Celebrating BlackScholesMerton

Post on: 23 Май, 2015 No Comment

Celebrating Black-Scholes-Merton

Published: October 4, 2013

Two Nobel Prize winners look back, and forward, as they reflect on their famous model

Professor Robert Merton, in the classroom, 1980

There are very few academic papers that you have a 40th anniversary for, said MIT Sloan finance professor Stewart Myers. And yet, in honor of the anniversary of the Black-Scholes-Merton options pricing model, MIT Sloan did just that, with a two-day symposium celebrating the famous model and its widespread adoption and influence.

Capping off a day of talks featuring finance professors including Deborah Lucas and Stephen Ross as well as alumna Judy Lewent, SM 72, was a fireside chat between Robert Merton and Myron Scholes, moderated by Myers. The group spoke to MIT Sloan students, alumni, and fellow faculty in a packed house that included the daughter of the late economist Fischer Black, as well as at least one former masters student of Mertons.

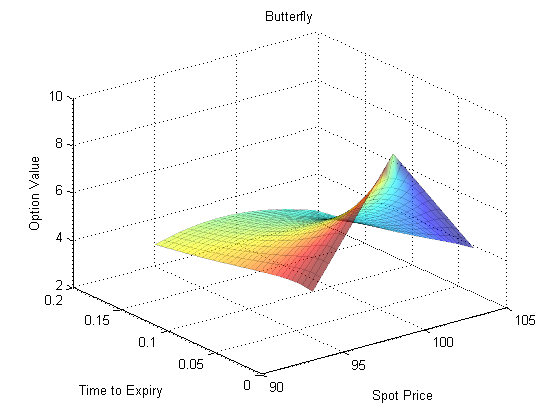

Merton and Scholes won the Nobel Memorial Prize in Economic Sciences for their work on the model, which provides a way to value options and dynamically hedge risk. The model, which can be applied to financial products ranging from interest rate swaps to mortgages as well as to a wide array of corporate investment decisions or real options, is notable not only for its ability to solve a challenging problem, but also for its rapid uptake by practitioners and its many uses.

It isnt just that they had a formula for a particular thing, its that the methodology can be applied so broadly. The range of things it can be applied to is amazing, said Myers recently.

The Black-Scholes-Merton option pricing model is probably one of the most successful theories in all of the social sciences, said finance professor Andrew Lo in an interview before the anniversary event. It is an idea that has come out of academic research that has been adopted in practice. The approach they created, not just the formula but the theoretical framework they created, launched a thousand additional research papers as well as a lot of industry practices that rely on that framework.

Entire industries, including the exchange-traded options market, the over-the-counter derivatives market, and the market for credit derivatives, evolved based on Black-Scholes-Merton. There are multiple trillions of dollars in each of those industries, and at the heart of each of them is the analysis pioneered by Black, Scholes, and Merton, said Lo, who added that he uses their ideas all the time in his own work on quantitative models in financial economics.

Lessons learned

At the event, Merton and Scholes shared good-natured ribbing and humorous anecdotes about the models evolution, including a story Scholes told about giving an early public presentation of the work together with Black and waiting for Merton to reveal the grand finaleonly to find that Merton, who did not appear, had overslept.

The pair agreed that they could not have imagined the models impact when they published their work in 1973. Indeed, the now famous paper was initially rejected by multiple academic journals whose editors deemed it too arcane. It was only when friends at the University of ChicagoEugene Fama and Merton Millerpressed their contacts at the Journal of Political Economy that the model finally made it into print.

When discussing the models use in practice and their own early trading experience applying it, Merton and Scholes advised the audience that even the most sophisticated model is no match for a trader with inside information. The market knows things that the models dont, said Merton. One ounce of non-public information is going to clean the clock of the smartest person with the model and no information. You have to ask yourself, Is there somebody who knows more? Use the model, use history, but also use what the market is telling you.

Looking ahead to the next 40 years, Scholes said corporate managers could use the model as they decide how to structure their companies in an increasingly technologically advanced world. The Black-Scholes-Merton approach could help determine whether or where to manufacture goods, for example, or which products to develop or innovations to pursue and which to abandon.

Merton added that the model could also be applied to risk management in emerging markets and that it could help central bankers better understand their risks as they strive to avoid another financial crisis. Developing financial markets like Chinas could also rely on the model to build a stronger, safer financial system that appropriately transfers risk.

I think it will be expanded and extended in many different ways, said Lo. One hundred years from now, people will still be reading about Black-Scholes-Merton.