CBOE Options Hub Your source for daily options industry news analysis and commentary

Post on: 9 Июль, 2015 No Comment

Volatility as an asset class

Volatility has increased for currencies as the euro trades near a 12-year low.

Euro Currency Trust (FXE) is recently up 79c to $104.45. March weekly call option implied volatility is at 21, March is at 16, April is at 12, June is at 10; compared to its 26-week average of 10 according to Track Data, suggesting large near term price movement.

PowerShares DB US Dollar Index Up (UUP) is recently down 16c to $26.20. Overall option implied volatility of 10 compares to its 26-week average of 9.

PowerShares DB US Dollar Index Down (UDN) is recently up 9c to $21.34. Overall option implied volatility of 11 compares to its 26-week average of 9.

ProShares UltraShort Euro (EUO) is recently down 45c to $27.26. Overall option implied volatility of 25 is compares to its 26-week average of 19.

CBOE EuroCurrency ETF Volatility Index (EVZ) down 3.7% to 13.57 compared to its 10-day moving average of 11.47

www.cboe.com/micro/xsp/

CBOE/CBOT 10-year U.S. Treasury Note Volatility Index (VXTYN) up 0.35% to 5.8 cboe.com/VXTYN

CBOE Volatility Index-VIX methodology for Energy Select Sector SPDR (VXXLE) down 2.48% to 24.37. cboe.com/micro/VIXETF/VXXLE/

Active options at CBOE: AAPL C BAC TEVA TWTR MRK HPQ NFLX SLXP INTC

Options with increasing volume @ CBOE: MEIP LXK CUR ARO ONTY BLL QIWI ACAD AMRN JASO

CBOE Volatility Index (VIX) down 1.07% to 15.80, high 16.40, low 15.65, March 16 and 17 puts are active on total volume of 177K cboe.com/VIX

iPath S&P 500 VIX Short-Term Futures (VXX) is recently down 3.42% to 28.24.

CBOE S&P 500 Short-Term Volatility Index (VXST) is recently down 1.3% to 15.39; compared to its 50-day moving average of 15.89. stks.co/r0CS2

CBOE DJIA BuyWrite Index (BXD) up 0.93% to 267.09 compared to its 50-day moving average of 264.93 cboe.com/micro/bxd/

S&P 100 Options (OEX) recently up 1.91 to 206.42 as February retail sales decreased.

Retail Sales for February were down 0.6% (small rise expected, Core off 0.2% as expected). This following a Jan drop of 0.8% and Dec Sales reporting -0.9% So stock futures are higher. Weekly Jobless Claims fell, erasing some of last weeks spike higher. Intel (off $1.48) with revenue warning before the open. Traders talking about glut of Crude in US, running out of storage space waiting for higher prices. FED approved 29/31 major banks capital plans helps that sector this morning. Volatility as an asset class:

Volatility has increased for currencies as the euro trades near a 12-year low.

Euro Currency Trust (FXE) is recently up 99c to $104.66 in the premarket. Overall option implied volatility of 12 compares to its 26-week average of 10.

CurrencyShares Swiss Franc (FXF) overall option implied volatility of 16 compares to its 26-week average of 10.

CurrencyShares British Pound Sterling Trust (FXB) overall option implied volatility of 10 compares to its 26-week average of 7.

CurrencyShares Australian Dollar Trust (FXA) overall option implied volatility of 12 compares to its 26-week average of 10.

CurrencyShares Canadian Dollar Trust (FXC) overall option implied volatility of 10 compares to its 26-week average of 8.

CBOE EuroCurrency ETF Volatility Index (EVZ) at 14.09 compared to its 10-day moving average of 11.13 www.cboe.com/EVZ

Equity Options Volume @ CBOE; 872,647 calls, 580,798 puts, 1,453,445 total cboe.com

CBOE Crude Oil Volatility Index (OVX) at 49.17 compared to its 50-day moving average of 55.17 WTI Crude oil near $49. CBOE.com/OVX

Options expected to be active @ CBOE: MW MS AXP C BAC JPM UTX BOX

Volatility as an asset class

Express (EXPR) is recently up 36c to $15.31 after the retailer reported better than expected Q4 results and outlook. March call option implied volatility is at 42, April is at 36, July is at 38; compared to its 26-week average of 46.

