Cash Flow Statement Understanding Financial Statements

Post on: 21 Апрель, 2015 No Comment

Cash Flow Statement — Show Me The Money

Most companies use the Accrual Method of accounting — sales are booked when goods leave the doors of the company. even though it might take a few months for the money to actually come in. Likewise, expenses are booked when they occur and not when they are actually paid for.

The Income Statement reflects these accrual-based transactions. But then the question arises: how do you keep track of the actual cash that flows in and out of the company?

You do it using what’s called a Cash Flow Statement.

Components of the Cash Flow Statement

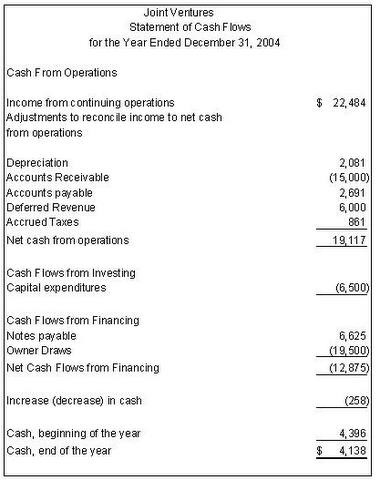

The Cash Flow Statement can be divided into three main sections:

Cash from Operating Activities — net income plus all the non-cash items related to the operations of the company.

Cash from Investing Activities — money spent on capital expenditures, such as new equipment, acquisition of other businesses, etc.

Cash from Financing Activities — cash outflows such as paying off debt, dividends, etc. Cash inflows would include borrowing money, raising money by issuing stock, etc.

Let’s dive into the details of the Cash Flow Statement using an example — the Smart Widget Inc. Cash Flow Statement.

CASH FROM OPERATING ACTIVITIES

Net Income — This is the net income found on the Income Statement.

Depreciation — Every year since their purchase, the property, plant and equipment that a company owns lose value due to use. Depreciation is a charge taken to account for this. However, depreciation is a non-cash charge — it’s an expense from an accounting point of view, but it represents cash that was eaten up years ago. Hence, we add it back to net income.

Amortization — Amortization is similar to depreciation, except it represents intangibles. Again, we add it back to net income since it, too, is a non-cash charge.

Deferred Taxes — Taxes that are owed, but have not been paid yet.

Non-Cash Items — This includes any non-cash, share-based compensation expenses and any one-time, unusual items.

Changes in Working Capital — Changes in accounts payable, accounts receivable, inventories, and pre-paid expenses between consecutive accounting cycles are captured here.

Cash from Operating Activities — Adding all the above line items gives us the cash from operating activities.

CASH FROM INVESTING ACTIVITIES

Capital Expenditures — This is usually a negative number since it is money spent to buy new equipment, buildings or short-term assets such as marketable securities.

Other Investing Cash Flow Items, Total — When you add up all the cash going out or coming in when a company buys and sells income-producing assets, the net amount goes on this line. Acquisitions of subsidiaries and proceeds from sale or insurance settlements of the company’s property, plant and equipment are the main sources of Other Investing Cash Flow items.

Other Investing Cash Flow Items, Total — Adding the above two line items, you get the total Investing Cash Flow.

CASH FROM FINANCING ACTIVITIES

Financing Cash Flow Items — This includes financing costs incurred like the cost to acquire debt. Also, when employees of a company exercise their stock options, the company can claim a tax benefit. This amount is reflected here.

Total Cash Dividends Paid — If the company pays dividends, that cash outflow is recorded here.

Issuance (Retirement) of Stock, Net — If the company issues new stock, that cash inflow goes on this line. On the other hand, if the company buys back (retires) its shares, that cash outflow gets recorded here.

Issuance (Retirement) of Debt, Net — If the company issues new bonds, that cash inflow goes on this line. If the company buys back (retires) bonds or enters into a long-term debt, that cash outflow gets recorded here.

Cash from Financing Activities — The sum of the above line items goes here.

NET CHANGE IN CASH

Adding the Total Cash from Operating, Investing, and Financing activities, we get the Net Change in Cash during the year. You can also see how much Cash the company started and ended the year with.

In summary, we saw the importance of the Cash Flow Statement and analyzed all its components. We now have a good understanding of the different sources of cash inflow and outflow for a company.