Cash Flow Statement Analyzing Cash Flow From Financing Activities

Post on: 21 Апрель, 2015 No Comment

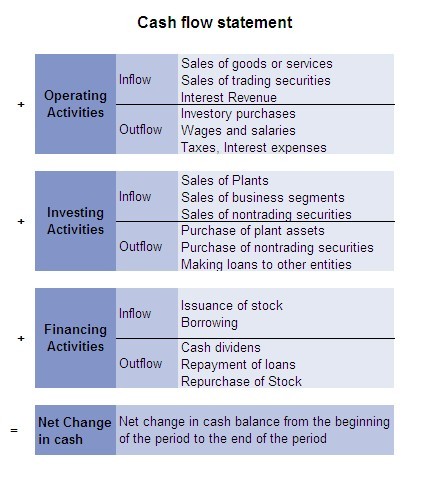

The cash flow statement is one of the most important, but often overlooked, of a firm’s financial statements. In its entirety, it lets an individual, whether he or she is an analyst, customer, credit provider, or auditor, learn the sources and uses of a firm’s cash. Without proper cash management and regardless of how fast a firm’s sales or reported profits on the income statement are growing, a firm cannot survive without carefully ensuring that it takes in more cash than it sends out the door. When analyzing a company’s cash flow statement, it is important to consider each of the various sections that contribute to the overall change in cash position. In many cases, a firm may have negative overall cash flow for a given quarter, but if the company can generate positive cash flow from its business operations, the negative overall cash flow is not necessarily a bad thing. Below we will cover cash flow from financing activities, one of three primary categories in the statement of cash flows.

An Introduction to Cash Flow from Financing Activities

The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through the capital markets. These activities also include paying cash dividends. adding or changing loans, or issuing and selling more stock. This section of the statement of cash flows measures the flow of cash between a firm and its owners and creditors. A positive number is going to indicate that cash has come into the company, which boosts its asset levels. A negative figure indicates when the company has paid out capital, such as paying off long-term debt or making a dividend payment to shareholders.

Examples of more common cash flow items stemming from a firm’s financing activities are:

- Receiving cash from issuing stock or spending cash to repurchase shares

- Receiving cash from issuing debt or paying down debt

- Paying cash dividends to shareholders

- Proceeds received from employees exercising stock options

- Receiving cash from issuing hybrid securities, such as convertible debt

To more clearly illustrate, here is an actual statement of cash flow that covers three years of finance activities for waste-to-energy company Covanta Holdings (NYSE:CVA ), which is very active in the capital markets and in raising capital:

In its 2012 10-K filing with the Securities Exchange Commission (SEC), Covanta provides a summary of its liquidity and capital resources activities. It details that it repurchased 5.3 million of its own shares at an average cost of $16.55 per share, which adds to the $88 million in the above financing cash flow schedule. It also paid out $90 million in dividends to shareholders, which included the early payout of first quarter 2013 dividends to help shareholders due to the fact that the taxes on dividends increased in 2013. And as you can see above, it raised more than $1 billion in long-term debt, stemming from a mix of a senior credit facility that is due in 2017 and term loan due in 2019. It used some of these proceeds to pay off a past term loan. It summarized that net cash used during 2012 was $115 million that “was primarily driven by lower common stock repurchases, partially offset by higher cash dividends paid to stockholders and the 2012 corporate debt refinancing and project debt refinancing.”

IFRS Vs. GAAP

U.S.-based companies are required to report under Generally Accepted Accounting Principles, or GAAP. International Financial Reporting Standards (IFRS), are relied on by firms outside of the U.S. Below are some of the key distinctions between the standards. which boils down to some different categorical choices for cash flow items. These are simply category differences that investors need to be made aware of when analyzing and comparing cash flow statements of a U.S.-based firm with an overseas company.

How do some items in the balance sheet relate to this cash flow section?

Analyzing the cash flow statement is extremely valuable because it provides a reconciliation of the beginning and ending cash on the balance sheet. This analysis is difficult for most publicly-traded companies because of the thousands of line items that can go into financial statements, but the theory is important to understand. A company’s cash flow from financing activities typically relates to the equity and long-term debt sections of the balance sheet. One of the better places to observe the changes in the financing section from cash flow is in the consolidated statement of equity. Here’s Covanta’s numbers:

The common stock repurchase of $88 million, which is also on the cash flow statement we saw earlier, is broken down into a paid-in capital and accumulated earnings reduction, as well as a $1 million decrease in treasury stock. In Covanta’s balance sheet, the treasury stock balance declined by $1 million, demonstrating the interplay of all major financial statements.

To summarize other linkages between a firm’s balance sheet and cash flow from financing activities, changes in long-term debt can be found on the balance sheet, as well as notes to the financial statements. Dividends paid can be calculated from taking the beginning balance of retained earnings from the balance sheet. adding net income, and subtracting out the ending value of retained earnings on the balance sheet. This equals dividends paid during the year, which is found on the cash flow statement under financing activities.

What should investors/analysts look out for when reviewing this section?

An investor wants to closely analyze how much and how often a company raises capital, and the sources of the capital. For instance, a company relying heavily on outside investors for large, frequent cash infusions could become an issue if capital markets seize up, as they did during the Credit Crisis in 2007. It is also important to determine the maturity schedule for debt raised. Raising equity is generally seen as gaining access to stable, long-term capital. The same can be said for long-term debt, which gives a company flexibility to pay debt down (or off) over a longer time period. Short-term debt can be more of a burden as it must be paid back sooner.

Returning again to Covanta, the firm must have access to stable, long-term capital because the waste-to-energy facilities it builds cost millions of dollars and are under contracts with local governments and municipalities that can last for a decade or more. The energy that is provided (in most cases, steam is generated from the burning of trash and related waste) is also sold under long-term energy contracts. As such, the financing portion of its cash flow statements is very pertinent to how it builds plants and raises the funds to do so over many years.

The Bottom Line

In its basic form, the financing activities on a cash flow statement provide great details on how a company borrows and repays money, issues stock, and pays dividends. A firm’s cash flow from financing activities relates to how it works with the capital markets and investors. Through this section of a cash flow statement, an investor can learn how often (and in what amounts) a company raises capital from debt and equity sources, as well as how it pays off these items over time.