Can Goldman Sachs and Wall Street Compete on Improving Society Not Just Wealth Accumulation

Post on: 10 Июнь, 2015 No Comment

How do you pick a winner? Bet on both sides.

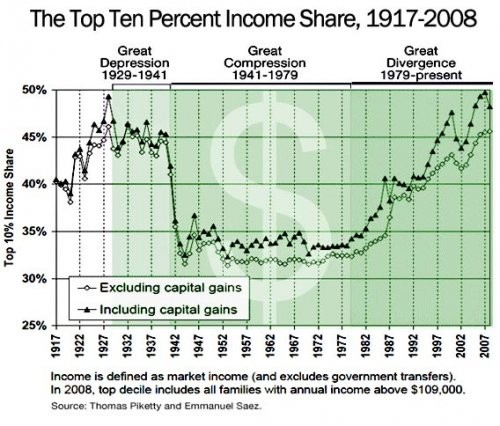

CEOs and companies donate generously to both political parties; more than 70 percent of the S&P 500 practice this approach. Traders of options craft strategies like straddles to cover both sides. And savvy investors like Goldman Sachs play both sides too: John Paulson’s mortgage-market bets minted him a billionaire in the 2008 meltdown. But Goldman profited by both co-investing in this strategy while also selling the exact opposite trade to its clients. Playing both sides, for which Goldman is rightly assailed, results in conflicts of interest, and erosion of client trust.

This week’s New York Times guest editorial by Greg Smith. formerly of Goldman Sachs’ equity derivatives unit, continues to chip away at Goldman’s formerly stellar brand and reputation, cracking the foundation built more than Marcus Goldman and Samuel Sachs back more than 140 years ago. This is not a surprise to most of us, but continues to reinforce how the culture of money at any cost is deeply embedded on Wall Street. Greg Smith’s piercing quote sums it up: People who care only about making money will not sustain this firm — or the trust of its clients — for very much longer.

These masters of the universe as Tom Wolfe called them in the 1980s book Bonfire of the Vanities have the wealth, power and connections to improve our society. Yet these financial leaders do not regularly integrate this noble goal into everyday business and investing. Is there anything sustainable about Goldman Sachs or Wall Street itself? Can finance and investing be a tool for good as well as profit? Let’s take a deeper look using the methodology my firm developed called the HIP Scorecard. measuring how human impact + profit are connected.

Does Goldman Sachs Already Prioritize Positive Societal Impact as Well as Profit?

A sustainability evaluation, or HIP Scorecard, evaluates three components of any organizations: the share of products and services that generate positive human, social and environmental impact; the quantitative impact metrics that are leading indicators of profit; and the management systems and practices that foster long-term sustainability.

1.Products and services generating positive impact on society: While Goldman Sachs was a thoughtful, productive partnership as it grew, Goldman became a public corporation in 1999. In the aftermath of the 2008 crisis, Goldman Sachs then became a federally-insured bank receiving capital from US taxpayers through the Federal Reserve.

What most people don’t know, including Goldman Sachs’ own clients and bankers, is Goldman operates a portfolio that seeks positive ecological, social and human benefits as well as profit. Named GS Sustain. the fund initiated in 2007 in collaboration with the United Nations. The first report in 2007 highlighted how sustainability criteria can drive profit and shareholder value, as well as reducing risk and volatility. While the GS Sustain portfolio does not report its performance publicly, it has tended to do better than the market, according to those familiar with the portfolio’s results. Yet despite this performance, sources say that it holds less than $100 million of Goldman’s $923,000 million in assets, or about 1 in 9230 dollars invested for clients. Why do Goldman’s executives and bankers shy away from sharing this compelling approach that benefits society with more clients?

Wouldn’t Goldman benefit publicly from sharing this approach more consistently? Yet when CEO Lloyd Blankfein and former commodities trader went to Capitol Hill during hearings on the financial crisis to be critiqued for Goldman playing both sides of the housing trade, it was never mentioned. Blankfein could have shifted the both sides argument on its head — playing both sides of doing good and making money through GS Sustain’s portfolio. However, there was not mention of it — on neither of his D.C. public hearings. And still isn’t. Could the reaction to this week’s publicity provide an opportunity for third time being the charm? Mr. Blankfein, you have your opportunity now.

2. Quantitative metrics that reduce risk and create value: At HIP Investor, we evaluate more than 30 fundamental metrics of sustainability in business operations. They cover five themes: health, wealth, earth, equality and trust. In Health, while Goldman retains client loyalty and low employee turnover, the firm’s culture is mocked in Twitter accounts like @GSelevator. In Wealth, Goldman’s staff has been the highest paid on average for the past several years; but CEO compensation to average worker is typically in the hundreds of multiples higher, a sign of potentially concentrated wealth — and thus a higher risk factor.

