Call Options V Options

Post on: 16 Май, 2015 No Comment

Types

Options come in two forms: call options and put options. Though different in function, it is important to know that buying options gives you the right to exercise the option, while selling options obligates you to follow through in the event the purchaser exercises the option.

Buying Put Options

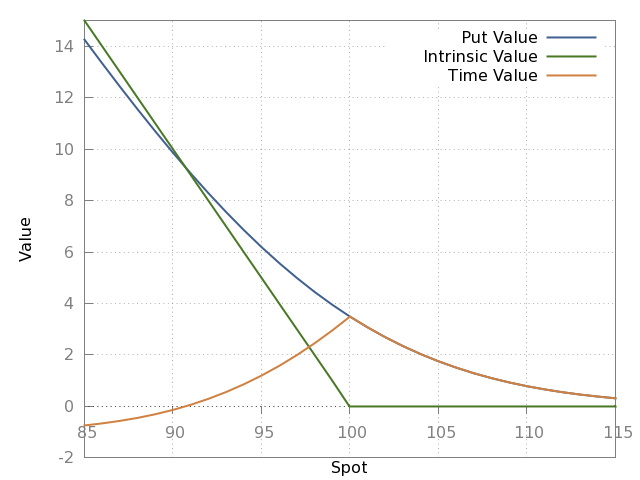

In contrast to the call option, put options are what you buy when you believe a stock’s price will fall. The option fee guarantees you a set price at which to sell the stock, no matter how far it drops.

Selling Call Options

Selling call options is similar to buying put options because in both cases, you believe the underlying stock’s value will decline. As long as you own the underlying stock, the main risk is not reaping the profit associated with a climbing stock price.

Selling Put Options

References

More Like This

Put Option Vs. Call Option

You May Also Like

Puts and calls are the two types of option contracts. Option contracts give the option holder the right to buy or sell.

Both the covered call and short put are stock option trading strategies designed to generate a steady stream of income. The two.

Options are legal contracts that give one party the ability or option to buy a stock from or sell a stock to.

Options trading intimidates some investors. While options strategies can get complicated, the basic premises behind call and put options are quite straightforward.

A bull put spread and a bull call spread are equivalent strategies in options trading. They are equivalent because the strategies will.

In investing parlance, calls and puts are contracts that give you the right to buy or sell an asset at a specified.

Call and put options are important parts of advanced stock trading. They are contracts that investors can buy to make profits or.

In the stock market, a put or a call is what's known as an option. Options are contracts that give you the.

A stock option is a legal contract that represents the right to buy or sell 100 shares of a specific stock at.

Put Option Vs. Call Option. Put options increase with a falling stock price, and call options gain with a rising stock price.

Puts and calls are purchased options that give the buyer the right but not the obligation to buy or sell securities (stocks.

Options are classified as derivative contracts that are tied to an underlying asset, such as a stock, bond or futures contract. Call.