BlackScholes Formula (d1 d2 Call Price Put Price Greeks)

Post on: 23 Май, 2015 No Comment

This page explains the Black-Scholes formulas for d1, d2, call option price, put option price, and formulas for the most common option Greeks (delta, gamma, theta, vega, and rho).

If you want to use the Black-Scholes formulas in Excel and create an option pricing spreadsheet, see detailed guide here:

Alternatively, you can get a ready-made Black-Scholes Excel calculator from Macroption, which also includes additional features like scenario simulations and charts. See:

Black-Scholes Formula Parameters

According to the Black-Scholes option pricing model (its Mertons extension that accounts for dividends), there are 6 parameters which affect option prices:

S0 = underlying price (USD per share)

X = strike price (USD per share)

r = continuously compounded risk-free interest rate (% p.a.)

q = continuously compounded dividend yield (% p.a.)

t = time to expiration (% of year)

Note: In many resources you can find different symbols for some of these parameters. For example, strike price is often denoted K (here I use X), underlying price is often denoted S (without the zero), and time to expiration is often denoted T t (difference between expiration and now). In the original Black and Scholes paper (The Pricing of Options and Corporate Liabilities, 1973 ) the parameters were denoted x (underlying price), c (strike price), v (volatility), r (interest rate), and t* t (time to expiration). Dividend yield was only added by Merton in Theory of Rational Option Pricing, 1973 .

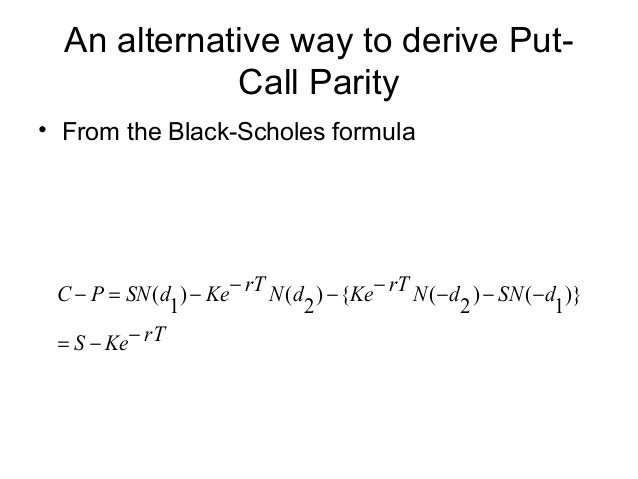

Black-Scholes Call and Put Option Price Formulas

where N(x) is the standard normal cumulative distribution function.

The formulas for d1 and d2 are:

Original Black-Scholes vs. Mertons Formulas

In the original Black-Scholes model, which doesn’t account for dividends, the equations are the same as above except:

- There is just S0 in place of S0 e -qt

- There is no q in the formula for d1

Therefore, if dividend yield is zero, then e -qt = 1 and the models are identical.

Black-Scholes Formulas for Option Greeks

Below you can find formulas for the most commonly used option Greeks. Some of the Greeks (gamma and vega) are the same for calls and puts. Other Greeks (delta, theta, and rho) are different. The difference between the formulas for calls and puts are often very small usually a minus sign here and there. It is very easy to make a mistake.

In several formulas you can see the term:

which is the standard normal probability density function.