Butterfly Options Trading Explained Example Commodity Trading

Post on: 28 Июль, 2015 No Comment

Details about Butterfly Options Trading Strategy Explained with Examples & Payoff Functions

Every option trader, whether novice or experienced, is aware about the various structures and combinations which can be created by using multiple options. One very commonly used and frequently traded option strategy is the Butterfly Options Trading Strategy .

The Butterfly Options position can be constructed in many ways depending upon the preferences of the option trader using either call or put options. Butterfly Options Position offers a limited profit-limited loss potential.

Butterfly Options Trading Explained

Let’s see the basic details about the Butterfly Options Trading:

What is the reason for the name Butterfly Options?

The name Butterfly Options comes because the final payoff structure formed in the Butterfly Options Position resembles a butterfly. It can be either a simple butterfly position (Long Butterfly) or an inverted butterfly position (Short Butterfly) depending upon what you decide to trade on.

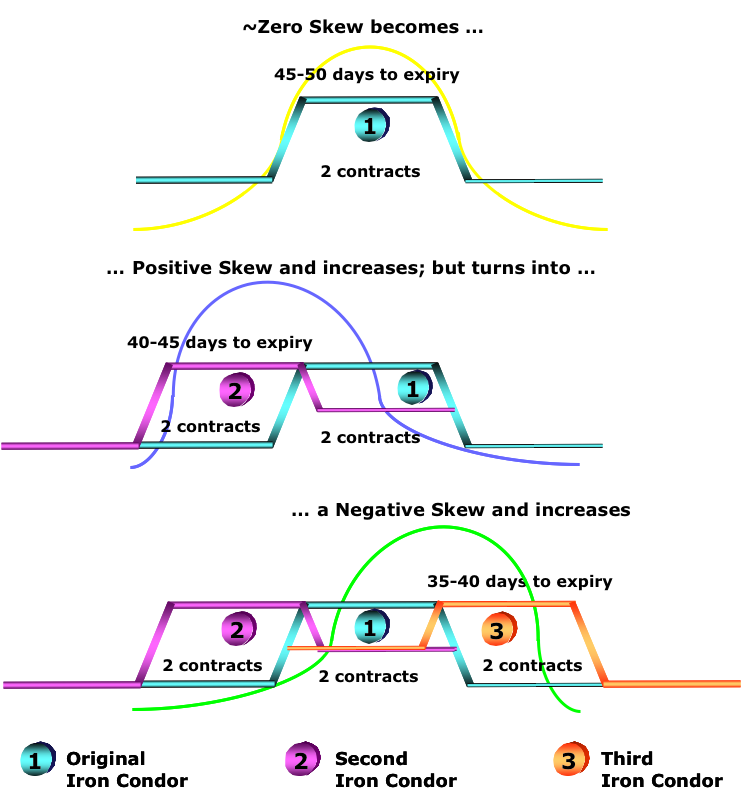

Here is how the Long Butterfly (RED colored Graph) and Short Butterfly (YELLOW colored graph) look.

If you look closely, then the RED graph resembles the butterfly — center pyramid indicating the body of the butterfly and the horizontal lines on either sides indicating the wings.

Similarly, the YELLOW graph resembles the inverted butterfly — again the center inverted pyramid resembling the body of butterfly and horizontal lines on either sides indicating the wings.

Why are Butterfly Options so popular to trade?

Butterfly options can be constructed by taking multiple option positions — some short and some long (as we’ll see in the following details). That allows low amount of money for getting into such a trade.

They offer limited profit limited loss potential, so considered safe bets in options trading.

Margin requirements are also not that huge as compared to other strategies

They are easy to construct with simple call and put options — that prevents the improper pricing effects of puts and calls (put-call-parity)

How to construct Butterfly Options positions?

Butterfly option positions can be constructed by using either all call options (some long and some short) or by using all put options (some long and some short).

Before an option trader decides to use calls or puts, he needs to first decide which butterfly (long or short) he wants to trade on. As indicated above, the long butterfly (RED graph) will be profitable only when the underlying stock or index price doesnt move much and remains in a narrow region. On the other hand, the short butterfly (YELLOW graph) will be profitable to the option trader when the underlying stock or index makes a big move in either direction with a big value.

Once the option trader decides which butterfly he wants to trade (long or short), he can then select the call butterfly or put butterfly. Please remember that the final net payoff function for short butterfly and long butterfly option will always remain the same, irrespective of whether they are constructed using call options or put options.

Here are the details about constructing Long Butterfly using

- Long Butterfly using Call Options :

- Long Butterfly using Put Options :

- Short Butterfly using Call Options :