Bond Funds

Post on: 17 Апрель, 2015 No Comment

Bond mutual funds are generally less risky than stock mutual funds, but they generally do not yield the same high rates of return as stock mutual funds. When you purchase a single bond, your money is tied into the bond until maturity. You can sell the bond, but sometimes bonds can be more difficult to sell because they trade in the bond market. Buying and selling the bonds is the job of the fund manager. A bond fund, thanks to interest, can provide a monthly check, which can also be reinvested into the fund.

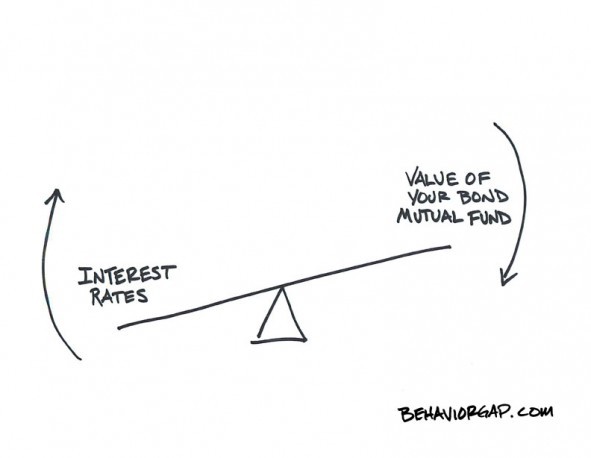

Remember that your principal is not secured in a bond fund. Should the fund price drop, you could lose some of your initial investment. The price of the fund dictates the worth of your investment rather than the underlying bond holdings. The value of the bonds in the portfolio will fluctuate until they reach maturity, based inversely on the interest rate.

While looking through bond funds, you will notice the three primary types of bonds represented: municipal, government, and corporate. International bond funds also exist. As is the case with stock funds, there are different levels of risk associated with different types of bond funds. The greater the risk (when dealing with junk bonds, for example), the greater the potential returns, and vice versa. When dealing with low-risk government bond funds, the rate of return is relatively low.

Municipal Bond Funds

These are bond funds that invest in either intermediate or long-term municipal bonds. Such money is often allocated to worthwhile projects, such as building new roads, repairing older ones, upgrading sewer systems, or other projects that both produce revenue and add to the community. An incentive of such munis, as they’re often called, is that they generally offer you income that is not taxed. The tax-free bond funds, while paying lower yields, are often paying as much or more than many taxable bond funds because you are not paying those ugly federal and, in many cases, state taxes. Municipal bond funds can be national, investing in municipalities nationwide; statewide, investing in specific state municipalities; or local, investing in local municipalities. If you are in a state with high taxes, you may find these funds to be appealing because you avoid such taxes. Crossing state lines, however, may require you to pay taxes. In other words, you may be taxed in your home state if you buy a municipal bond from another state.

U.S. Government Bond Funds

You want low risk? Invest in the government. Despite high deficits and outstanding loans to countries that no longer exist, the U.S. government has never defaulted, and there is no risk in the securities in a government bond fund. These funds hold treasury securities, bonds, and notes, as opposed to savings bonds. There is some volatility because the fund managers do trade on the market, but for the most part this is a very safe route, and many people will use a government bond fund to balance out other funds they hold. Since there are not as many choices in regard to government bonds, and since the risks are significantly lower, many investors do not bother looking for such a fund. Instead, they simply purchase their own government investment vehicles from the government directly, since it is so easy to do.

Corporate Bond Funds

The majority of the holdings in this type of fund are, as the name implies, in corporations. Like equity funds, there are a variety of types of corporate bond funds, and they differ depending on the corporations from which they are purchasing bonds and the length of the holdings. Bond funds that buy high-grade (or highly rated) bonds from major corporations are safer on the fundamental risk scale than other corporate bond funds. They also tend to produce slightly better returns than government bond funds over time.

Specialty funds describe funds that don’t quite fit into any other category. These funds often hold more unusual investments, like precious metals, currencies, commodities, and stock options. These funds come with a higher risk, but they also carry potentially higher rewards.

However, some of these funds cheat a little, albeit legally, by owning a small percentage of lower-grade bonds to balance out their portfolio and if they pick the right ones enhance the numbers slightly. As is the case with most funds, there is some flexibility beyond the category in which the fund falls.

Beware of bond funds that buy from corporations issuing bonds that are below investment grade. These junk bonds produce a high-yield fund that can be more volatile than many equity funds. The risk of the company backing this bond is higher and, therefore, the yield is also higher to compensate. In short, junk bond funds mirror junk bonds (which are high-risk bonds), only the fund contains more of them.

Choosing Bond Funds That Work for You

Just as you would consider the track record of a mutual fund before buying, you need to examine a bond fund’s history before making your investment decision. In addition to learning the fund’s track record, you need to ask some key questions when it comes to picking bond funds:

Is the fund picking bonds with long or short maturities?

What quality bonds is it selecting?

What do interest rates look like today?

How will the current interest rate environment impact my investment?

Bonds with longer maturities and bonds of a lower grade, or lesser quality, are more risky, which taps into your risk/tolerance equation. Risk tolerance is always a key factor in your investment selection process. Although bonds are generally perceived as a less risky alternative to equity investments, there are risks in the bond market and in bond funds. Since bond funds do not hold onto most of their bonds until maturity, longer-term bonds will have more time to fluctuate and may therefore be more risky. If the bonds were held until their final maturity, these changing rates would not matter.

Many people select bond funds to round out an equity fund portfolio, with perhaps two stock funds and two bond funds, or one balanced fund and one bond fund. The inclusion of a bond fund is often meant as a conservative safeguard in the portfolio.

The taxable/nontaxable question reflects primarily on municipal bonds. Why in the world would you want a taxable bond if you could own one and pay no taxes? Well, a 12 percent yield on a junkier bond, after taxes, still earns you more than a 5 percent yield on a tax-free bond. Also, if you are buying the bond fund in a tax-free vehicle, such as your IRA, why purchase a tax-free fund? You are already not paying taxes on your IRA investment, so it’s a useless advantage. Depending on your current investment strategy and the amount of time you have remaining until retirement, consider holding taxable bonds (to preserve principal) or a bond fund (to balance out an equity-laden portfolio) in your tax-free retirement vehicle.

As for management, you must once again evaluate how the fund is run. Bond funds generally have fewer operating costs than equity funds. However, they generally have fewer high payoffs.

Just like the equity fund player, however, someone who is primarily investing in bond funds may allocate a certain amount to safer funds while putting the rest in lower-grade or riskier funds. The higher-yield funds do have their share of successes, and with the right fund manager, they, like a good equity fund, can be profitable. Unlike owning one junk bond, a high-yield fund will consist of a carefully balanced portfolio. If one or two of the issuers default, you will still be fine due to the great deal of diversification in that area.

Like all other areas of investing, bond funds offer higher rewards for higher risk. While there are many funds to choose from, it’s also to your advantage to understand more about bonds in general.