Call Option vs Put Option Difference and Comparison

Post on: 9 Июль, 2015 No Comment

Options give investors the right but no obligation to trade securities, like stocks or bonds. at predetermined prices, within a certain period of time specified by the option expiry date. A call option gives its buyer the option to buy an agreed quantity of a commodity or financial instrument, called the underlying asset, from the seller of the option by a certain date (the expiry), for a certain price (the strike price ). A put option gives its buyer the right to sell the underlying asset at an agreed-upon strike price before the expiry date.

Contents: Call Option vs Put Option

edit Motivations

Buyers of a call option want an underlying asset’s value to increase in the future, so they can sell at a profit. Sellers, in contrast, may suspect that this will not happen or may be willing to give up some profit in exchange for an immediate return (a premium) and the opportunity to make a profit from the strike price.

The buyer of a put option either believes it’s likely the price of the underlying asset will fall by the exercise date or hopes to protect a long position on the asset. Rather than shorting an asset, many choose to buy a put, as only the premium is at risk then. The put writer does not believe the price of the underlying security is likely to fall. The writer sells the put to collect the premium.

edit Expiry and Option Chains

There are two types of expirations for options. The European style cannot be exercised until the expiration date, while the American style can be exercised at any time.

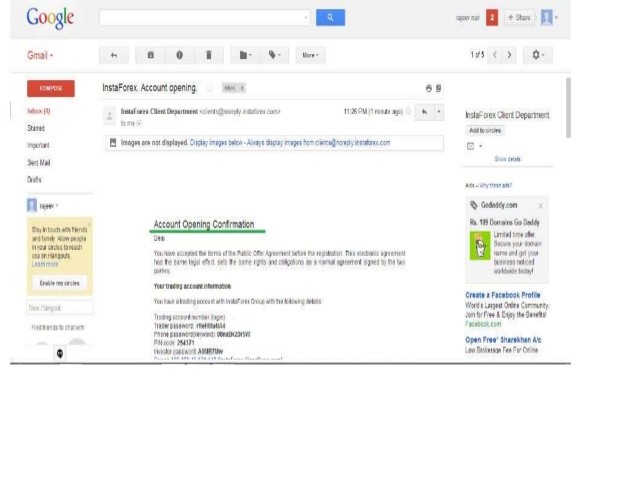

The price of both call options and put options are listed in a chain sheet (see example below ), which shows the price, volume, and interest for each strike price and expiration date.

edit Strike Price

For each expiry date, an option chain will list many different options, all with different prices. These differ because they have different strike prices: the price at which the underlying asset can be bought or sold. In a call option, a lower stock price costs more. In a put option, a higher stock price costs more.

edit Profits

With call options, the buyer hopes to profit by buying stocks for less than their rising value. The seller hopes to profit through stock prices declining, or rising less than the fee paid by the buyer for creating a call option. In this scenario, the buyer will not exercise their right to buy, and the seller can keep the paid premium.

With put options, the buyer hopes that the put option will expire with the stock price above the strike price, as the stock does not change hands and they profit from the premium paid for the put option. Sellers profit if the stock price falls below the strike price.

edit Risks

Options are high-risk, high-reward when compared to buying the underlying security. Options become entirely worthless after they expire. Also, if the price does not move in the direction the investor hopes, in which case she gains nothing by exercising the options. When buying stocks, the risk of the entire investment amount getting wiped out is usually quite low. On the other hand, options yield very high returns if the price moves drastically in the direction that the investor hopes. The spreadsheet in the example below will help make this clear.

edit Example

Consider a real-world example of options trading. Here is a subset of options available for GOOG (so the underlying asset here is Google stock) on a day when the stock price was around $750, as taken from Yahoo Finance. The expiry date for all these options is within 2 days. Call options where the strike price is below the current spot price of the stock are in-the-money.

For simplicity, we will only analyze call options. This spreadsheet shows how options trading is high risk, high reward by contrasting buying call options with buying stock. Both require the investor to believe that the stock price will rise. However, call options give very high rewards compared to the amount invested if the price appreciates wildly. The downside is that the investor loses all her money if the stock price does not rise well above the strike price. The spreadsheet can be downloaded here.

edit Trading Options vs. Trading Stocks

With options, investors have leverage. When a prediction is accurate, an investor stands to gain a very significant amount of money because option prices tend to be much more volatile. However, the potential for higher rewards comes with greater risk. For example, when buying shares, it’s usually unlikely that the investment will be entirely wiped out. But money spent buying options is entirely wiped out if the stock price moves in the opposite direction than expected by the investor.

edit Put Options vs. Short Selling

There are two ways for speculators to bet on a decline in the value of an asset: buying put options or short selling. Short selling, or shorting, means selling assets that one does not own. In order to do that, the speculator must borrow or rent these assets (say, shares) from his or her broker, usually incurring some fee or interest per day. When the speculator decides to close the short position, he or she buys these shares on the open market and returns them to their lender (broker). This is called covering ones short position.

Sometimes brokers force short positions to be covered if the share price rises so high that the broker believes there isn’t going to be enough money in the account to sustain the short position. If the market price of the shares at the time the position is covered is higher than it was at the time of shorting, short sellers lose money. There is no limit to the amount of money a short seller can lose because there is no limit to how high the stock price will go. In contrast, the ceiling on the amount of loss that buyers of put options can incur is the amount they invested in the put option itself. Some speculators view this loss ceiling as a safety net.