Mastercard (MA) is recently down $1.24 to $87.60 after 12.773M share Spot Secondary priced at $86.85. March call option implied volatility is at 23, April is at 21, May is at 22; compared to its 26-week average of 22.

SanDisk (SNDK) is recently up $3.10 to $83.26 after being upgraded to Conviction Buy from Buy at Goldman. March call option implied volatility is at 32, April is at 31, July is at 32; compared to its 26-week average of 31.

CBOE/CBOT 10-year U.S. Treasury Note Volatility Index (VXTYN) down -0.69% to 5.76 cboe.com/VXTYN

CBOE Volatility Index-VIX methodology for Energy Select Sector SPDR (VXXLE) down 0.63% to 25.27. cboe.com/micro/VIXETF/VXXLE/

Active options at CBOE: AAPL C TSLA PBR TWTR X KO NFLX INTC TEVA

Options with increasing volume @ CBOE: BKD MEIP VRA ACAD LL BK STLD RKT AMPE MGA MAN

CBOE Volatility Index (VIX) down 1% to 16.53, high 16.99, low 16.53, March 17 and 20 calls are active on total volume of 178K cboe.com/VIX

iPath S&P 500 VIX Short-Term Futures (VXX) is recently up 29c to 28.80.

Today CBOE set the date (pending regulatory approval) for the launch of trading of the MSCI EAFE (EAFE) and MSCI Emerging Markets (EEM) index options. Recently I was at a conference where an individual trader told me all he trades is SPX. He said he loves (his words not mine) the cash settlement feature of SPX options. He went on to say he’d been looking around for another index option market to trade and said he felt EAFE and EEM were going to give him that opportunity. Whenever someone makes a statement that needs to be backed up by data I get to number crunching. The first table below takes the weekly performance for the S&P 500, Russell 2000, EAFE, and EEM indexes from January 2000 through the end of 2014 and looks at the correlations among these markets.

Note the correlation between the S&P 500 and both EAFE and EEM is lower than the relationship between the Russell 2000 and the S&P 500. This is especially true with EEM which is 0.69 correlated with the S&P 500. That’s a great number, but what traders are really interested in is short term price movements. I ran another quick test, actually two tests to check into relative weekly price changes.

Over the 15 year period from 2000 to 2014 there were 782 weekly observations. The S&P 500 was higher 428 weeks and lower 354 weeks. The next two tables show what EAFE and EEM did when the S&P 500 was higher and what the MSCI index price action was when the S&P 500 lost value.

This table shows that EAFE was up 81.3% of weeks when the S&P 500 was higher and EEM was up 79% of those positive weeks for the S&P 500. Flipping this around, 20% of the time that the S&P 500 rose these two indexes lost value or one in every five weeks.

The second table shows that EAFE was down 77.4% of the time when the S&P 500 lost value and EEM was lower 72.3% of weeks when the S&P 500 was lower. We can roughly take this as the two MSCI Indexes rise one out of every four weeks when the S&P 500 is lower.

It appears the numbers back up the idea that MSCI Index options will provide traders with different opportunities than SPX options. It also appears that there is a close enough relationship between SPX, RUT, EAFE, and EEM options that relative value trading opportunities will abound as well. That thought has me back to number crunching, I’ll return to this space with some more thoughts about trading these markets in tandem next week.

Market News | Mar 11, 11:00 am

Regarding the possibility of launching new options on MSCI global indexes, in the past month I have received positive feedback from more than a dozen managers of options-based funds that are listed in a new 2015 white paper. In the past decade a number of managers have requested new CBOE options on MSCI’s global indexes.

CBOE announced an April 21 launch date for cash-settled products on two of the world’s best known global indexes –

Interest in global equities and related benchmarks has grown tremendously over the past two decades, but some investors have noted the higher volatility of certain global investments.

