Bullish Options Trading Strategies Bull Put Spread

Post on: 26 Май, 2015 No Comment

Bull Put Spread — Bullish Options Trading Strategy

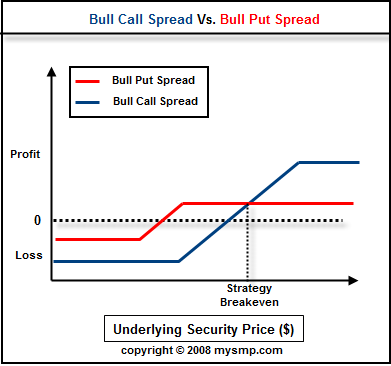

A Bull Put Spread is one of the moderately complex stock option trading strategies and its purpose is to profit from stock that is either stalled or rising. It was conceived to find income generating options trades that are bullish and have limited downside risks. Because of its limited risk, a Bull Put Spread is even safe when learning the basics of stock market investing .

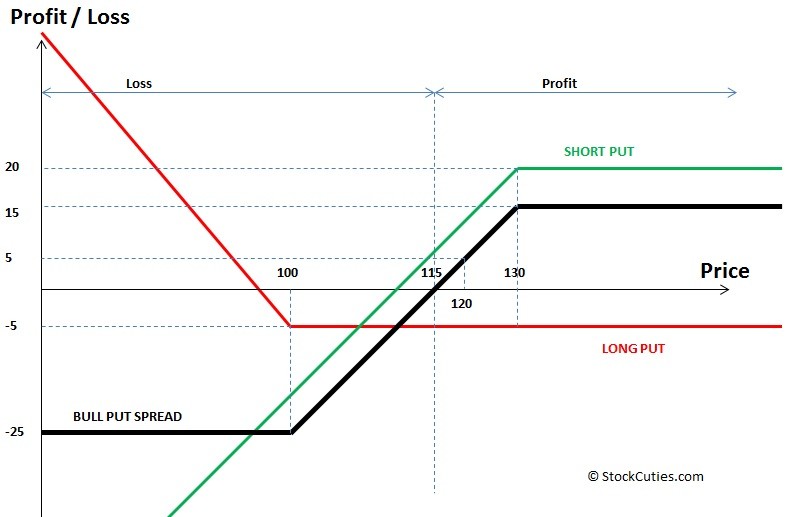

In order to identify a stock for a Bull Put Spread, it is necessary to perform some solid stock market technical analysis. Once you find a stock that is range-bound or able to rise, you need to make a trade on the options that will expire in one month or less. At that point, you should buy lower strike puts that are $5 below the higher strike price. Then sell the same number of higher strike puts that expire on the same date. (Note – both puts should have strike prices that are LOWER than the current stock price.) Your goal in such a strategy should be to earn a 12% net credit from the trade. For example, if the difference, or spread, between the two strike prices is $10.00, you want to realize a net credit of at least $1.20 for the trade. If the stock remains steady or moves higher, the profit you earn is the net credit amount. Your risk is the difference between the strike prices minus the net credit for the complete trade. A Bull Put Spread, as mentioned before, is relatively safe and has the potential for a nice return. This makes it a perfect opportunity for beginner stock market investing .

Ok, let’s complete an example of a Bull Put Spread. Using your best technical analysis tools. you have identified ABC, Inc. (ABC) as a perfect stock for your transaction. You are able to purchase 30 Strike Put at $9.00, while ABC has a stock price of $21.00. After, you purchase 20 Strike Put at $1.00. Both purchases have the same expiration date of November 20, 2006. The plan of a Bull Put Spread is that you are going to sell the $9.00 Put options that are in-the-money (higher priced) and buy out-of-the-money $1.00 Put options of the same stock with the same expiration date. This becomes a vertical Bull Put Spread. If the stock has closed above the in-the-money Put option strike price on November 20th, then you will realize your maximum profit. Remember that there will be there will be a net credit that will modify the bottom line of the completed trade. Because you have bought strikes above and below the current stock price, any movement upward works to your benefit. This, in turn, is an example of a Bull Put Spread and has made money for many successful traders .

Bull Put Spreads are a great opportunity to realize a profit with a stock that looks to remain steady or move upward. Such a strategy is also a good idea for the beginner investing in the stock market. Once the investor masters such a technique, only her, or his, technical analysis tools and abilities will limit the success of this strategy. Adding the utilization of the Bull Put Spread to your techniques will enhance your success in trading.