Calculating Present Value Money Over 55

Post on: 5 Октябрь, 2015 No Comment

Present Value Is a Useful Retirement Planning Tool

Learn how to calculate present value to see how much you need for retirement. John Lamb/Photodisc/Getty Images

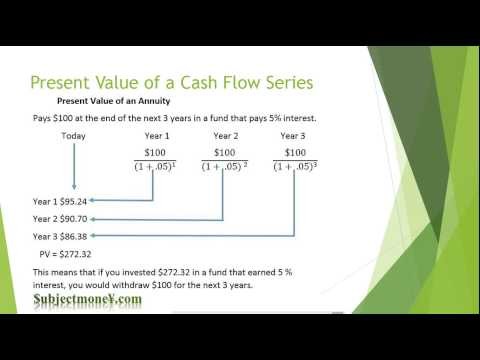

Present value is a term that is important to your retirement planning. Put in simple terms, present value is the amount of money you need in an account today, to meet a future expense, or a series of future expenses, given an assumed rate of return .

Present Value Examples — How You Calculate Present Value

If you need $200,000 ten years from now, below is the present value based on various assumed rates of return:

- 3% $148,818

- 4% $135,112

- 5% $122,782

(I did these calculations on an hp12C calculator. Entries to do this are: n = 10, i = rate of return, PMT = 0, FV = $200,000. Then hit PV to solve for present value.)

This simple present value calculation shows you that the higher the rate of return, the lower the amount needed today to fund the future expense. This is a challenge in retirement planning; in order to achieve a higher rate of return you must typically choose a riskier portfolio, which means the higher return is possible, but not certain.

If you want something certain, you must often accept a lower rate of return, which means more savings are required to deliver the same standard of living.

Present Value Gets Even Trickier in Retirement Due to an Unknown Time Horizon

Suppose you know you need $20,000 a year in addition to your Social Security income to live comfortably. To do this calculation, there are now two unknown variables; the rate of return and your longevity. In the table at the bottom of this article are the respective present values taking both variables into account. Using the present value table you see that:

- If you live 20 years and can earn a 5% rate of return, you will need $261,706 to provide you with $20,000 a year.

- If you live 30 years and earn a 3% rate of return you need $403,769.

If your family and personal health history indicates you may be long-lived, you’ll either need to save more or work longer than someone with a shorter life expectancy.

How to Use Present Value in Retirement Planning

Present value can be used to give you a rough idea of the amount you need to have saved at the start of retirement to meet your spending needs. You would add up your anticipated annual expenses, subtract out your anticipated fixed sources of income such as Social Security, determine how long you think you will live. and then calculate the present value of that stream of expenses. Compare that to what you now have saved, or what you think you’ll have saved by your retirement date and you’ll have a rough idea of whether you’re on track or not.

You can also use present value calculations to make choices about risk.

For example, assume you are a single female, age 65 and you need $20,000 a year ($1,666 a month) for life. Using the quote system at immediateannuity.com you can see that right now (Nov 2012) it will cost you about $329,379 to provide $1,000 of income for life in the form of an annuity. In this example you can compare that to the present values in the table at the bottom of the article.

Is $329,379 for $20,000 a year a good deal? It depends. If you live long, and don’t want investment risk than yes it is!

Calculating Present Value in Excel

When using an Excel spreadsheet you can use the PV formula to calculate present value. Here is an excel file that shows you how the present value formula is applied to annual payments of $20,000 a year for 25 years at a 3% interest rate, and how it is applied if those payments are made monthly at $1,666 per month, instead of annually.

If you like to do your own calculations the Guide to Spreadsheets provides numerous tips on how to use the various functions and formulas.

Present Value of Your Social Security Benefits

The online Social Security calculators use present value to help you compare one claiming option over another. This can help you visually see which choice is worth more to you over your expected lifetime.

Present Value of Pension Options

A similar present value calculation can be used to compare different pension choices. If you have a long live expectancy one option may be worth more to you in terms of present value than another option. If you are married, you ought to consider joint life expectancy in your calculations.

Present Value Table