Market News | Mar 11, 9:15 am

Understanding technical analysis is an art form that is certainly shaped most by experience. As a charting veteran, I have evaluated thousands of charts, a daily ritual that exceeds well over 100 in a day. That may seem exhausting but it is my requirement to perfect my craft and find the next winning trade nobody will just hand it over to me, I have to work for it.

My last class at San Diego State in 1990 was called Portfolio Management, where I had a brilliant instructor talked about different tools and models. He dedicated two of the twenty five session to discussing technical analysis, prefacing his first talk by saying it was useless, nobody used it and it was certainly going to fade away. Being a contrarian, at that point I needed to learn more about technical analysis.

I used to find pleasure in analyzing the financials but would find myself beating my head against the wall trying to understand valuations. It made little sense for a company to have such a rich valuation undeserved. I recall a time back in the late 90s when Brocade Communications was selling at 100x sales at its peak price. From a fundamental perspective that was just absurd.

Forget about the price/earnings ratio, which was probably something like 300 or more. Think a moment it would take 100 years for this company to grow into this valuation. Contrast that with Apple today, which currently sells at just under 4x sales.

What startled me at the time was this stock kept going up and up to reach that out of sight valuation. Before BRCD and other stocks started their meteoric rise they were already overvalued on a fundamental basis! There was nothing stopping this stock (and others) as it moved to higher ground. Sure it was ridiculous, but that didnt matter (eventually it would, as we all know). I found that trading/investing from the dark side was not so bad! The charts and technicals defined the price action, and if more buyers piled in that made the charts look all the better, and sometimes a price objective became a self-fulfilling prophecy.

Charts and technicals give us a good read on investor/trader sentiment. We need to understand where the money is flowing, why its moving and how to capitalize on it. While the fundamentals may help explain the long term trajectory of a company, it is a good chart read that ultimately helps the best with timing an entry or an exit. If we follow the big money then we at least have a guide

Bob Lang, Senior Market Strategist and trades various option trading newsletter Explosive Options. Check out the updated site.

US Markets with a small bounce higher after yesterdays smackdown. EUR falls below 106.5 vs. the USD overnight. General Mills off $0.71, Vera Bradley Q4 misses and is off $2.50, BUD up $2, EXPR beats and is up $1 in the pre-market. European shares mostly higher. Volatility as an asset class:

Volatility has increased for currencies as the euro declined to a fresh 12-year low and negative German interest rates.

Euro Currency Trust (FXE) is down 91c to $104.35 in the premarket. Overall option implied volatility of 12 compares to its 26-week average of 10.

CurrencyShares Japanese Yen Trust (FXY) is down 19c to $80.84 in the premarket. Overall option implied volatility of 11 compares to its 26-week average of 9.

Wisdom Tree Dreyfus Chinese Yuan Fund (CYB) overall option implied volatility of 19 compares to its 26-week average of 11.

Equity Options Volume @ CBOE; 885,807 calls, 596,476 puts, 1,482,283 total cboe.com

CBOE Crude Oil Volatility Index (OVX) at 48.99 compared to its 50-day moving average of 55.36 WTI Crude oil at $49. CBOE.com/OVX

Options expected to be active @ CBOE: WSM ARO DG ANN JKS JASO

CBOE EuroCurrency Volatility Index (EVZ) at 12.46, compared to its 50-day moving average of 11.51

CBOE/CBOT 10-year U.S. Treasury Note Volatility (VXTYN) at 5.80 www.cboe.com/vxtyn

CBOE S&P 500 Skew Index (SKEW) at 123.53 SKEW measures the purchase of out-of-the-money S&P 500 Index puts that require a very large downside move to profit from long put positions. An increase of this index indicates greater expectations for an extreme down move.

(Editors Note: We meant to put this up yesterday morning, very apropos with todays move lower.

Though it wasnt necessarily a bullish week (last week), the market was holding up well enough until Fridays implosion. That one bad day pulled the market under some key support levels, and as such we now have to entertain the possibility that some selling weakness has been opened. And yet, theres still a beacon of hope for a quick rebound.

Well dissect the broad markets odds below. First, lets paint look at the bigger picture painted by the economy.

