Can the VIX Indicator Help to Determine the Bottom of the Stock Market

Post on: 26 Апрель, 2015 No Comment

Can the VIX Indicator Help to Determine the Bottom of the Stock Market?

March 28th, 2010 by GarthW

In 1993 the Chicago Board Options Exchange created a volatility index that it called VIX. They modified this index in 2003 and it has supposedly since been an indicator of market sentiment. The index uses the amount of puts and calls (options) to indicate what the investors’ sentiment is for 30 days out. It will not measure a particular stock or market sector since it looks at all calls and puts for the S&P 500. A low VIX in the area of 20 – 25 should indicate that investors have become uninterested in the market. If the market becomes fearful, the higher the VIX will move. It will decrease as the investor feels confident about its future direction.

Contrarians will use the VIX as an indicator of when they think the market will move in one direction or another. Some feel that a VIX below 20 is a sign of a bear market. Some contrarians will then view a VIX above 30 as bullish.

The non-contrarians view the VIX as just the opposite. They feel that a move above 30 is a sign of more volatility while a move downward indicates that investors are comfortable with the direction of the market.

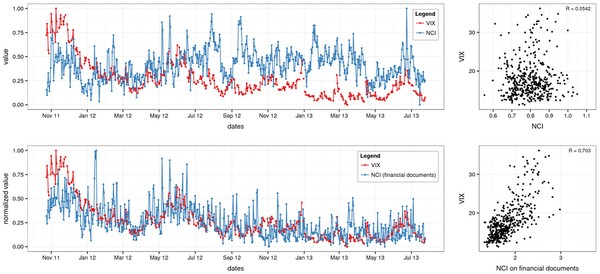

Below is a chart showing the VIX for the past year with a comparison to the S&P 500 and the 50 day EMA line.

The blue line is the VIX indicator while the red line is the S&P 500 and the green line is the 50 day average.

In an article dated March 16, 2010, Whitney Kisling writing for Bloomberg stated that in a study completed by Birinyi Associates the analysts did not find in their studies that the VIX indicator was able to predict the market movement. “The VIX is a coincidental indicator with limited predictive value” according to the study by Laszio Birnyi and Kevin Plienes.

After the VIX climbed to a record high of 80.86 on Nov. 20, 2008, the S&P 500 advanced 11 percent through April 2, 2009, according to data compiled by Bloomberg. The VIX sank to a 13- year low of 9.89 on Jan. 24, 2007, and the S&P 500 then rose 6.9 percent through June 4, 2007.

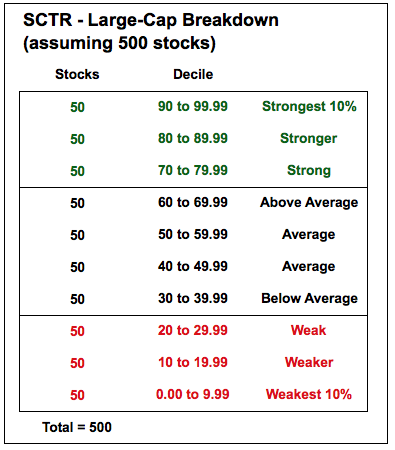

Birinyi analyzed the VIX’s performance since September 2003, including six periods of what he called “extreme” volatility, including the November 2008 record. He analyzed 12 times when the VIX fell 20 percent below its 50-day average and 18 periods when it was 20 percent above since 2003. The following is a table of the S&P 500’s average gain or loss during subsequent periods:

You can see from the chart above that since October, 2009 the VIX has spiked above the 50 day average four times. The market did do a slight downturn but the trend line continues to move upward.

However as you can see from the chart without the comparison, the period of time from November, 2009 to present is below 20. So even though it had spikes upward, the overall indicator was still below 20 which would indicate a satisfied outlook. Certainly the VIX indicator is one more avenue to use in your attempts to predict what the market is going to do.