BlackScholes Model by

Post on: 23 Май, 2015 No Comment

Black-Scholes Model — Definition

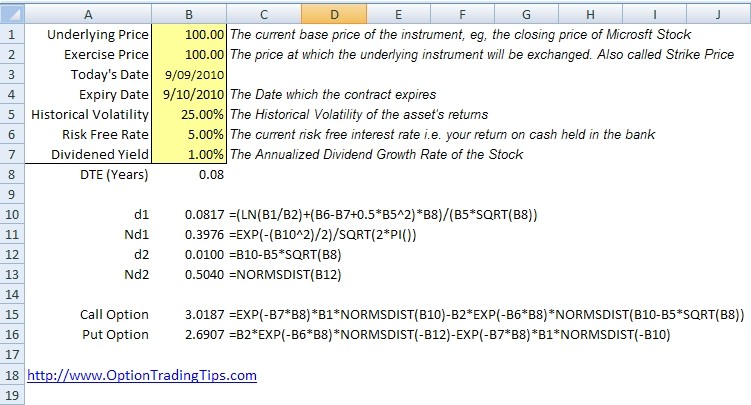

A mathematical formula designed to price an option as a function of certain variables-generally stock price, striking price, volatility, time to expiration, dividends to be paid, and the current risk-free interest rate.

Black-Scholes Model — Introduction

The Black-Scholes model is a tool for equity options pricing. Prior to the development of the Black-Scholes Model, there was no standard options pricing method and nobody can put a fair price to charge for options. The Black-Scholes Model turned that guessing game into a mathematical science which helped develop the options market into the lucrative industry it is today. Options traders compare the prevailing option price in the exchange against the theoretical value derived by the Black-Scholes Model in order to determine if a particular option contract is over or under valued, hence assisting them in their options trading decision. The Black-Scholes Model was originally created for the pricing and hedging of European Call and Put options as the American Options market, the CBOE, started only 1 month before the creation of the Black-Scholes Model. The difference in the pricing of European options and American options is that options pricing of European options do not take into consideration the possibility of early exercising. American options therefore command a higher price than European options due to the flexibility to exercise the option at anytime. The classic Black-Scholes Model does not take this extra value into consideration in its calculations.

Black-Scholes Model Assumptions

There are several assumptions underlying the Black-Scholes model of calculating options pricing. The most significant is that volatility. a measure of how much a stock can be expected to move in the near-term, is a constant over time. The Black-Scholes model also assumes stocks move in a manner referred to as a random walk; at any given moment, they are as likely to move up as they are to move down. These assumptions are combined with the principle that options pricing should provide no immediate gain to either seller or buyer.

The exact 6 assumptions of the Black-Scholes Model are.

1. Stock pays no dividends

2. Option can only be exercised upon expiration

3. Market direction cannot be predicted, hence Random Walk

4. No commissions are charged in the transaction

6. Stock returns are normally distributed, thus volatility is constant over time

As you can see, the validity of many of these assumptions used by the Black-Scholes Model are questionable or invalid, resulting in theoretical values which are not always accurate. Hence, theoretical values derived from the Black-Scholes Model are only good as a guide for relative comparison and is not an exact indication to the over or under priced nature of a stock option.