Economic Data

Though last week was jam-packed with economic news, none of it was as important or as impactful as Fridays grand finale Februarys employment data. It was much better than expected, sparking a chain reaction of events that may have caused some of the selling on Friday and could have longer effects.

The good news was, the nations unemployment rate fell from 5.7% all the way to 5.5% on the heels of 295,000 newly-created jobs. Thats the lowest unemployment rate number weve seen since 2008, when it was on the way up. Though weve seen even stronger monthly job-growth numbers since then, last months 295,000 new payrolls extends whats become an unusually prolonged period of firm growth.

The good news ended up being bad news, in a sense, as tepid employment was one of the factors behind the Federal Reserves decision to hold off on any interest rate hikes. With that worry abating, the odds of Fed rising interest rates went up considerably on Friday. Since higher rates mean potentially slower economic growth, the relative attractiveness of stocks fell sharply.

Though it remains to be seen if if-then concern is merited, the worry alone was enough to up-end the market on Friday, and perhaps trigger further weakness.

We also heard updates of a few other economic data points last week, but of particular interest were the ISM Index and the ISM Services Index. They werent interesting because they were firmly higher, nor because they plunged. They were interesting because both have been slowly, quietly fading for a few months now.

Last but not least, you may have heard factory orders fell 0.2% in January. What may not have been made as clear is that the 0.2% dip was based on the seasonally-adjusted data. Such an adjustment is usually merited, but making this adjustment can sometimes obscure an important reality like Januarys factory orders. The chart below plots the whole-dollar, non-seasonally-adjusted total of factory orders placed two months ago. It was the weakest spend wed seen since 2011. Everything else is on the grid.

Economic Calendar

Source: Briefing.com

The coming week isnt going to be nearly as busy, though well still be getting a couple of key economic announcements. Februarys Retail Sales will be posted on Thursday, and last months PPI figures will be reported on Friday.

Volatility as an asset class

Barnes & Noble (BKS) is recently down $2.09 to $22.77 on the bookseller sees FY15 retail SSS declining in low-single digits. March call option implied volatility is at 39, April is at 38, July is at 37; compared to its 26-week average of 42.

EMC (EMC) is recently down 60c to $27.26 on the information storage company sees EPS growth accelerating to double digits in 2018. March weekly call option implied volatility is at 30, March is at 24, April is at 23, July is at 21; compared to its 26-week average of 23.

Euro Currency Trust (FXE) is recently down $1.39 to $105.39 volatility elevated as the euro trends to end of historic range. Overall option implied volatility of 11 compares to its 26-week average of 10.

VIX methodology for Apple (VXAPL) up 5% to 28.38 a day after ‘Spring Forward’ Watch event. cboe.com/VXAPL

CBOE/CBOT 10-year U.S. Treasury Note Volatility Index (VXTYN) up 9c to 5.74 cboe.com/VXTYN

CBOE Volatility Index-VIX methodology for Energy Select Sector SPDR (VXXLE) up 3.03% to 25.19. cboe.com/micro/VIXETF/VXXLE/

Active options at CBOE: AAPL TWTR TSLA AA NFLX GILD C RIG AMZN CMCS

Options with increasing volume @ CBOE: NKE MGM VSI GNC PEP GDP ZION APD VNET CJES ACM URBN GAME LL

CBOE Volatility Index (VIX) up 11.4% to 16.82, high 16.91, low 16.03, March 18, 19 and 20 calls are active on total volume of 261K cboe.com/VIX

iPath S&P 500 VIX Short-Term Futures (VXX) is recently up $1.11 to 28.78.

CBOE S&P 500 Short-Term Volatility Index (VXST) is recently up 17.7% to 16.72; compared to its 50-day moving average of 15.75. stks.co/r0CS2

CBOE DJIA BuyWrite Index (BXD) down 0.9% to 265.77 compared to its 50-day moving average of 264.95 cboe.com/micro/bxd/

S&P 100 Options (OEX) recently down 13.70 to 902.20 as U.S. dollar traded at multi-year highs against the euro and yen.

