CBOE SPDR Options (SPY) Micro Site

Post on: 24 Май, 2015 No Comment

The Chicago Board Options Exchange (CBOE) began trading of options based on Standard & Poor’s Depositary Receipts (known as SPDRs, with the ticker symbol SPY) in January 2005. The SPDR exchange-traded fund (ETF) is designed to track the performance of the S&P 500 Index.

Here are some key facts about SPDRs, the CBOE and SPDR options:

- SPDRs represent shares of a security designated to track the value of the S&P 500. The SPDR price roughly approximates 1/10th of the price of the S&P 500 (SPX) Index. For example, in 2004 the year-end prices were 120.87 for SPDRs and 1211.92 for the S&P 500.

- SPDRs are the world’s largest ETF in terms of size, with about $52 billion in assets as of January 2005.

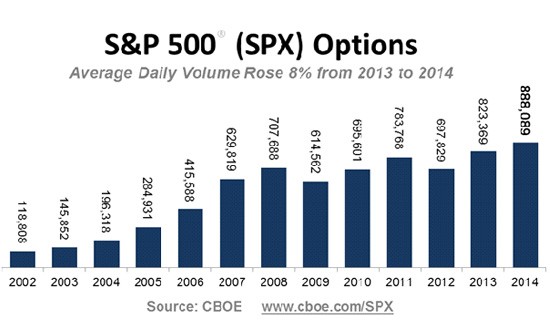

- The CBOE introduced listed options in 1973 and S&P options in 1983. All-time CBOE trading volume in S&P options is more than 1.5 billion contracts. In 2004 the underlying notional value of trading in S&P options was more than $20 billion per day.

- SPDR call and put options have an underlying value of 100 SPDRs. So, for example, if the SPDR is priced at 120, the underlying notional value covered by one SPDR option would be $12,000.

- The SPDR options contract specifications are similar to the contract specifications for most other U.S. options on ETFs. However, SPDR options have some key differences when compared to S&P 500 (SPX) options — SPDR options: (1) have a smaller contract size, (2) have American-style exercise, (3) usually cease trading at the close on the third Friday of the month, and (4) are settled by delivery of securities (rather than cash).

- CBOE SPDR options are offered on the CBOE Hybrid system, a composite of the most valuable aspects of screen-based and floor-based trading environments. CBOE selected Chicago Trading Company, LLC (CTC) to be the Designated Primary Market Maker (DPM) for CBOE SPDR options.

- CBOE SPDR options are SEC-regulated securities that are cleared by the Options Clearing Corporation.

- CBOE SPDR options are flexible investment tools that allow investors to manage risk, hedge their portfolios and add income. Please visit www.cboe.com/LearnCenter/ to learn more about how CBOE options can help you manage your investment portfolio.

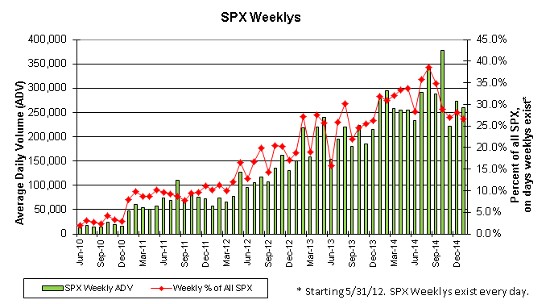

In July 2006 CBOE listed Quarterly options on five Exchange Traded Funds (ETFs): QQQQ, IWM, DIA, SPY, and XLE. For more information on Quarterly options please visit these links: