Bollinger Squeeze Trading Setups Review

Post on: 3 Июль, 2015 No Comment

Bollinger Squeeze is a trade setup by John Bollinger, using his very own Bollinger Bands.

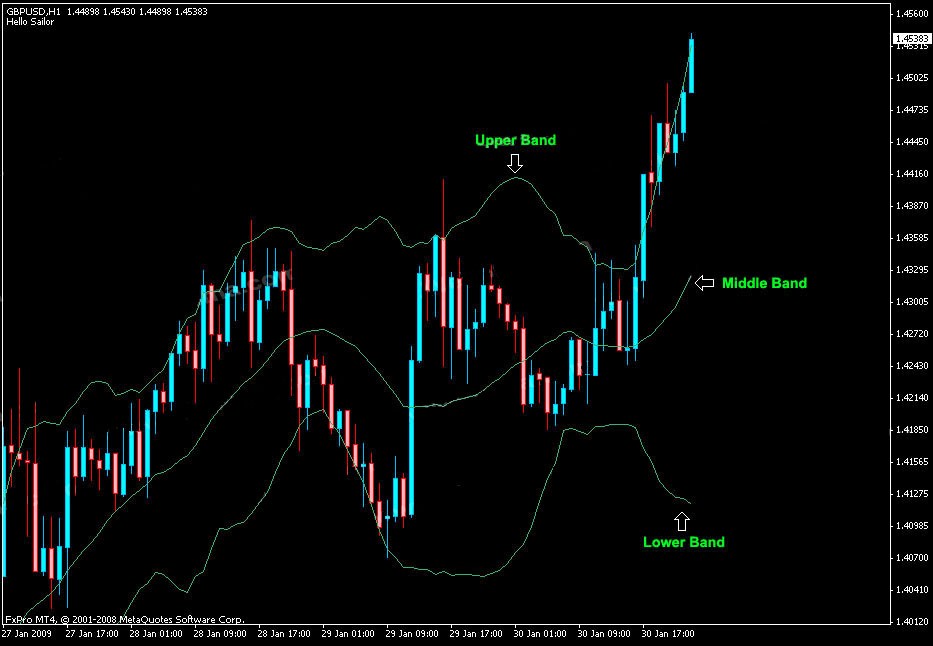

Bollinger Bands is a channel formed by two vertically displaced moving averages: one displaced upwards by two standard deviations and one displaced downwards by two standard deviations. The typical parameters refer to a simple moving average and standard deviation based on 20 periods.

Rules for Long Squeeze

- Wait for Bandwidth to reach its lowest in 120-period (John Bollinger mentioned 6 months, but I used 120-period on daily charts as an approximate)

- Go long on close above 20-period Bollinger Bands

Rules for Short Squeeze

- Wait for Bandwidth to reach its lowest in 120-period

- Go short on close below 20-period Bollinger Bands

Winning Trade Bollinger Squeeze

Bollinger Squeeze Winning Trade

This is a daily chart of Ameren Corp listed on NYSE. The bottom panel showed that Bandwidth had dropped to its 120-day low. As we were only interested in the relative value of Bandwidth, the standard deviation indicator worked fine. The blue line tracked the lowest standard deviation value in 120 days. (I used a 120-period Donchian Channel on the standard deviation indicator and displayed only the bottom channel line.)

On 18 October 2006, price closed above the Bollinger Bands and we went long. The price continued up over the next six days, giving us a good swing trade.

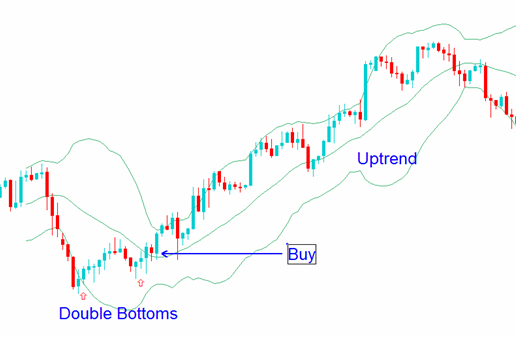

The earlier tag of the upper Bollinger Band met strong resistance as shown by the strong bear trend bar followed by a bearish reversal bar that tested the high of the bear trend bar before it. Despite such strong overhanging resistance, prices refused to move down much and entered a trading range. This showed that the bulls were holding power.

After Bandwidth reached its 120-day low, we got a shaved bottom bull bar which showed upwards momentum. The next bar was a great follow-through of this bar and closed beyond the Bollinger Bands, giving us a strong long entry.

Losing Trade Bollinger Squeeze

Bollinger Squeeze Losing Trade

The is a daily chart of Bristol Myers Squibb Co. listed on NYSE. Again, Bandwidth dropped to its 120-day low to show low volatility. We braced ourselves for a breakout and shorted on 8 June 2007 as the day closed below the Bollinger Bands. However, prices continued a little beyond our entry before reversing back up, giving us a failure.

Not over-analysing, just take a glance at the trading range before the breakout (the boxed area) and you would have noticed more green than red, suggesting that buying pressure dominated despite the clear sideways movement. In addition, there was an existing upwards trend and counter-trend breakouts were not a good idea.

Review Bollinger Squeeze

I like the Bollinger Squeeze setup as it makes use of the sound concept of low volatility leading to high volatility. Periods of low volatility are difficult to trade due to false breakouts. The Squeeze highlights record low volatility when it is safer to look for breakouts. This setup is extremely useful for trading options as it pinpoints explosive price moves following periods of low volatility.

However, such breakout plays are prone to failures (called head fakes by John Bollinger in his book). Hence, looking for subtle price action clues in the trading range leading up to the breakout is invaluable. Of course, trading with the last established trend also increases the odds of having winning trades. In John Bollingers book, he also explained how to avoiding false breakouts with volume analysis.

Learn: Bollinger on Bollinger Bands