After yesterdays nice rally, we give it all back. US Dollar hitting 12-year high (1.076 vs EUR) push Asian shares lower, with European stocks off over 1%. Brent Crude off 1.3%, Gold flat, Grains lower. + 16 K VIX Futures trade in early hours session. JOLTS Surver after the opening. Volatility as an asset class:

Qualcomm (QCOM) is up $1.43 to $74.10 in the premarket following its increase in capital return programs, including a $15B stock buyback authorization and dividend raise. Overall option implied volatility of 23 compares to its 26-week average of 22.

Urban Outfitters (URBN) is higher by $2.54 to $42.05 after reporting solid Q4 results and said the momentum carried into Q1. March call option implied volatility is at 52, April is at 34, June is at 30; compared to its 26-week average of 29.

Global X FTSE Greece 20 ETF (GREK) is up 14c to $11.60 as shares rebound from near historic lows on Greece funding concerns. Overall option implied volatility of 67 compares to its 26-week average of 50.

VIX methodology for Apple (VXAPL) at 27.02 compared to its 26-week average of 31.60 cboe.com/VXAPL

Equity Options Volume @ CBOE; 884,937 calls, 575,347 puts, 1,460,284 total cboe.com

CBOE Crude Oil Volatility Index (OVX) at 48.99 compared to its 50-day moving average of 55.36 WTI Crude oil at $49. CBOE.com/OVX

Options expected to be active @ CBOE: QCOM URBN GM AAPL

CBOE EuroCurrency Volatility Index (EVZ) at 10.96, compared to its 50-day moving average of 11.45

In the first two months of 2015, the CBOE VIX of VIX Index (VVIX ) had an average daily close of 100.2. a higher level than in any of its previous eight full calendar years from 2007 through 2014.

On Thursday at the 31 st CBOE Annual Risk Management Conference in Carlsbad, expert presentations on Volatility of Volatility (VOV) were delivered by Benn Eifert, Ph.D. Portfolio Manager, Mariner Investment Group and Kambiz Kazemi, Portfolio Manager, Picton Mahoney Asset Management.

INTRODUCTION TO INDEXES

Before highlighting the remarks of the speakers, here is an introductory overview of two key indexes that measure 30-day expected volatility – the CBOE Volatility Index® (VIX®) and the CBOE VIX of VIX Index (VVIX). The VIX Index measures expected volatility that is conveyed by prices of S&P 500 (SPX) options, while the VVIX Index measures expected volatility as conveyed by VIX options. On Dec. 12, 2014, the VVIX Index closed at 138.60 its highest daily close in more than four years.

In analyzing the weekly returns for the period of June 13, 2008 through Feb. 27, 2015, the VVIX Index had a correlation of negative 0.47 versus the S&P 500 Index, and a correlation of positive 0.76 versus the VIX Index.

TOPICS COVERED BY THE SPEAKERS

Dr. Eifert and Mr. Kazemi covered these topics More

Volatility as an asset class

General Motors (GM) is recently up 94c to $37.47 after the company settled a potential proxy battle with an investment group led by Harry Wilson by agreeing to return more cash to shareholders. March weekly call option implied volatility is at 27, March is at 26, April is at 25; compared to its 26-week average of 25.

McDonald’s (MCD) is recently up 62c to $97.76 after posting a worse than expected drop in February sales. Same-store sales decreased 1.7% worldwide, compared with a consensus forecast for a 0.3% decline. March weekly call option implied volatility is at 22, March is at 20, April is at 19, June at 18; compared to its 26-week average of 18.

BlackBerry (BBRY) is recently down 73c to $9.93 after Goldman Sachs cut its rating on the stock to Sell from Neutral, saying it believes the smartphone makers turnaround is entering a more challenging phase as it shifts from cutting costs to revenue growth. March weekly call option implied volatility is at 54, March is at 50, April is at 65, May is at 54, June is at 53; compared to its 26-week average of 54.

