Butterfly Option Spread Trading Strategy

Post on: 7 Апрель, 2015 No Comment

The butterfly is a neutral position that is a combination of a bull spread and a bear spread.

July 50 Call: $12

July 60 Call $6

July 70 Call $3

Butterfly:

Buy 1 July 50 Call $1,200 Debit

Sell 2 July 60 Call $1,200 Credit

As you can see our breakeven points are 53 and 67. As long as ABC stays between those strikes the trade will be profitable.

If you sign up for my FREE Option Selling Course I will show you some examples of Butterflies and Iron Condor trades and adjustments. To sign up just fill out your name and email in the sign up form at the Top, Right of this page.

Why Use the Butterfly Options Trade?

Butterflies are used in a few different ways. The most popular is on an underlying that is not moving very much and in which the trader feels that volatility will fall. As volatility falls, the biggest impact should be to the sold options since they are At the Money. This will result in them losing value and thus a profit.

Even if volatility does not fall rapidly, as the days go by the trade will make money through time decay. Since this is a theta positive trade, everyday that you are in the trade, the options lose value and the trade makes money.

So normally a trader wants the underlying stock, index, ETF, whatever to stay within the breakevens and as close to the sold strike as possible. The closer to the sold strike at expiration, the more money the trade makes.

Butterflies are also used in speculation. Out of the money butterflies are very cheap. If a trader thinks the stock is going up, he can do an bullish out of the money butterfly at a higher strike. If the stock makes it into the butterfly breakeven area, the trader can make several hundred percent. This works on the down side as well.

And that is how you can use the butterfly as a cheap hedge. Let’s say you own a lot of IBM stock and you think that IBM might go down on a bad earnings announcement. You can buy some bearish out of the money butterflies that will make a lot of money if IBM does drop.

Here is a link to a post on my blog that shows a butterfly that I did in my personal account along with a picture of the profit and loss diagram. Notice the triangle shape of the graph.

I trade Butterflies every month. Become a member today to get access to my site and my current trades. You can also see my past trades and how I adjusted them when I had to. Find out more about becoming a member.

The Iron Butterfly

Until now we have been talking about a regular butterfly. Now let’s talk about the Iron Butterfly. What’s the difference? A few strikes.

With a regular butterfly spread trade, you sell the At the Money Strike and the trade uses all put options or call options.

When doing an iron butterfly trade, you use both put options and call options, and the sold strikes are not At the Money but a strike or more out of the money. Here’s an example:

IBM is at 100. With a regular butterfly trade, we buy 2 of the 95 calls, sell 4 of the 100 calls, and buy 2 of the 105 calls. Instead of calls you can use puts, they are pretty much interchangeable.

With an iron butterfly you sell 2 of 105 calls, and buy 2 of the 110 calls. You also sell 2 of the 95 Puts and buy 2 of the 90 puts.

This makes your breakeven tent a bit wider and you can let all the options expire if IBM is in between your sold strikes of 95 and 105 at breakeven. An iron butterfly is a credit trade, while the regular butterfly trade results in a debit. You have to exit the regular butterfly and cannot let is expire.

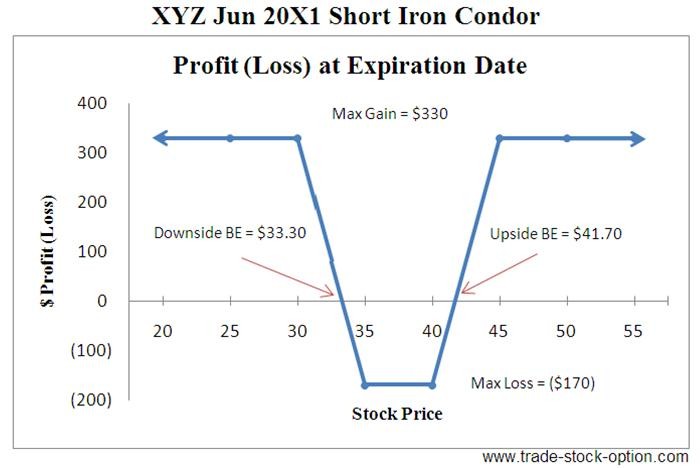

If you are familiar with iron condors, you will see that an iron butterfly is an iron condor, except the strikes are close to the money. You can also do an iron butterfly where you are at the money instead of out of the money.

I trade Butterflies every month. Become a member today to get access to my site and my current trades. You can also see my past trades and how I adjusted them when I had to. Find out more about becoming a member.

The Broken Wing Butterfly

The Broken Wing Butterfly is another variation of the classic butterfly options trade. You create a broken wing by changing the wingspan of the trade.

So if a classic butterfly is Buy 5 of the 100, Sell 10 of the 150 and Buy 5 of the 200 calls, you can see that the distance between the edge and the center is 50 points. With a broken wing butterfly you can have one of the legs be shorter than the other. Example: Buy 5 of the 100, Sell 10 of the 150, Buy 5 of the 160 calls.

By changing the wingspan, you can make the broken wing butterfly a directional trade either bullish or bearish. The trade will still make money if the stock does not move much, but you can set the trade up in a way that you can only lose in one direction.

It’s pretty much like a credit spread.

So why do a broken wing butterfly instead of a credit spread? Because it is easier to adjust. If the stock moves heavily against you, you can still adjust the trade to make money on it. With a credit spread, your adjustment options are limited.

But there is a problem. In 2010, the brokers and the governmental body that regulates options decided to change the margin requirements on broken wings. Now you are charged margin on both sides of the trade. In many cases, you can only lose money on one side of the butterfly, so you should only be charged margin on one side. But they are now charging margin on both sides. You can still do the trade, but your ROI is half of what it should be. Unless you have a portfolio margin account. But that is a different discussion.

Trading Butterfly Option

This has been a shot introduction to different butterflies. In order to really learn how to trade the butterfly you have to practice. As part of our advisory, we trade iron condors, butterflies, credit spreads, calendars, and double diagonals.

Here is a link to a blog post that discusses when to trade a butterfly instead of a calendar:

Butterfly Option Trade Adjustments

For a classic butterfly, the simplest adjustment is just to add a second butterfly when the stock hits a breakeven point. Let’s look at the example at the top of this page.

ABC is at 60

Butterfly:

Buy 1 July 50 Call Option

Sell 2 July 60 Call Options

Buy 1 July 70 Call Option

Breakevens are at 53 and 67.

Let’s say you put this trade in and ABC advances to 67. You just hit your expiration day breakeven. You adjust by adding a second butterfly at the strike closest to the money for the same expiration: 65.

Buy 1 July 55 Call Option

Sell 2 July 65 Call Options

This expands your breakeven and lets you stay in the trade. But this also doubles the amount of money in the trade (and at risk) as well as lowering your potential ROI%.

If ABC keeps moving up and hits your upside breakeven again, you can exit the first butterfly and stay in the trade.