Calculating Performance Fees for Your Own Hedge Fund Your Own Hedge Fund

Post on: 16 Март, 2015 No Comment

August 2, 2012 by Andrew

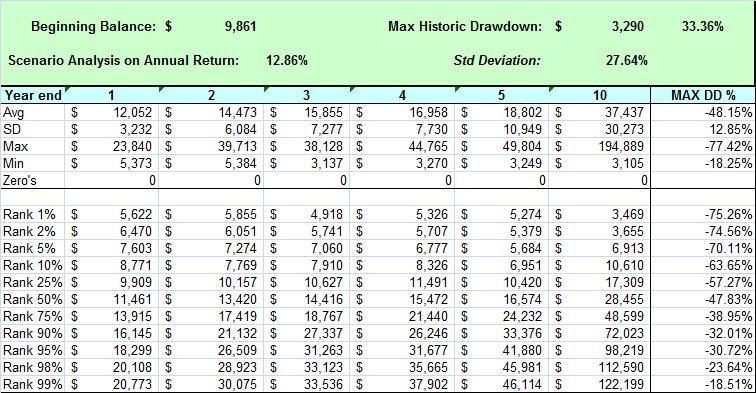

Ive been speaking to a few potential investors about opportunities for them to invest in my little fund. During the process of discussing the best way forward, one of the many topics we had to ensure was crystal clear is the payment of Performance fees. To help with the explanation I produced a diagram similar to the one below, and talked them through the various numbers. It was a few days later when I recognized that this may be useful to others looking to manage their own hedge funds, who wish to charge a performance fee for doing so. So I produced the following diagram for you!

First some context and definitions:

The Hedge Fund presented here is a theoretical fund that charges a Performance Fee only (no Management Fee although including a simple percentage based management fee would not add too much complexity). The Fee has a hurdle rate of 5%, charges a performance fee equal to 15% of any excess return above the hurdle rate, and uses a high water mark .

hurdle rate . the rate of return that the fund manager must exceed before charging performance fees.

performance fee . a payment made to a fund manager for generating returns in excess of the hurdle rate .

Investopedia explains Performance Fee

www.investopedia.com/terms/p/performance-fee.asp#ixzz22NQyorht

high water mark . the minimum value a fund must achieve before a performance fee can be charged. In your first year of operation, the high water mark is the minimum value (generally measured as Unit Price) that the fund must reach by year end (assuming annual Performance Fees) before a fee can be charged, which is therefore the starting value plus the hurdle rate. High water marks motivate the fund manager to avoid taking large risks to achieve large performance fees, and come in to their own in a year following a negative or low return year. For example, if an investor buys Units in your fund at $1.00, and after the first year the Units are only worth $0.80, not only will the manager get no Performance Fee (for failing to exceed the hurdle rate), but they will need to get your Unit price back above its previous high water mark of $1.00 before a performance fee could be considered. In the example below, the high water mark is incremented each year by the hurdle rate.

So lets use the table below to walk through an example.

The four rows within the table represent four different investments in the fund, made at different times and at different prices (Unit Value). The highlighted numbers in the example correspond with the numbered list below.

- The first external Investor in the fund makes an Investment of $1,500 on 30/11/2010, at a Unit Price of $1.1085 per unit.

- To generate a Performance Fee payable to the Fund manager, the Unit Price one year after the date of investment (30/11/2011) must be greater than 1.1085 plus the 5% hurdle rate [1.1085 x 1.05], or greater than 1.1639. Otherwise no Fee is payable.A Year Later.

- The Actual Unit Price on the first anniversary of the investment (30/11/2011) was 1.3380 per unit, representing a 20.70% return over the year. Before fees, the Investors $1,500 has grown to $1,810.55.

- This 20.70% return was 15.70% more than the Minimum Return (Hurdle Rate) required to trigger a Performance Fee, and as such generated a performance fee of 15% times the excess return [15% x 15.70%], or 2.36%. This fee is applied to the Investment Value at the start of the relevant year, so 2.36% times $1,500 equals a $35.33 Performance Fee.

The Investor can be invoiced directly for this fee, or can transfer Units to the Fund Manager to the value of the Fee.

- the HWM at time t (see point 2 above) or,

- the Price a time t (see point 3 above).

Lets consider another investor. Investor 3 invested $1,000 on 31/03/11 after the Unit price had climbed to $1.2854. With the 5% hurdle rate, the fund price (unit value) must grow to $1.3497 before a Performance Fee is payable

A Year later.

6. The fund has grown by 4.29%, but only to $1.3406. Where the Return is less than the Minimum return (5%), no Performance fee is payable.

7. The final row represents a fourth investor who held their investment for a year in which the fund underperformed (returning -1.25%). Where the Return is less than the Minimum return (5%), the HWM (High Water Mark) set for the subsequent Year is 5% greater than the HWM for the initial Year (so the HWM goes from $1.4191 as the minimum after 1 year to generate a fee, up to $1.4900 by the end of the second year).