Black gold contributes to a stellar quarter balanced portfolio Mar 15 update

Post on: 28 Июнь, 2015 No Comment

Despite a difficult geopolitical background, the UK stock market has done well over the past quarter.

In the last week of February, the FTSE 100 index finally broke through the previous record set in December 1999 at the height of the dotcom boom.

After failing to break through this barrier several times in the past, share prices were given an additional boost by a combination of relief that eurozone finance ministers had approved the reform proposals submitted by Greece, optimism about the UK economy and a lack of alternative homes for cash.

To view the balanced portfolio’s holdings and trading chronology, click here .

Oil set to bounce back

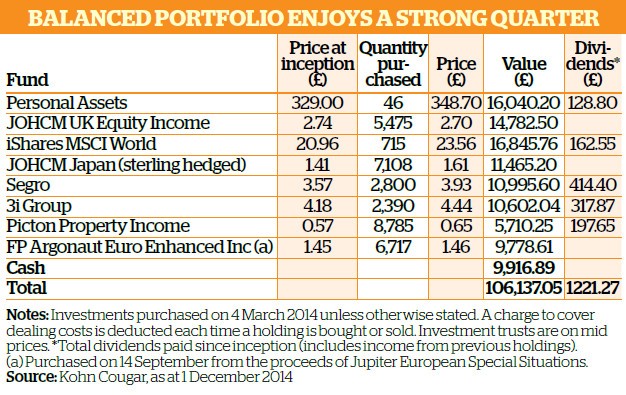

Helped by this tailwind, the portfolio had a very strong quarter. All its holdings rose in value, and overall it produced a total return of 6.2 per cent, well ahead of the FTSE All-Share index. This is the best quarterly gain the portfolio has achieved since it was set up a year ago.

Manager Roddy Kohn, principal of Kohn Cougar, attributes the strong performance to three main factors: ‘Our overweight position in property and the strong outperformance of our property investments; our underweight position in fixed interest, and finally the strong performance of our overseas holdings.’

Performance was also helped by Kohn’s decision on 9 February to use the cash he had held in the portfolio since inception (plus some of the accumulated income) to purchase a holding worth nearly £10,000 in ETFS Brent 1 Month Oil Securities .

Having watched the price of oil fall sharply in recent months, he said: ‘We believe the oil price fall has been overdone. We expect the oversupply to be corrected in time because most oil-producing countries need a higher oil price to balance their budgets, and we therefore expect the price to rise to a higher level than today.’

He argues that once Saudi Arabia sees the lower oil price has forced enough supply out of the market on a permanent basis, the price will recover. In less than a month since the exchange traded fund (ETF) was added to the portfolio, it has returned 3.2 per cent.

STAR PERFORMER

However, it was the investment company 3i Group that was the star performer over the quarter. 3i invests internationally in three distinct areas — mid-market private equity, infrastructure and debt. Its share price rose 11 per cent over the period.

Kohn explains: ‘The private equity portfolio was the main driver of performance at 3i, with a number of successful exits. The company has generally been a seller of companies at significant profit.

‘It continues to have a good pipeline of sales and IPOs, which we would expect to continue to provide upward momentum for its net asset value. With financing continuing to be favourable and economic growth progressing, there should continue to be plenty of scope for deals to be made going forward.’

The FP Argonaut European Enhanced Income fund also had a strong quarter, returning over 10 per cent and making up for its lacklustre performance in the previous quarter. The majority of the fund is hedged into sterling, which benefited performance as the euro weakened.

Kohn points out that if stock markets react as they did in the US and UK during such stimulus, there could be plenty more growth to come from European markets following the European Central Bank’s long-awaited announcement that it will implement quantitative easing. In the meantime, the fund is producing an enhanced income of 5 per cent, helped by its use of options.

Strength in property

Other strong performers over the quarter were the portfolio’s two property holdings Segro and Picton Property Income. Picton Property may be the portfolio’s smallest holding but it has been its best performer since inception, with a 25 per cent increase in value.

Much of the progress in the property market in recent years has been centred on London and the South East, but Picton’s managers commented recently that there were ‘encouraging signs of strengthening occupier activity outside the London markets’.

The portfolio’s performance would have been even better over the quarter if the returns from its two largest holdings had not lagged somewhat behind its other investments. The biggest holding, the i-Shares MSCI World ETF. was up only 3.6 per cent. Kohn uses this holding partly to gain exposure to the US market.

Meanwhile, Personal Assets gained less than 2 per cent, but this trust has never tried to shoot the lights out. Its ethos is capital preservation; expecting a fall in markets, its manager Sebastian Lyons decided to reduce its equity weighting from 44.5 per cent to 40.8 per cent at the end of January and increase cash holdings.

Kohn does not share Lyon’s view: ‘As long as central banks continue with their mantra of doing what it takes to stimulate growth, long-term investors need to be overweight equities, providing they are comfortable in riding the inevitable wave of volatility.’