Bollinger Bands Archives I Trade Weekly Options Profitably

Post on: 12 Март, 2017 No Comment

Trading weekly options, one of the important elements of the trade is being able to define a good trend and then find current events that support that trend.

Trend in the SPY is Bearish

In early December 2013, I was looking at the S&P 500 ETF (SPY) for a possible trade. Trading weekly options can be a challenging event if the right signs don’t fall into place.

Trading Weekly Options Must Have a Well Defined Trend

This particular week I use the Bollinger bands to identify a good downward trend in the stock. Since I was entering the trade on a late Wednesday afternoon, I would only have two days of trading left and I would expect the options to expire. In order for this trade to be good for me, I need the current events to be able to support the downward trend. If the news would continue to be good, then it could make the market go up in my trade could be challenged. When I am trading weekly options, I usually try to use a debit spread. Since the SPY was moving down, I decided to use a Bull Put Spread.

Trading Weekly Options Must Have Events that Support the Trend

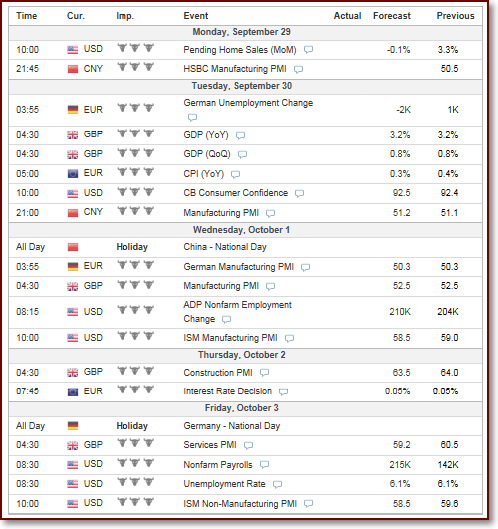

When I made that trade, here are the notes that I wrote on the current events that I can observe for the last two days of trading:

Current Events- the events this week have continued to prove to be positive and this has driven the markets down in fear of the tapering starting. Friday is the big report: November’s non-farm payroll report. ADP came out today & beat the analysis so I would expect the same to happen in Friday sending the markets down. So this supports the trend, I will give this one a good.

The attitude in the market at the time surrounded a fear that tapering would be starting soon. That means that all the good news that came out was actually bad for the market because the more good news he came out the fear of tapering getting closer and closer would take place.

Even though the market was doing well they continue to go down at this point because of all the good economic news. It’s amazing how topsy-turvy the market can be. Looking at both of the trend and the news, I felt the market would continue to go down and therefore I made a trade that would make me a 2% profit over two days. Here’s a trade I did:

- Sold the 182.5 call option for $0.4

- Bought the 183.5 call option for $0.2

This gave me a 2% profit upfront on the trade. Trading weekly options, one is looking for a small profit each week. It doesn’t look like much but it really adds up at the end of the year. These trades can be very safe if done correctly.

I believe in order for these trades to work out well, is important that a trend be defined. I have found the easiest way to do that is use the Bollinger band. That is the first thing that needs to be done and the second is the current events that are taking place for the rest of that week must support the movement of that trend.

Let me also point out that if one is trading commodities. always confirm the direction of the commodity if the trade is not less than a week. This is important and could prevent a useless loss.

The trade that we are going to make will depend on the trend continuing in the same direction so that our options expire worthless at the end of the week. So, if you are trading weekly options, make sure you have a well-defined trend and the news and events that will be taking place for the rest of that trading week support the movement of the trend in the same direction. If this does not occur, then I would question making the trade.

One of the most dependable attributes of the Bollinger bands is the use of the middle band to help judge the strength of a trend when trading weekly options.

If you are unfamiliar with the Bollinger bands, it is an indicator that consists of a middle band and two outer bands.

The middle band is simply a 20 day moving average that we can used to judge the strength of the particular trend of the stock.

This is important because when I am trading weekly options and I am using time decay as an ally; I need to know how strong the present move this because the options expire quickly.

There are two ways I can judge a trend with the middle Bollinger band that help me make a decision in my trade: above the band or below the band.

Trends above the Middle Band

When I am trading weekly call options, or I am using a strategy that takes advantage of a bullish trend, it’s important for me to know how strong the trend is through the end of my trade.

There are two observations that we are going to make here. When we see the stock bouncing off the middle band and using it as support, we are going to consider that a strong trend.

But when we are using weekly options to trade, we must be aware of the position of the stock. Depending upon the trade, we would either want the stock moving toward the middle band or just bouncing off the middle band.

When the stock is hugging the upper band and not even touching the middle band this is the strongest possible trend that we can observe using this indicator. When this occurs it is a very good sign that a weekly call option trade has a high probability of success.

Trends below the Middle Band

Besides trading call options, I might be trading weekly put options. After the same manner as the call options, I need to know how strong the bearish trend is through the end of my trade and that’s what the middle band is able to tell me in my observations.

When the stock is using the middle band as resistance (instead of support like the call option) this is considered a strong trend down and the trade we are making with weekly put options has a very good chance of being successful.

Like the judgment that we need to make with the call option, sometimes the position of the put option is very important. Ideally, the stock should be bouncing off the middle band and continuing its move down. This would be the best scenario for a short term weekly options trade.

If the stock is hugging the lower band and not touching the middle band at all this is the strongest bearish trend that we can observe using Bollinger bands. If we are making a trade while it is in this pattern we have a better chance of being highly successful.

When we are trading options in order to make money, I have observed an important point that all option traders, new and old, should be aware of.

Many times I find myself focusing on the technical aspect of the chart when am trading options. I would like to share a trade from February 2013 that I did with Bristol Myers Squibb (BMY).

As we look at this chart, we see the company coming off the upper Bollinger bands.

Even though the stock has been going up, how do we know it will continue to go up? How do we know buying a call option at this point is profitable?

The RSI indicator has been overbought and looks like it start to go down. The MACD indicator looks a bullish but it also looks like it is going down.

I did make options trade off Bristol-Myers, and here’s a trade I did:

- Buy a June ‘37’ call option at $0.99

I have learned through many observations in trading options that when the stock moves off the Bollinger band in such a way, that means the stock more than likely continue to move up.

As the stock moves off the upper Bollinger band that it has been hugging it is important to watch the “lean” of the movement. Since this one has a slight bullish lean moving off the band that is a real indication that the stock will continue to move up.

This is very simple.

Since the movement off the band is still bullish, that showing me that it still has strength. It’s just not moving as fast as it did while it hugged the upper band. This is pretty common. As a stock moves up it doesn’t need the rest. This is the reason it moves off the upper band. A bullish lean to the move off the band is a sign that the stock will continue to move up.

As the stock continued to move up, I sold the options for profit.

- (3/6) 37.57 Close Option sell the June ‘37’ call for $1.36.

- Profit of $0.37 with an ROI of 37.3%

Trading options can be very profitable. An option trader can either buy an option outright, or they could create a debit spread trade. Regardless, it’s important to be able to identify how to use indicators well. In this example, watching the “lean” as the stock moves off the Bollinger band is very important.