Buy Low Sell HighIs That It

Post on: 19 Апрель, 2015 No Comment

Master trading psychology to get the best values

By Jon Markman. Editor, Trader's Advantage | Jun 4, 2013, 4:04 pm EDT

The Vanguard Group just published a report that declared — and dont fall off your chair when I say this — that the most important factor for predicting future performance over the past 86 years has been valuation. (The report is not available to the public yet, but it essentially updated their Oct. 2012 report, available here.) That is, if you pay little enough for a stock, it has the best chance of outperforming for you in the future. So their advice, no kidding, is to buy low and sell high.

I may sound a little sarcastic, but actually, the question gets interesting when you start to think about where valuation comes from.

Sentiment and Stock Valuation

As Steve Reynolds of Craig Drill Capital put it in a note to clients, valuation actually comes from some other elements. As economic and corporate fundamentals weaken, investor sentiment worsens, leading to falling stock prices and thus lower valuations. Conversely, as conditions improve, spirits are buoyed and markets advance. So the most effective way to manage money is to master the timing of the swings of psychology.

Emotions transform the one standard deviation economic event into three standard deviation stock market moves. That is to say, when there is a little bad news people freak out and sell stocks hard. And vice versa give a little positive stimulus for long enough and investors will push stocks a lot higher. Both these things show up as P/E multiples.

Just to frame it, bear market P/Es tend to base around the 7x to 8x level for big stocks, while in bull cycles they tend to top out around 28x. And as Reynolds points out, the range of underlying economic outcomes are significantly less volatile than the extremes of investor psychology and therein lies the opportunity for traders and investors.

So if past personal experiences influence current sentiment, strategists should study investors recent financial history in order to assess their future willingness to purchase equities. Reynolds proposes that a simple measurement of this risk tolerance might be as follows: ERP = P = (W+I)/N + Δ (W+I).

In this formula, ERP is equity risk preference, P is investor psychology, WI is wealth and income and N is financial needs. The more positive investors feel about their current financial conditions, the more likely they are to purchase equities. Conversely, negative experiences lead to equity liquidation. Its nice to think the opposite would be true but there are very few real contrarians.

Shift to Optimism in U.S. Markets Underway

Reynolds points out that in moving from recession and bear market lows to recovery and bull market highs, there is a natural tendency for investors to assume greater risk, reallocating portfolios from defensive securities to ones with more aggressive growth characteristics. In the United States, this process of moving from pessimism to optimism is currently underway as depicted by the following chart, which was created by Reynolds firm.

At bear market bottoms, psychology is at a nadir ((W+I)/N = 50%) and margin calls are at a peak. As the market improves, balance sheets are repaired, but not enough to mend confidence and stem equity liquidation. However, once investors have recouped their losses ((W+I)/N = 100%) and negative sentiment has abated, the process of equity accumulation begins.

Reynolds argues that the U.S. stock market is now at this inflection point. Looking forward, additional market gains will increase confidence and equity risk preferences will continue to rise. Then, as all good things must come to an end, the eventual self-reinforcing interplay between extreme euphoria and imprudent leverage will culminate in speculative excess.

On the Road to Wealth Creationbut With Few Prospects

The good news is that we appear to just be in the rehabilitation phase of the market psychology cycle and are embarking on a period of wealth creation. As the market moves higher, it is crucial to understand how this improving sentiment will be expressed in stock selection.

At the market bottom in 2008-2009, the outlook for equities was dismal. The trailing 10-year market return was negative and psychology so pessimistic that even reversion to the mean disciples were despondent. Pension and endowment fund sponsors were demoralized over the prospect of at best mid-single digit returns. With annual actuarial assumption mandates of roughly 8%, they were operating in a crisis mode, Reynolds notes.

He explains that traumatized investors maintained historically high fixed income and cash holdings. Risk aversion was the portfolio managers mantra as the market rallied, however, a modicum of confidence was gradually regained and gradually positions were increased in high yielding stocks and low quality bonds. As performance lagged the market indices, managers adopted the concept of risk-adjusted returns to rationalize their sub-par absolute results. By early 2013, four years of gains had improved psychology and they dared to look back and see that they had driven the road to the current point too cautiously.

