Butterfly Option Strategy Overview

Post on: 7 Апрель, 2015 No Comment

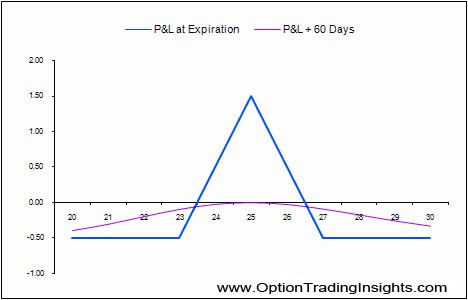

The graphic below demonstrates the risk graph for an iron butterfly position. An iron butterfly uses both calls and put options. A butterfly uses only calls or only puts. With these trades the center strike is always where the short options reside while the outer strikes are where the long options reside.

Click to Enlarge Iron Butterfly Risk Graph

A butterfly trade is typically placed for a small debit, which represents their maximum risk. An iron butterfly is placed for a credit. Both trades, butterfly and iron butterfly, accomplish the same thing and can be used interchangeably.

We are left with a relatively narrow range in which a profit might be realized. The maximum risk is quite limited, however. The benefit of a butterfly or iron butterfly trade when compared to an iron condor is that we have improved upon the overall risk-to-reward ratio. The cost of that improved ratio is that we have reduced the size of the profit zone and, therefore, the probability of our trade being successful.

Embedded Positions With The Butterfly

You will find that with a traditional butterfly you are essentially long one vertical spread and short another vertical spread. The iron butterfly uses two short vertical spreads; calls on one side and puts on the other. These vertical spreads are your primary embedded positions.

Once you appreciate the nature of the embedded positions, you will find that if you are now better able to efficiently adjust the overall trade structure. Until then you can still efficiently manage the trade by simply closing the position if the market appears poised to exit the profit area.

Adjusting Into A Butterfly Trade

Also, understanding that the butterfly trade is a combination of two vertical spreads also allows you to roll into an butterfly trade. For example, assume you buy a bull call spread for a $1.00 debit. After opening your debit spread, the market moves favorably and you now expect the market to consolidate at current price levels. If you close your spread now, you will realize a small profit but if the consolidation breaks down you risk a loss.

One possible solution may be to sell a bear call spread by selling the same short strike in your bull call spread while simultaneously buying a higher strike. Assume you receive a $1.50 credit for the sale of the bear call spread.

Opening the bull call spread cost you $1.00 and selling the bear call brought in a $1.50 credit, which means that you are now long a butterfly for a net .50 cent credit. The position is risk free, with a guaranteed profit of .50 cents. If the market remains between the strikes of your long options you may enjoy additional profits while the adjustment has eliminated the risk of loss.

Learning How To Use Butterflies In Your Trading

The butterfly is a complex position, that has more uses than those outlined here. Many professional traders favor these positions for several reasons and use them to control risk while still generating meaningful profits.

These strategies do require some additional insight that you can only gain by studying how the position works and how to incorporate it into your option trading arsenal. The effort is worthwhile because as you master these trades you will find that you can better control risk while preserving significant profit potential.