Buy Stock Shares that Pay Dividends

Post on: 18 Май, 2015 No Comment

Buying shares that pay dividends can be a very profitable investment. When the stock markets were raging ahead, many people lost focus of dividend paying stocks and instead went for the big gains. Since the markets crashed and as they rebound, savvy investors are once again looking to dividends to supplement growth and help cushion losses in tough times. It has been proven that long-term investments which pay dividends will likely outperform those that do not pay dividends by 6% or more annually. Before we get into the proof, let us talk a little about what dividends are, how they are paid and why one company may choose to pay them while another company may not.

What are Dividends?

Dividends are payments, made to shareholders on a per share basis, which are used to distribute excess cash or profits from the company’s earnings. In other words, it is how the company pays its owners. Not all companies pay dividends nor are they required to do so. Some instead aim to reward shareholders solely through the growth of the company and thus the growth in value of each share of stock owned. Those which pay dividends, pay so on a quarterly basis, although dividend yields are quoted on an annual basis.

For instance, if XYZ Corporation pays a $1 per share quarterly dividend and shares are currently trading at $50 per share, they are paying an 8% annual dividend. We get this figure by taking $1 (dividend) multiplied by 4 quarters, which comes to a $4 annual dividend. Divide this by the current share price of $50 and we get .08 or 8%. So, ($1 x 4) / $50 = .08 or 8%. Because dividend yields are based on the current per share price of the stock, the yield may vary from time to time.

Most companies that pay dividends take pride in this fact and go to great lengths to ensure that they continue to pay dividends each and every quarter. Some companies even strive to increase their dividend payments on a regular basis.

When Do Dividends Get Paid?

Once the board of directors votes to pay a dividend, they will set the payment date and amount per share. They will also set a record date, which is the date on which you must own the stock in order to receive a dividend payment. For instance, if XYZ Corporation declares a dividend of $1 per share, payable on September 10th, with a record date of August 8th. In this case, you must have actually owned the stock on August 8th to be eligible to receive a dividend payment. If you purchase the stock after August 8th, then you will not receive the dividend. Two days before the record date, the stock price is adjusted for the future dividend payment. This accounts for the time it takes for a stock sale to settle and adjusts for the difference in price if the stock is sold after the record date, since the former owner will receive the dividend. This date is called the ex-dividend date. For example, when XYZ Corporation (XYZ) declared their dividend with a record date of August 8th, then August 6th becomes the ex-dividend date. If XYZ is trading at $75 at the end of the day on August 5th, then on August 6th, the price will automatically adjust to $74 to account for the $1 dividend. Then, on September 10th, shareholders will receive $1 per share that they owned on August 8th. It may seem a bit confusing, but the point of the different dates and price adjustments are so that investors cannot simply take advantage of the dividends by trading stocks just before or after the dividends are declared or paid.

Many Stocks DO NOT Pay Dividends

As we discussed, dividends are the means by which a publicly traded company pays out profits to its shareholders. Profit is of course the goal of publicly traded corporations and when they achieve this goal there are a few options for what to do with the extra cash. We mentioned that some businesses will choose to keep the cash and reinvest it in the company for future growth.

For instance, one large American company known for not paying dividends is Apple (AAPL). Financial analysts and investors alike have debated whether or not Apple should pay out some of the more than $40 billion (yes, billion) they have in cash reserves to its shareholders. Apple’s CEO, Steve Jobs, has said publicly that he has no intention of paying dividends. Instead, he believes the company could better use the cash to invest in new innovations, technology and knowledge, without mortgaging the future of Apple. He also knows that Apple is in the enviable position of having substantial cash reserves should the economy turn south or for any other financial emergency. Apple has successfully grown the company at an incredible rate, adding value to shareholders, all without paying dividends. However, they may more of the exception than the rule.

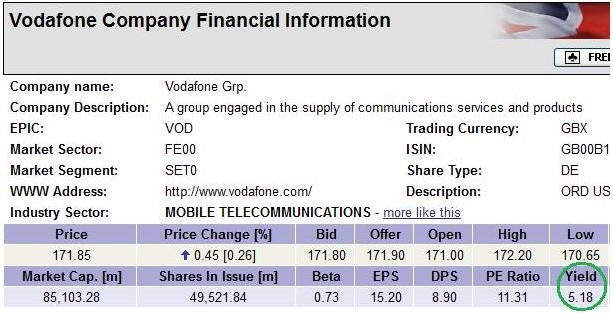

While Apple has chosen this approach to saving or reinvesting their cash, other companies may decide to pay a dividend. One example of a stock that pays out dividends is Home Retail Group, PLC (HOME), listed on the London Stock Exchange. Home Retail Group pays annual dividends currently yielding about 8.4%. They, along with many other dividend paying companies, believe that it is in the best interest of their shareholders to pay out excess cash. As we mentioned in the open, time has proven that those who invest in dividend paying companies have outperformed those who do not by a wide margin.

On Average: Dividend Paying Shares Well Outperform

A study by Ned Davis Research (www.ndr.com) from 2008 showed that over a 35 year period, from 1972 to 2007, a portfolio consisting of dividend paying stocks would see an annual return of between 8.9% and 10.9%. The difference is that the 8.9% gains represent a portfolio in which the stocks did not change their dividend over the time period. The 10.9% gains come from a portfolio consisting of stocks that increase (or begin) their dividends over time. Meanwhile, a portfolio consisting of only non-dividend paying stocks would only see an annual return of 2.5% over the 35 year period.

In terms of real dollars, the non-dividend portfolio would be worth $240,000 in 2007, after starting with an investment of $100,000. On the other hand, the portfolio of dividend paying stocks would be worth over $3.2 million and the stocks that increase their dividends would end with a value of more than $4 million, each after starting with the same $100,000 in 1972. These numbers are pretty incredible and show: over a long period of time (35 years in this case), stocks that pay dividends to their shareholders outperformed those that do not.

Over the short term, the results may be quite different. In fact, during the technology boom of the late 1990’s and early 2000’s, non-dividend stocks greatly outperformed dividend paying stocks.

Companies that pay dividends tend to be older, more established companies that are fairly dominant in their industry. That does not mean that only the top companies in each industry pay dividends, but those that pay them generally have a solid foothold in their respective market. For this reason, along with other reasons laid out in this article… buying stocks that pay dividends is a recommended strategy for investors who aim to build wealth over a long period of time.