Calendar Ratio Backspread

Post on: 28 Июль, 2015 No Comment

Profiting In Sideways And Breakout Markets

Calendar Ratio Backspread

by Jeff Neal

Would you be interested in a trading strategy that has limited risk, unlimited profit potential, is adjustment-friendly, and can profit in a sideways or breakout-type market? Of course you would! Here’s a look at the calendar ratio backspread strategy.

T he calendar ratio backspread is an options strategy that can be constructed using either puts or calls, depending on the trader’s directional bias. While the strategy may sound complex, using it is fairly simple.

CALENDAR RATIO BACKSPREAD DEFINED

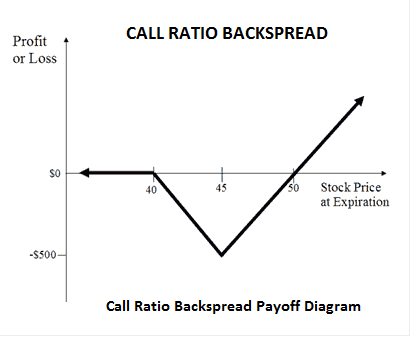

As the name suggests, the calendar ratio backspread combines a standard ratio backspread and a diagonal options strategy. For example, when using calls, the standard ratio backspread involves purchasing calls with a higher strike price and selling fewer calls with a lower strike price at little or no cost — or even a credit. The ratio of calls purchased to those sold is generally less than 0.67. The most common ratios are 1 to 2 and 2 to 3. This means buying two calls offset by selling one call, or buying three calls against selling two.

The ratio backspread is usually implemented at little or no cost or sometimes even for a credit, because the premium received from selling the calls is often equal to or greater than the price paid for the long options. The risk in this position is limited and equal to the number of short calls, multiplied by the difference in strike prices, times 100, and minus the net credit (or plus the net debit). The potential reward is unlimited. Another important characteristic is that the standard ratio backspread is constructed with strike prices all within the same expiration months.

Putting together a diagonal spread consists of both the sale and the purchase of an equal number of calls or puts with the same underlying security, different strike prices, and different expiration dates. Shorting the front-month option and hedging it by going long an option that expires at a later month creates a diagonal spread. The anticipated directional bias of the market is a strong factor in determining which strike prices to use. The maximum risk of a diagonal spread is equal to the net debit of the options.

Merging the standard ratio backspread and the diagonal spread involves selling shorter-term options and buying more longer-term options. The marriage of these two strategies creates the calendar ratio backspread.

. Continued in the October 2003 issue of Technical Analysis of STOCKS & COMMODITIES