VIX methodology for Apple (VXAPL) down 5c to 29.75 into ‘Spring Forward’ Watch event cboe.com/VXAPL

CBOE/CBOT 10-year U.S. Treasury Note Volatility Index (VXTYN) down 53c to 5.71 cboe.com/VXTYN

CBOE Volatility Index-VIX methodology for Energy Select Sector SPDR (VXXLE) down 0.61% to 24.56. cboe.com/micro/VIXETF/VXXLE/

Active options at CBOE: AAPL TWTR TSLA AA NFLX GILD PBR WMT

Options with increasing volume @ CBOE: YOKU AMAT CTIC RTI MAC WPX PNK ACRX WBAI GLPI URBN ERIC

CBOE Volatility Index (VIX) down 0.3% to 15.15, high 15.76, low 15.12, March 20 and 21 calls are active on total volume of 116K cboe.com/VIX

iPath S&P 500 VIX Short-Term Futures (VXX) is recently down 31c to 27.72

CBOE S&P 500 Short-Term Volatility Index (VXST) is recently up 2.3% to 14.64; compared to its 50-day moving average of 15.63. stks.co/r0CS2

CBOE DJIA BuyWrite Index (BXD) up 1.20% to 268.01 compared to its 50-day moving average of 264.94 cboe.com/micro/bxd/

S&P 100 Options (OEX) recently is up 2.82 to 914.84 after stocks sold off Friday’s on U.S. February nonfarm payrolls rise 295K and unemployment drops to 5

Investors who sell VIX-based products often keep a close eye on contango, and the VIX was in contango on 248 days in 2012 and 219 days in 2014.

On Friday at the 31 st Annual Risk Management Conference presentations on Selling Volatility Safely: VIX, VXX, and Other Short Volatility Option Strategies – were delivered by David Burchmore, Portfolio Manager, Ontario Teachers Pension Plan, and Rocky Fishman, CFA, Equity Derivatives Strategy, Deutsche Bank Securities.

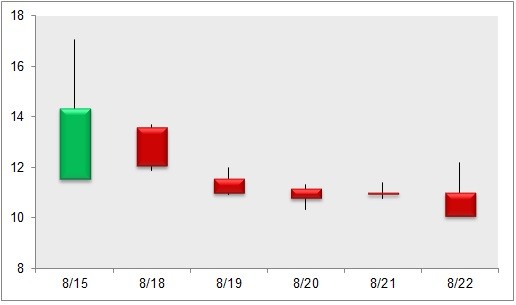

As an introduction to the topics covered by the expert speakers, investors who roll short positions in VIX-related products often prefer that VIX be in contango (futures priced higher than spot) rather than in backwardation (futures priced lower than spot). As shown in the chart below, if we compare the daily closing prices of the spot price of the VIX Index and the second month of VIX futures, VIX was in backwardation 111 days in 2008 and 33 days in 2014. In 2014 VIX was in contango 219 days.

TOPICS COVERED BY MR. BURCHMORE AND MR. FISHMAN

Topics covered at the Friday presentations included

Macerich up $5 on takeover bid. GM announces a $5 Billion buyback. MCD February Sales disappoint. Overseas stocks mixed to lower. Volatility as an asset class:

RTI International (RTI) is up $12.72 to $40 in the premarket, the supplier of titanium and specialty metal products and services for the commercial aerospace, defense, energy and medical device markets will be purchased by Alcoa (AA) in a stock-for-stock transaction with an enterprise value of $1.5B. Overall option implied volatility of 34 compares to its 26-week average of 33.

Alcoa (AA) is down $0.41 to $14.09. Overall option implied volatility of 34 compares to its 26-week average of 33.

Pinnacle Entertainment (PNK) is up $6 to $33.43 in the premarket after CNBCs David Faber report Gaming and Leisure Properties (GLPI) is attempting a hostile takeover in a deal worth $36 per share. Overall option implied volatility of 35 compares to its 26-week average of 37.

VIX methodology for Apple (VXAPL) at 29.80 into ‘Spring Forward’ Watch event cboe.com/VXAPL

Equity Options Volume @ CBOE; 1,116,602 calls, 743,627 put, 1,860,229 total cboe.com

CBOE Crude Oil Volatility Index (OVX) at 48.96 compared to its 50-day moving average of 55.46 WTI Crude oil at $49. CBOE.com/OVX

Options expected to be active @ CBOE: AAPL AA RTI GM URBN EXPR KKD MTN BKS QIHU JASO ARO