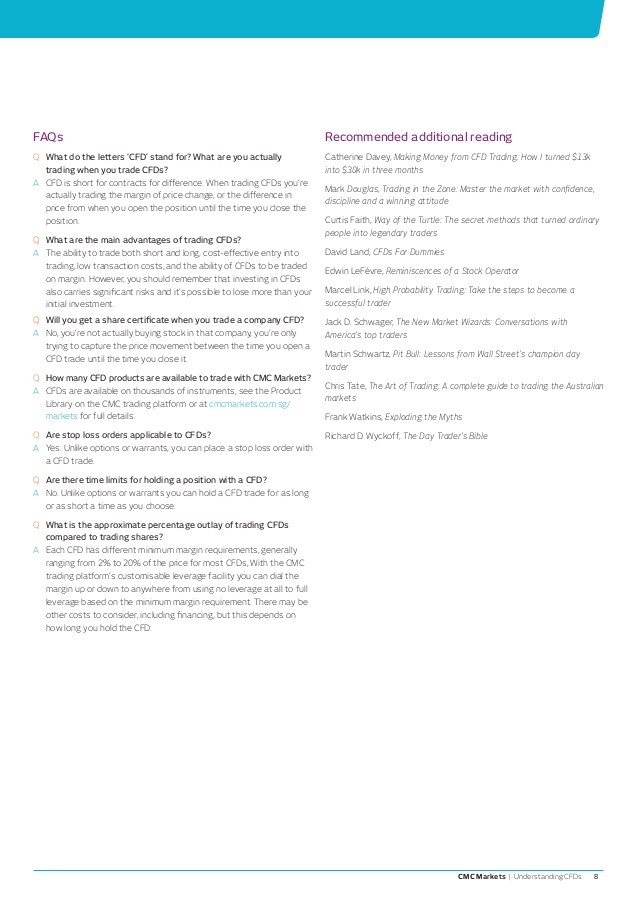

Contracts for Difference ( CFDs ) are an invaluable instrument for investors trading on the financial markets, magnifying the traders buying power. A CFD is a contract on an underlying asset (for example, a share price, commodity or currency) to pay or receive the difference between the opening price and the closing price of the underlying asset.

CFDs allow you to trade in the financial markets without actually owning the underlying asset on which the CFD is based.

You can make money from CFDs whether the market (e.g. a share price) moves up or down. This is known as going long (making money when the market rises) and going short (making money when the market falls). Of course, if the market moves against you (e.g. it goes down when you went long) youll make a loss, much like conventional types of trading (e.g. share trading). You can perfect your trading strategy with our CFD platform trial before committing funds.

In the UK, CFD trading is popular due to the pricing benefits it offers over spread betting and the flexibility it offers over traditional derivatives, like options and futures. At Accendo Markets, we provide multi-venue trading (including BATS, CHI-X and Turquoise) to CFD traders. When placing equity orders, this means that a CFD trader can select the exchange offering the best price. Under certain conditions, this might mean no market spread. Whats more, as a CFD trader youll enjoy Direct Market Access (DMA) which allows orders to be placed directly onto your chosen trading venue, including the London Stock Exchange.

Unlike options and futures, CFDs have no contract expiry. You can hold the position for as long as you choose.

Under current UK tax law, no stamp duty is payable on CFD transactions.*

CFDs are leveraged products, and can result in losses that exceed your initial deposit. Risk management tools are available such as stop-losses, which can limit your risk.

*Under current UK tax law. Tax laws may be subject to change.