Calendar Call Spread A Neutral to Bullish Strategy Know Your Options

Post on: 18 Июль, 2015 No Comment

Share | Subscribe

Even if you aren’t that familiar with options, I’ll bet you’ve heard some one use the term ‘calendar spread’.

Whether they knew what they were talking about is another story.

So let’s define it here.

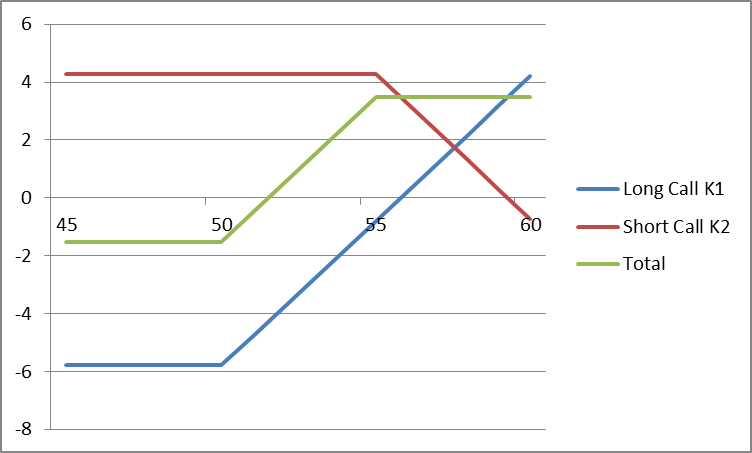

A Calendar Spread (also known as a ‘time spread’ or ‘horizontal spread’) is when you sell (write) an option in one month and buy an option with the same strike price but in a different, further out month.

Since the option you’re writing has less time (worth less) and the one you’re buying has more time (will be worth more), this can also be referred to as a debit spread as well.

You can do this with puts too — sell a put in a nearby month and buy the same strike in a further out month.

As you would expect, you’d have a neutral to bullish bias with the calls and a neutral to bearish bias with the put.

You can also ‘sell’ this strategy by buying the nearby and selling the further out — but today, let’s keep our focus on the long side.

Let’s use IBM ( IBM ) for this example.

- Let’s say you wrote the Feb. 185 call for 3.40 (collect $340)

Why would I want to do this?

The maximum potential loss is limited to what you paid for the spread — in this case $300.

The maximum profit if removed together would be the difference between the two option prices at the expiration of the nearby month.

Let’s say IBM closed below $185 when the February options expired.

- At expiration, the Feb. 185 call I wrote for $340 is now worth $0

$500 less my cost of $300 = profit of $200 or a 66% profit

If I wanted, I could decide to hold onto that further out call if I thought a rally was underway — and make even more money.

But of course, if it went down, I could lose the rest of the premium. But again, my maximum loss would be limited to $300.

This is a great strategy.

Granted, you’re limited in your profit potential, but you’re capitalizing on the dynamics that the nearby month will lose its value (time value) quicker than the further out one.

Some people probably don’t bother with this strategy because the profit potential seems small. But if you look at it in percentages, a 30%, or 40%, or in this case a 66% return isn’t small at all. If you put ten of these on for example, before commissions, that would cost $3,000. If you made $200 profit on each one, that’s a $2000 profit.

And that’s pretty exciting.

You can learn more about different types of option strategies by downloading our free options booklet: 3 Smart Ways to Make Money with Options (Two of Which You Probably Never Heard About). Just click here.

And be sure to check out our Zacks Options Trader service.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

INTL BUS MACH ( IBM ): Free Stock Analysis Report