Buying a HUD Foreclosure Learn some key tips

Post on: 1 Май, 2015 No Comment

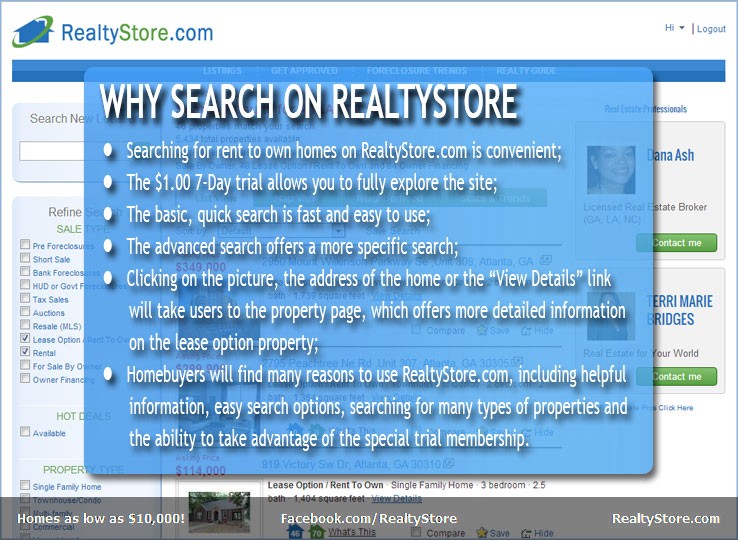

The U.S. Department of Housing and Urban Development (HUD) has thousands of homes for sale nationwide. Despite the publicized risks and drawbacks of HUD homes, real estate agents who specialize in these sales say buying homes HUD owns may actually be easier than buying a home in a traditional sale. You can search for HUD homes here.

Please know buying a HUD home requires specialized knowledge from your Real Estate Agent and from your lender. Make sure they have experience buying HUD Foreclosures.

Homes HUD owns

Before digging deeper into the HUD buying process, its helpful to understand why HUD has these homes for sale. HUD homes are homes foreclosed by lenders that had government-insured mortgages, such as Federal Housing Administration (FHA) loans. When homeowners default on these mortgages, HUD pays a percentage of the mortgage balance to the lender and the lender turns the property over to HUD. HUD does not actually foreclose on properties. The current surplus of HUD houses stems from the volume of foreclosures since the 2007 financial crisis, when the real estate bubble burst.

You are likely to find a home priced below market value because of this influx of foreclosures. HUD sells these homes to recover the loss from the foreclosure, rather than make a profit.

The homes HUD owns are available in almost every state. Prices range from $1 to $1,000,000. These homes are residential properties with one to four units, including condominiums, duplexes, townhouses, single-family homes and apartment complexes.

You can browse these homes on the HUD Home Store website. The site provides photos and extensive details of each listing, including:

•Square footage

•Age of the home

•Number of rooms

•Appraisal amount and date

•Listing date and listing period

Property listings on the site also include the HUD listing brokers information. When you are ready to bid on a HUD property, the HUD broker must place the bid for you. The broker can also help you search for homes, arrange home inspections, follow the bid results and close the sale. Your own personal Real Estate Agent can help you with this process.

HUD bidding process

HUD gives you preference during the initial bidding period if you plan to live in the HUD house after you buy it. Hamilton says that preference is given to owner-occupants for the first 30 days the home is listed. HUD collects online offers for the first 10 days of the listing and opens them on the 11th day. He says the agency typically takes the highest acceptable offer. If there are no acceptable offers in the first 10 days, HUD looks at offers daily thereafter. You shouldnt expect a price drop until the home has been on the market more than 35 days. If you are an investor, you may bid on the property after it has been listed for 30 days.

Its crucial to know that HUD properties are sold as-is. HUD does not make any repairs or allow you to make any repairs before the sale is closed. The agency strongly encourages you get a home inspection before purchase. If you are an owner-occupant, you can back out of the sale if the inspection discloses unanticipated problems and your earnest money will be returned. However, if you are an investor and you back out of a sale, your earnest money will not be returned.

Financing HUD houses

You may buy the homes HUD owns with cash or with financing from a mortgage lender. To place a bid on a HUD house, you must provide a pre-approval letter whether you use a conventional loan or a government-insured mortgage.

Using an FHA home loan can streamline the buying process, however, the home must meet FHA requirements, so it is important to understand the four financing categories of HUD home listings.

The homes HUD owns fall into one of four categories that determine if the house is eligible for an FHA loan: IN, IE, UI or UK. The first category is IN, or insurable. These homes are the easiest to finance. Homes rated IN meet the insurance eligibility requirements for an FHA 203(b) mortgage and usually require little or no repairs. Because these HUD homes are insurable and in good condition, you can easily get a conventional mortgage for them.

The second category is IE, which means insurable with repair escrow. These homes also meet the requirements necessary for an FHA 203(b) mortgage. These HUD homes require repairs, so a repair escrow must be established in order to proceed with the mortgage. The HUD listing includes amount required for the repair escrow.

Repair costs on homes in this category cannot exceed $5,000 and must be completed within 90 days of closing on the property. It is also possible to obtain conventional home financing for homes in this category. If you use outside financing not backed by the government, a repair escrow may not be required.

The third category is UK. These homes are not eligible for the FHA 203(b) mortgage because they need more than $5,000 worth of repairs, yet they often qualify for a FHA 203(k) mortgage. These loans, known as rehabilitation loans, are available for one to four-family HUD homes that require significant repairs. This loan program may also be used to convert a single-family home into a two, three or four-family dwelling.

This HUD property requires a repair escrow.

The final category is UN, which means the property is uninsurable. These properties typically require extensive repairs and the homes may be uninhabitable. These homes are not eligible for FHA financing because of their condition. It may also be difficult to get a conventional mortgage for these homes. Uninsurable homes may be a good option if you have investment funds available and the resources to make the repairs yourself

While you can use any type of financing for these homes, HUD makes it easy to use FHA loan programs. The purpose of HUD programs is to promote fair housing to all people. Many traditional lenders offer FHA loans insured by the government. If you are denied a conventional mortgage, you are an ideal candidate for an FHA loan. You can apply for a home loan for a single-family home, a multi-family complex, a fixer-upper that needs rehabilitation or a manufactured home. The FHA also offers home loans for building a home. Some loans in HUD programs are designed for first-time homebuyers, while others are open to anyone. FHA programs include:

Fannie Mae also has a HomeStyle Renovation Mortgage that you may be able to use for buying a HUD house. Not many national lenders offer this program, however.

When it comes to buying homes, HUD insurance categories only dictate your home loan options if you want a government-backed mortgage. Many traditional lenders offer mortgages for HUD homes that are move-in ready or need minor repairs.

A FHA 203(k) loan is available on most HUD homes and is different than the FHA 203(b) with repair escrow. A FHA 203(k) loan is a rehab loan that allows the buyers to finance as many repairs as they would like into the loan. The buyers must qualify for the loan and two appraisals are needed to determine the pre and post repaired value. An FHA 203k rehab loan can take much longer and cost more than a typical FHA loan.

As an FYI may not be able to use a conventional mortgage to buy a HUD home if it has major problems, such as the plumbing or heating system doesnt work. Most mortgage programs require that the home pass a home inspection, having no major issues. Additionally, the HUD repair escrow cannot be used with loans from the Veterans Administration or U.S. Department of Agriculture.

With a little research and effort, you may find the perfect home for yourself and your family, and financing you need to buy it.