Cashless Exercise of Nonqualified Stock Options

Post on: 15 Апрель, 2015 No Comment

Tax rules for cashless exercise of nonqualified stock options.

Some employers make it easier for option holders to exercise their options by providing a method of cashless exercise. Usually the company makes arrangements with a brokerage firm, which loans the money needed to buy the stock. The brokerage firm sells some or all of the stock immediately, with part of the proceeds being used to repay the loan — often on the same day the loan was made. The remaining proceeds (net of any withholding and brokerage commissions or other fees) are paid to the option holder.

Not all companies permit this method of exercise. Some companies want to encourage option holders to retain the stock so they’ll have an ongoing stake in the business. Others may be concerned that sales executed in this manner will depress the price of their stock. Review your option documents, or check with the company, to see if this method is available.

Tax consequences

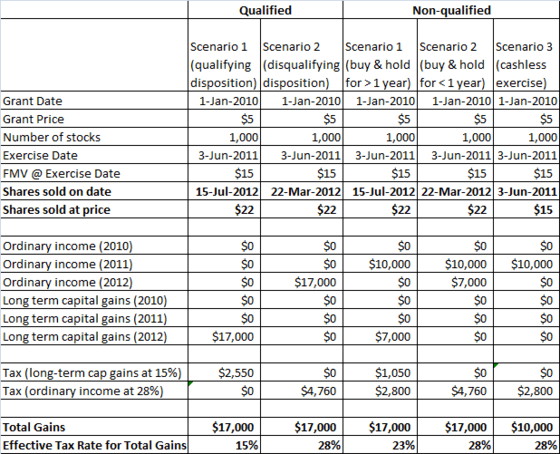

In general, the tax consequences of a cashless exercise are the same as the tax consequences of two separate steps:

- Exercising the option. This step generally requires you to report ordinary compensation income. If you’re an employee, a withholding requirement applies as well. The income (and withholding, if any) will be reported to you on Form W-2 (if you’re an employee) or Form 1099-MISC (if you’re not). For details see Exercising Nonqualified Stock Options .

- Selling the stock. This step requires you to report capital gain or loss (which in this case is obviously short-term). You’ll receive Form 1099-B telling you the amount of the proceeds (not the amount of gain or loss) from the sale. For details see Sale of Nonqualified Option Stock .

Frequently asked questions

We often see confusion on the following points:

Q: My gain from exercising the option appears on my Form W-2 as wages — but Form 1099-B reports the full amount of proceeds, including the gain. Why is the same amount reported twice?

A: The same amount is reported twice, but it’s not taxed twice. Form 1099-B shows how much you received for selling the stock. When you figure your gain or loss, the amount reported on your W-2 is treated as an additional amount paid for the stock. (In other words, it increases your basis.) The effect is to reduce your gain or increase your loss, so you’re not double taxed. See Sale of Stock from Nonqualified Options .

Q: Why do I have gain or loss when I sold the stock at the same time I exercised?

A: Usually there’s a small gain or loss to report, for two reasons. First, the amount reported on your W-2 as income is usually based on the stock’s average price for the day you exercised your option, but the broker may have sold at a price slightly above or below that average price. And second, your sale proceeds are likely to be reduced by a brokerage commission, which can produce a small loss. But any gain or loss should be minimal.