The U.S. stock market had delivered an annual total return in excess of 15%; well above previously dire expectations and fortunately, well in excess of their actuarial/personal needs. And yet most investors were too cautious to achieve that. While in 2009 the look back over your shoulder suggested overly conservative strategies, now it is signaling that it is time to speed up!

The best part of Reynolds analysis is coming up. He notes that even though improved market psychology is on the cusp of enticing investors to take on greater risk, the economic outlook continues to be relatively uninspiring. Though the persistent headwinds that have been buffeting the economy are finally abating, the monetary and fiscal stimuli are simultaneously slowing.

These offsetting forces leave us with a subpar, slow growth, flattish recovery; one likely to linger indefinitely. For investors, this is troublesome since the number of companies able to demonstrate strong, organic revenue and profit growth is rapidly declining.

At the onset of the economic recovery, the vast majority of companies showed a significant rebound in earnings from depressed recession levels. This leaves investors in a dilemma: Investors now have a rising propensity to increase equity exposure and a declining universe of attractive investment alternatives! He calls this the Reynolds Paradox, and it is a very clever concept.

Cautious Investors Will Tiptoe Back to Risk

The preponderance of portfolios today are conservatively structured, both in equity exposure and stock selection. If they remain invested in high-yielding, slow and no-growth companies, they will find themselves caught in value traps. Continued frustration from persistent underperformance will necessitate methodically moving into a faster lane.

As a result, Reynolds argues that the transition from the current value/yield leadership to growth stocks is just around the bend. From bond-substitute, income-oriented equities, investors will, with caution, embrace growth at a reasonable price and price earnings to growth rate (PEG). They will seek investments with predictable growth prospects and conservative valuations, he argues.

And Then the Cycle Begins Again

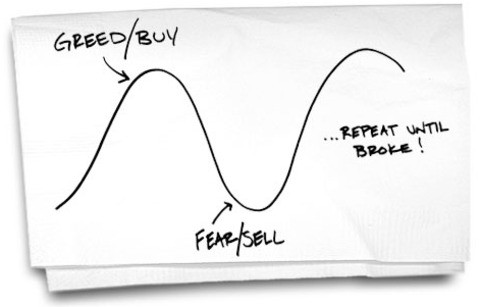

As the bull market grinds forward, the improved absolute returns will lead to a marked rise in confidence. Reynolds observes that greed will begin to replace caution, spawning more creative and riskier investment policies. Increasingly, momentum strategies will be embraced and sharp pencils, rulers, and chart books will replace sophisticated mathematical models.

Eventually, the rearview mirror will only reflect a limited number of exemplary companies capable of perpetual growth. Pundits will re-coin the term one decision stocks, ones to be bought and never sold. Almost cult-like, Reynolds argues, investors will continue to crowd into this narrow list of global growth names whose valuations will become egregious. A new, global Nifty 250 will be born.

This great bull market will frustrate most participants. Value, income and disciplined growth investors will be left in the dust, seeing only the fading tail lights of the reckless, irrationally exuberant momentum managers.

At the peak of this sentiment cycle, confidence will be so elevated by bulging wallets and inflated egos that investors, traveling at high speeds, trusting only their rear view mirrors, will recklessly ride off the road, he concludes.

What to Do in This Environment

But dont worry too much about what will happen far down the road. The joy ride has barely begun, and has many miles to go before it is done.

My recommendation: Be prepared to buy growth stocks now, like the ones I am recommending. and will recommend in coming months, and dont remain anchored in the value-oriented, consumer staples, dividend-focused world of the past few years. It may not look like a time to bet on an improved economy, but really that is the best time to do so.

InvestorPlace advisor Jon Markman operates the investment firm Markman Capital Insight . He also writes a daily swing trading newsletter, Trader’s Advantage, which aims to capture profits of 15% to 40% and often as much at 100% to 200% in less than 90 days.

Professional traders and hedge funds make huge profits off volatility. Now, Jons service CounterPoint Options levels the playing field with the first service geared towards helping individual traders make steady, consistent profits with the VIX. Get more information on Trader’s Advantage and CounterPoint Options today.