For Earth, Goldman has been a leader in eco-efficient operations (though the investment portfolios funds fossil fuels and fracking). Goldman beat JP Morgan Chase to the punch on declaring its own green operations despite JPM sharing its early policies with GS. For Equality, Goldman has yielded both the 85 Broads alumnae group of women investment bankers, as well as the 10,000 Women program seeking capital for female entrepreneurs globally.

Finally, for Trust, an indication of conflicts of interest are staff that have left because of Goldman’s policy of excluding other firm’s products, but seeking to serve its own portfolios for high net worth clients, even if the performance is not as attractive.

3. Management Practices embedding long-term value. Firms emulate their founders and evolve with new CEOs. Early partners at Goldman, risking their own capital through the partnership, ensured prudent risk-taking, and spurring the culture of smartest investors, typically first. Former lead partner John Morehead upheld strong ethical, moral and professional standards. Yet recent CEOs have not embraced that integrated approach. CEO Blankfein’s career focused on trading, charting wins in profits. Greg Smith wrote in his New York Times op-ed resignation this week: It astounds me how little senior management gets a basic truth: If clients don’t trust you they will eventually stop doing business with you. It doesn’t matter how smart you are. A more HIP firm would integrate a sustainable society’s goals into its vision, metrics, financials, accountability and decision-making.

Can Wall Street Compete on Improving Society, Not Just Wealth Accumulation?

The financial services industry is lacking the integration of this broader purpose. Few investment houses embrace the opportunity to use business and investing as tools and levers to improve society. Since 2010, JP Morgan Chase has advocated for impact investing — where doing good and making money can happen at the same time. They estimate a $1 trillion (a million-million) capital market for themes from sustainable agriculture to workforce housing to clean energy technologies. JPM’s December 2010 report of 96 pages documents the path towards 21st century investing, seeking positive impact for society as well as profit, a stark contrast to the robber baron mentality of the past 200 years.

UBS embraces investing for impact, authoring reports on cleantech and best places to work for. UBS is the largest wealth manager globally — stretching from Switzerland to Singapore to San Francisco to Sao Paolo. UBS has created creative partnerships with organizations like Ashoka.org, which supports social entrepreneurs, to scale up systems change to benefit society.

Merrill Lynch advocated values-based investing in past year-s — but since avoiding bankruptcy by being acquired by Bank of America, this large retail bank is continually seeking how to up fees for consumer banking, hampering more time and capital (and public recognition) for investing in entrepreneurs and job growth. BofA started in the North Beach pubs of San Francisco back in the 19th century, when bartenders trained by A.P. Giannini orchestrated local loans to emerging businesses. (To see how BofA and JPM compare on creating impact as well as profit, see the Fast Company faceoff from 2010)

Will Morgan Stanley, Smith Barney, Citibank and other Wall Street firms seek any competitive advantage from the estimated current $3 trillion market for impact investing in the U.S. or about 1 in 8 dollars of assets managed for investors? (More info on these markets at SocialFunds.com and Social Investment Forum)

Will your bank, investment manager or financier change? Maybe a few renegades inside Goldman Sachs and other firms can ultimately spur the society-friendly innovations while continuing to make money. But as Greg Smith wrote in his op-ed, People who care only about making money will not sustain this firm — or the trust of its clients — for very much longer.

What Can You Do? Vote with Your Money — Move It If Necessary

However, the fastest way to spur this is by voting with your own money — if you are not happy, then bank and invest with those who seek higher impact. Some investors are even choosing to commit to investing for impact — www.InvestingPledge.com — some like Napa, Calif.-based Meyer Family Enterprises ‘s goal of 100 percent invested for impact by 2020 or Canadian investor Joel Solomon’s expected 95 percent invested for impact by the year 2015. These investors are focused on both sides — a goal of doing good and making money at the same time.

When you vote with your money — switching banks, moving assets, or demanding impact investing — that’s a language that all in the financial industry understand.

It’s up to you — will you take up the challenge? Money talks — empower it with your voice, and moving it if necessary. When you do, the big banks and financial firms will listen.

NOTE: This is not an offer of securities nor a solicitation. The information presented is for information and education purposes, and does NOT imply any investment recommendations. Past performance is not indicative of future results. All investing risks loss of principal. The author, HIP Investor Inc. and HIP’s clients may invest in the securities mentioned above, including in the HIP Portfolios. Details and full disclosures are at www.HIPinvestor.com